Question

1. How do you interpret Netflix's adjustment for accrued expressions and other liabilities (198,183) in its operating cash flows? 2. How do you interpret Netflix's

1. How do you interpret Netflix's adjustment for accrued expressions and other liabilities (198,183) in its operating cash flows?

2. How do you interpret Netflix's adjustment for deferred revenue (183, 247) in its operating cash flows?

3. How do you interpret Comcast's adjustment for current and noncurrent receivables, net (-20) in its operating cash flows? (2-4 sentences)

4. How do you interpret Comcast's adjustment for Accounts Payable and accrued expenses (-266) in its operating cash flows?

5.2020 was an odd year. Many companies grew their cash balances to increase liquidity during the pandemic. To look at a more normal year, we will analyze the year ending 12/31/2019 for this question. Based on each company's cash flow patterns, what stage of the corporate life cycle is each firm in? Explain. (1-3 sentences each company)

Supporting data below:

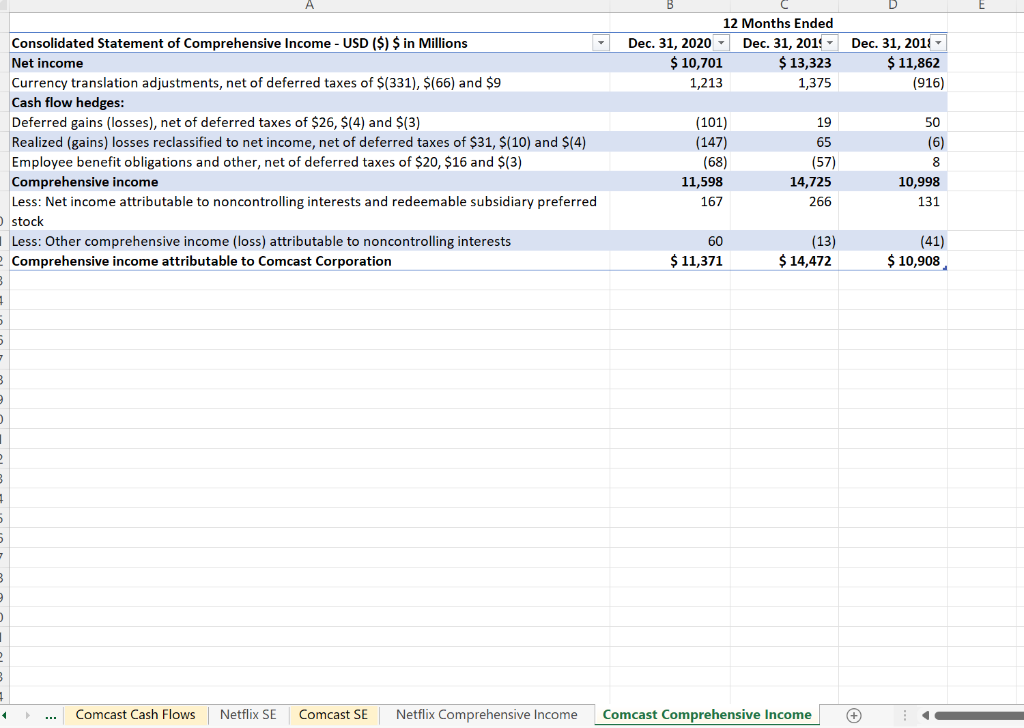

sup 1: Comcast comprehensive income

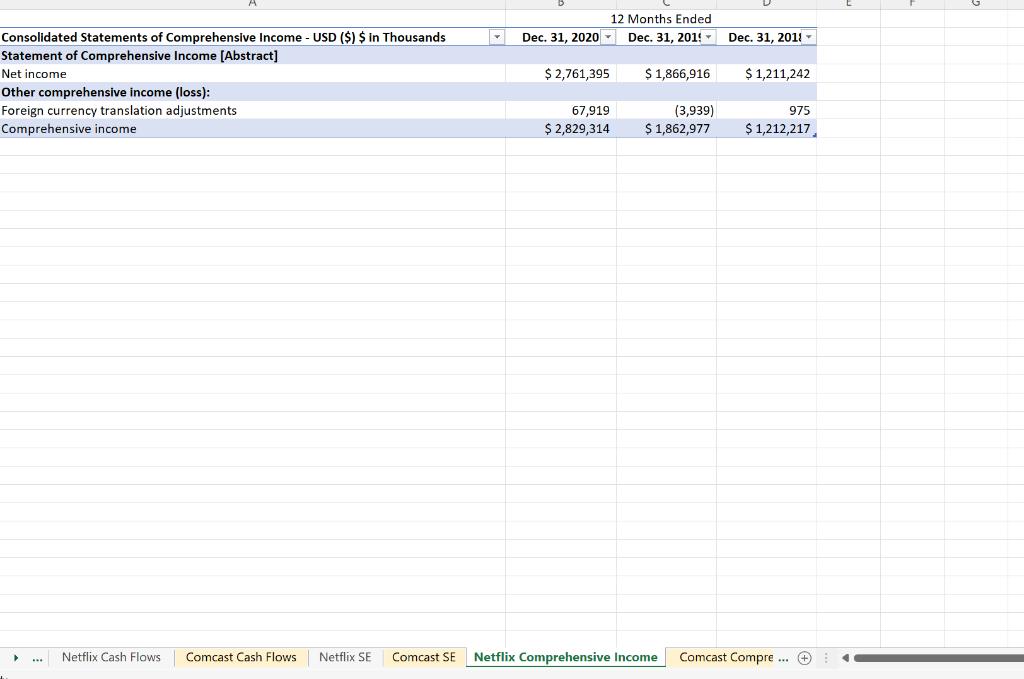

sup 2: Netflix comprehensive income

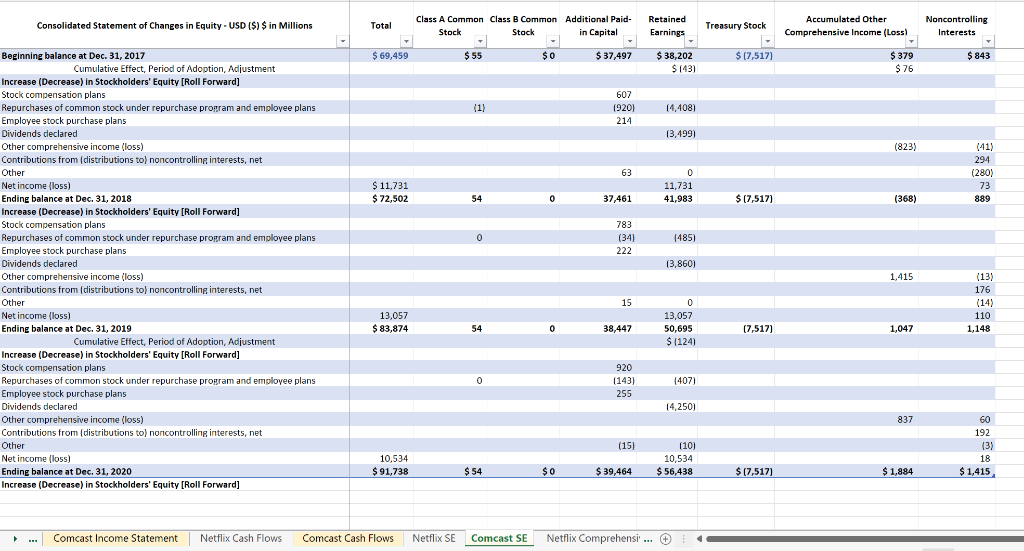

sup 3: Comcast SE

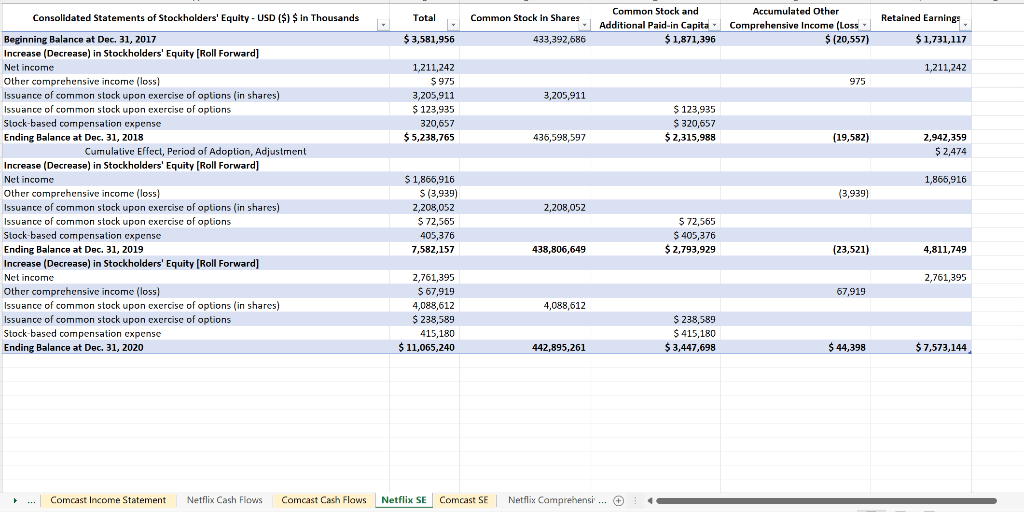

sup 4: Netflix SE

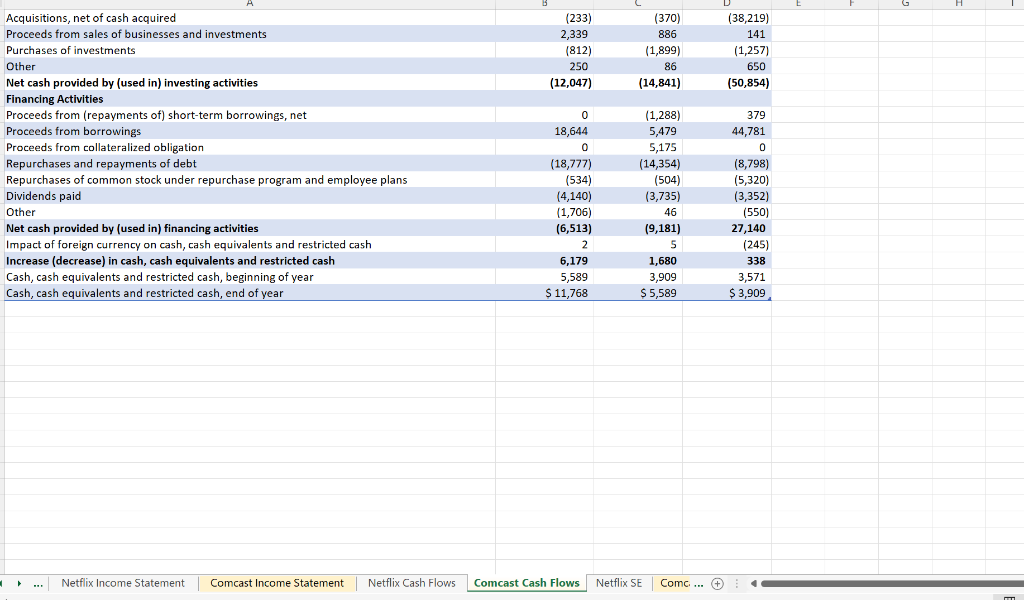

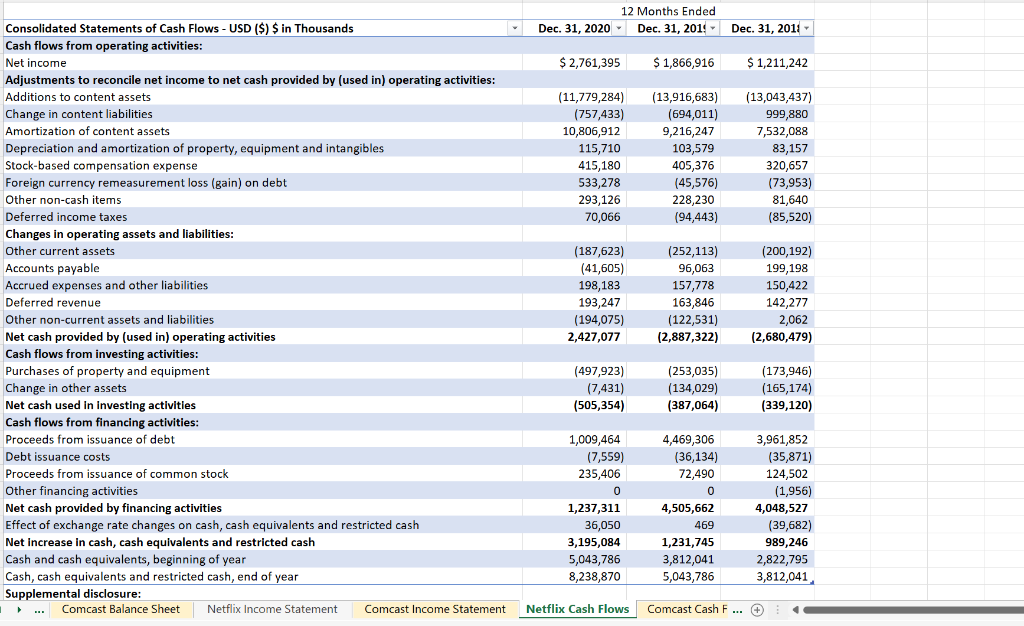

sup 5: Comcast cash flow

sup 6: Netflix cashflows

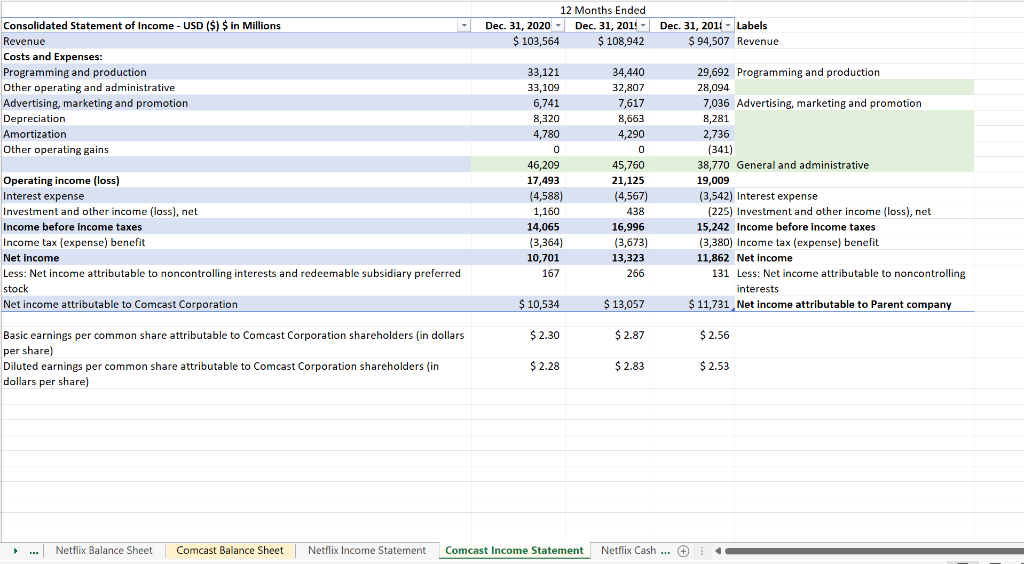

sup 7: Comcast income statement

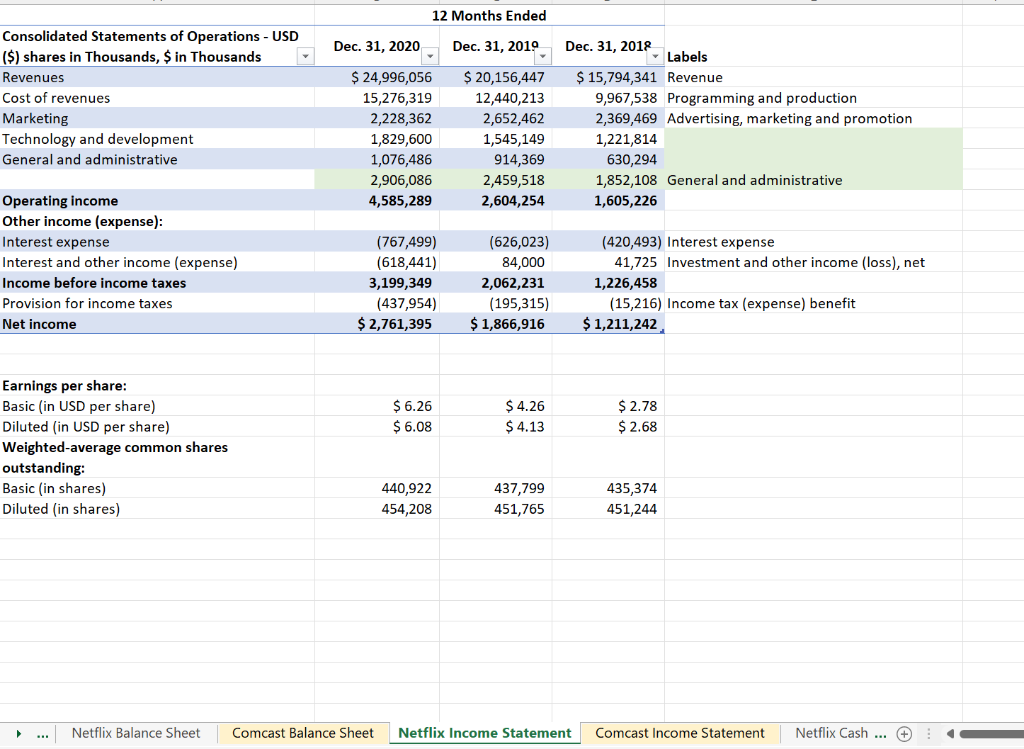

sup 8: Netflix income statement

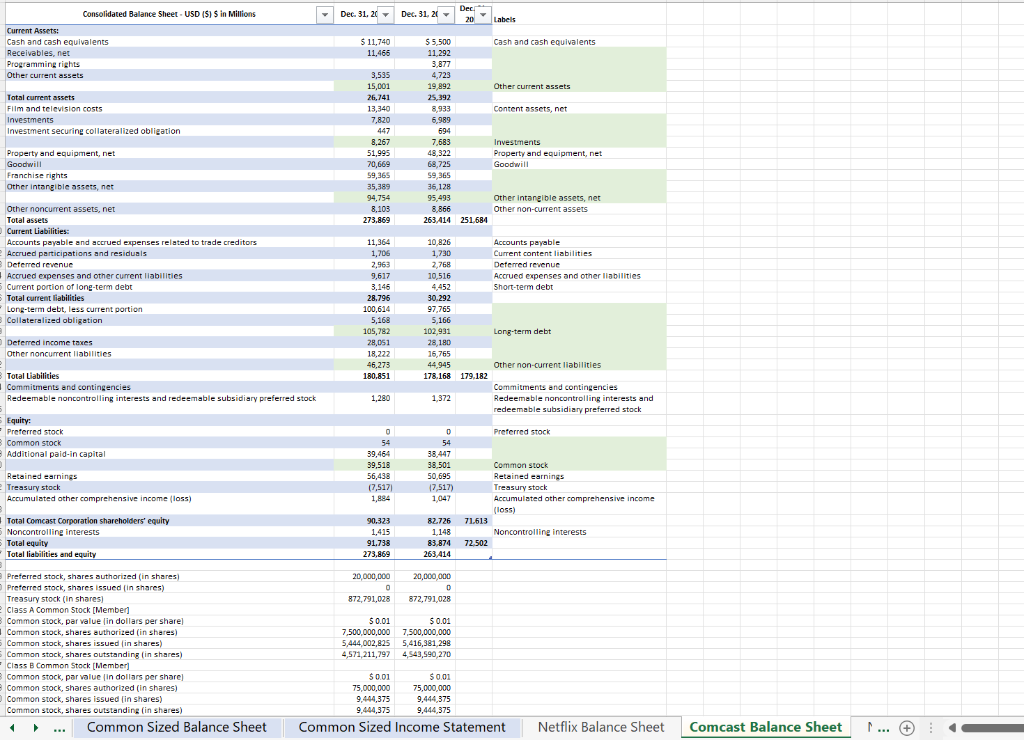

sup 9: Comcast balance sheet

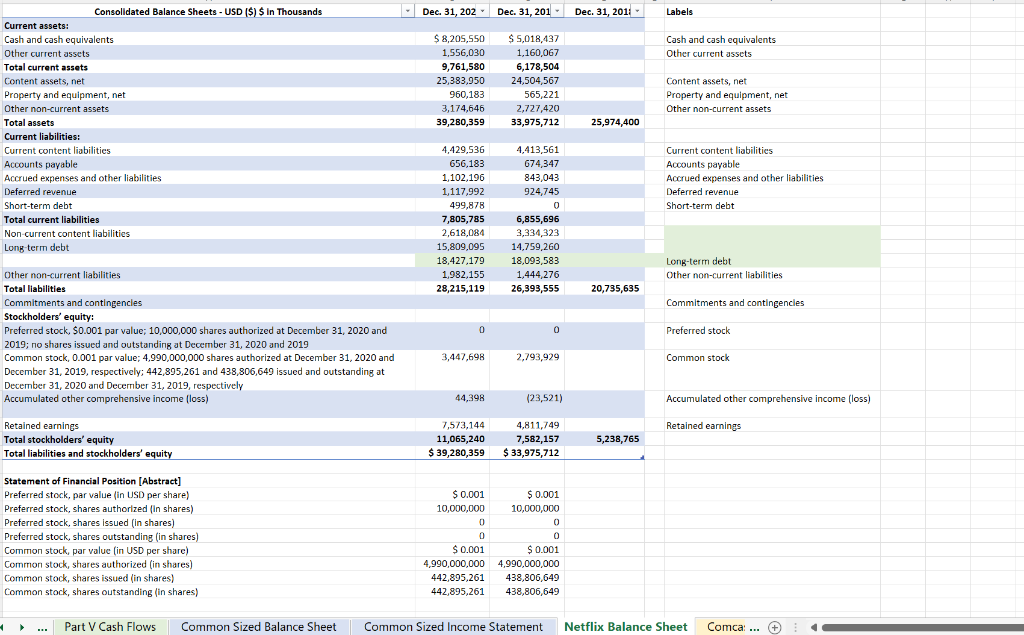

sup 10: Netflix balance sheet

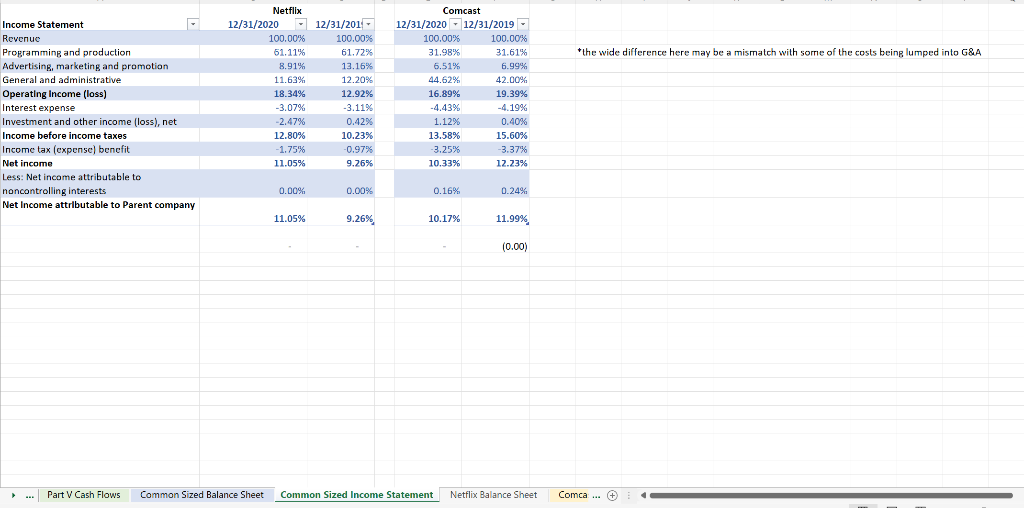

sup 11: Common sized income statement

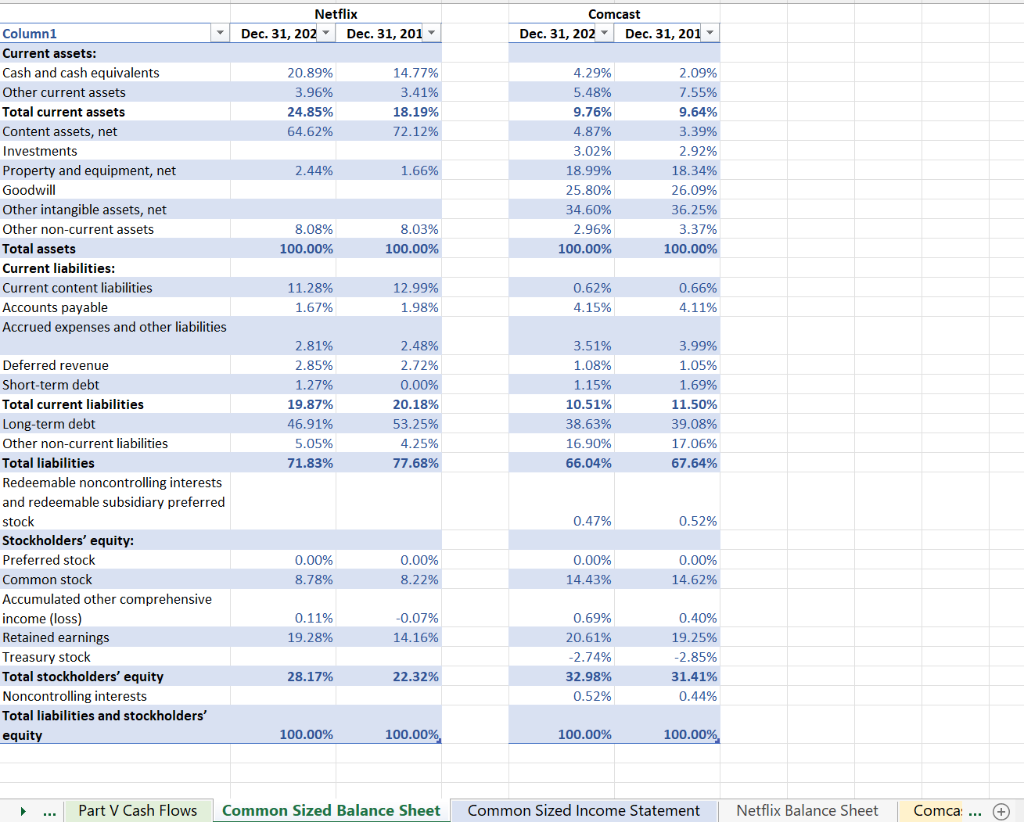

supp 12: common-sized balance sheet

?

?

A Consolidated Statement of Comprehensive Income - USD ($) $ in Millions Net income Currency translation adjustments, net of deferred taxes of $(331), $(66) and $9 Cash flow hedges: Deferred gains (losses), net of deferred taxes of $26, $(4) and $(3) Dec. 31, 2020 $ 10,701 1,213 12 Months Ended Dec. 31, 2015 $ 13,323 1,375 Dec. 31, 201 $ 11,862 (916) (101) 19 50 Realized (gains) losses reclassified to net income, net of deferred taxes of $31, $(10) and $(4) Employee benefit obligations and other, net of deferred taxes of $20, $16 and $(3) Comprehensive income (147) 65 (6) (68) (57) 8 11,598 14,725 10,998 Less: Net income attributable to noncontrolling interests and redeemable subsidiary preferred O stock 167 266 131 Less: Other comprehensive income (loss) attributable to noncontrolling interests 2 Comprehensive income attributable to Comcast Corporation 60 $ 11,371 (13) $ 14,472 (41) $10,908 1 7 7 B 9 Comcast Cash Flows Netflix SE Comcast SE Netflix Comprehensive Income Comcast Comprehensive Income E

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Netflixs adjustment for accrued expenses and other liabilities of 198183000 reflects the changes in balance sheet items that had an effect on cash flow but were not part of the net income for the pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started