Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1l ech question, enter the letter of the best response on the blank preceding the question. 16. The process of evaluating and selecting long-term investments

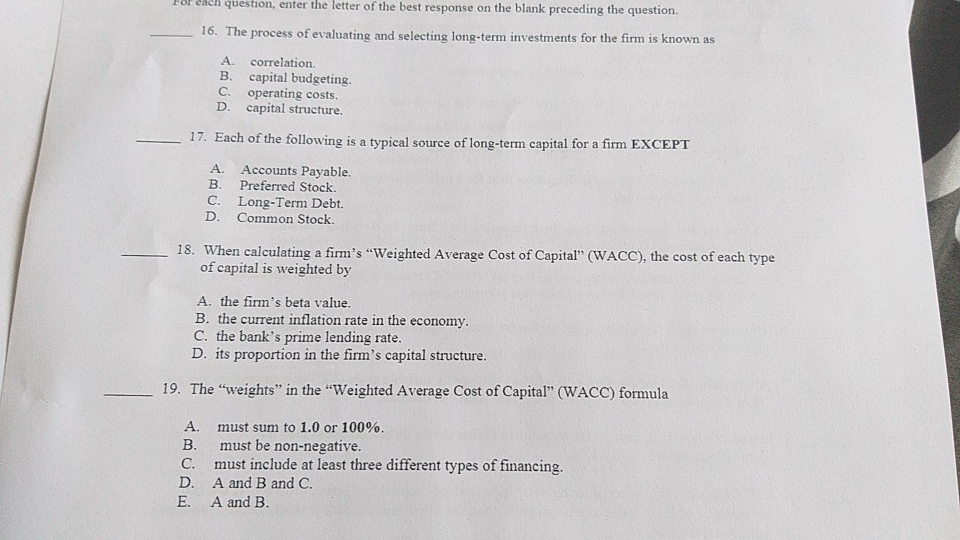

1l ech question, enter the letter of the best response on the blank preceding the question. 16. The process of evaluating and selecting long-term investments for the firm is known as A. correlation. B. capital budgeting. C. operating costs. D. capital structure. -17. Each of the following is a typical source of long-term capital for a firm EXCEPT A. Accounts Payable B. Preferred Stock C. Long-Term Debt. D. Common Stock. 18. When calculating a firm's "Weighted Average Cost of Capital" (WACC), the cost of each type of capital is weighted by A, the firm's beta value. B. the current inflation rate in the economy. C. the bank's prime lending rate. D. its proportion in the firm's capital structure 19. The "weights" in the "Weighted Average Cost of Capital" (WACC) formula A. must sum to 1.0 or 100%. B. must be non-negative. C. must include at least three different types of financing. D. A and B and C E. A and B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started