Answered step by step

Verified Expert Solution

Question

1 Approved Answer

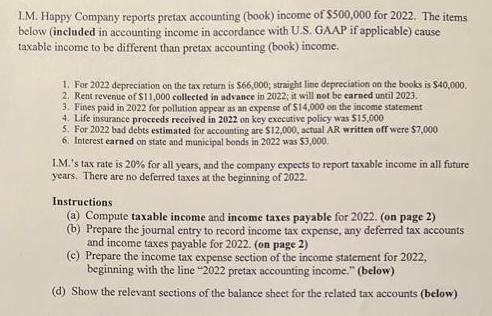

1.M. Happy Company reports pretax accounting (book) income of $500,000 for 2022. The items below (included in accounting income in accordance with U.S. GAAP

1.M. Happy Company reports pretax accounting (book) income of $500,000 for 2022. The items below (included in accounting income in accordance with U.S. GAAP if applicable) cause taxable income to be different than pretax accounting (book) income. 1. For 2022 depreciation on the tax return is $66,000; straight line depreciation on the books is $40,000. 2. Rent revenue of $11,000 collected in advance in 2022; it will not be earned until 2023. 3. Fines paid in 2022 for pollution appear as an expense of $14,000 on the income statement 4. Life insurance proceeds received in 2022 on key executive policy was $15,000 5. For 2022 bad debts estimated for accounting are $12,000, actual AR written off were $7,000 6. Interest earned on state and municipal bonds in 2022 was $3,000. I.M.'s tax rate is 20% for all years, and the company expects to report taxable income in all future years. There are no deferred taxes at the beginning of 2022. Instructions (a) Compute taxable income and income taxes payable for 2022. (on page 2) (b) Prepare the journal entry to record income tax expense, any deferred tax accounts and income taxes payable for 2022. (on page 2) (c) Prepare the income tax expense section of the income statement for 2022, beginning with the line "2022 pretax accounting income." (below) (d) Show the relevant sections of the balance sheet for the related tax accounts (below)

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a To compute taxable income and income taxes payable for 2022 we need to adjust the pretax accountin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started