Question

1.Molly is working in CopCo's finance department and she is trying to determine the company's cost of equity. CopCo is 100% equity funded. Molly has

1.Molly is working in CopCo's finance department and she is trying to determine the company's cost of equity. CopCo is 100% equity funded. Molly has found two industry peers that have very similar assets as CopCo (see table below). Assume debt beta = 0 and corporate tax rate = 30% for CopCo as well as its two peers. The risk-free rate is 2% and the expected market return is 8%.

| Company | Equity beta | Debt / Equity |

| A | 1.5 | 20% |

| B | 1.8 | 40% |

(i) (3 pt) Is the average of these two peers equity betas (1.65 = (1.5+1.8)/2) a good estimate of CopCos equity beta? (1 pt) Why? (2 pt)

(ii) (7 pt) CopCos stock is not traded publicly. Use the information on peers provided above to estimate (a) asset beta, (b) equity beta, and (c) cost of equity for CopCo. Provide the details of your calculations.

2. (7 pt) Fountain Corporation currently has $150m cash. The $150m cash is the only valuable asset the company has. It currently has only Project A available for investment, but an initial capital expenditure of $150m is required for investing in Project A. The cash flow of Project A in one year depends on the economy as shown in the following table. There are no taxes. Fountain's cost of capital is 10%.

| Economy | Probability | Project A Cash Flow |

| Bad | 0.8 | $50 |

| Good | 0.2 | $500 |

(i) If Fountain's objective is to maximize firm value, should it invest in Project A? (2 pt)

(ii) The company has $200m debt due in one year. At that time, the company would have no other valuable assets other than the $150m cash (if company does not invest in Project A) or the cash flow from Project A (if the company invests in the project). What is debt holders expected cash flow in one year: (a) if the company does not invest in Project A? (b) if the company invests in Project A? (2 pt)

(iii) (continue from (ii)) What is equity investors expected cash flow in one year: (a) if the company does not invest in Project A? (b) if the company invests in Project A? (c) if equity investors are only interested in maximizing their own wealth rather than firm value, will they choose to invest in Project A? (3 pt)

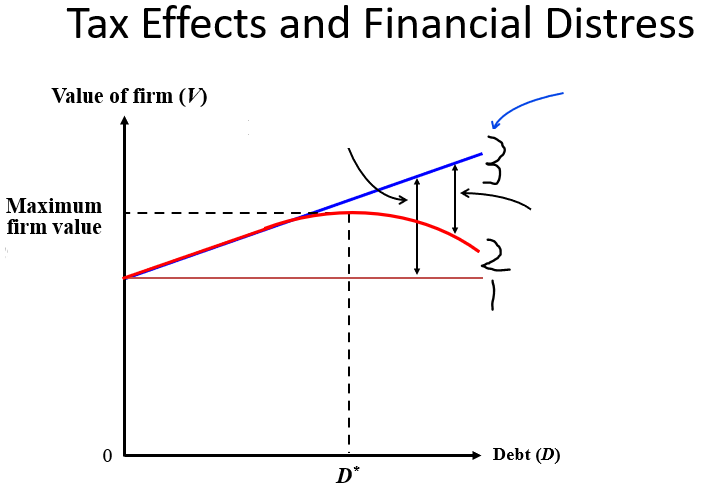

7. (14 pt) Interpret this graph:

(for example, what do these lines/curve represent? What are these differences between lines? And what is D*? you can also describe the trade-off between two effects when firms change leverage). Try to describe as more as possible.

You can use Line 1 to represent the dark red line when you describe, line 2 for the bright red curve, and line 3 for the blue line.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started