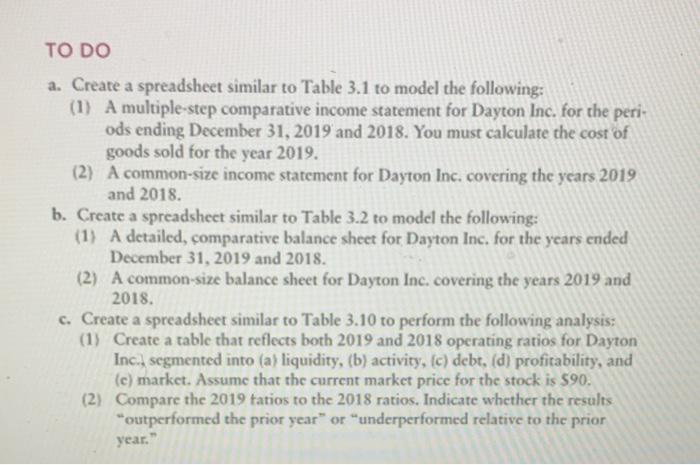

1)multi step comparative income statement

2) comparative balance sheet

please only multy step- comparative

I will send other question to the common- size apart

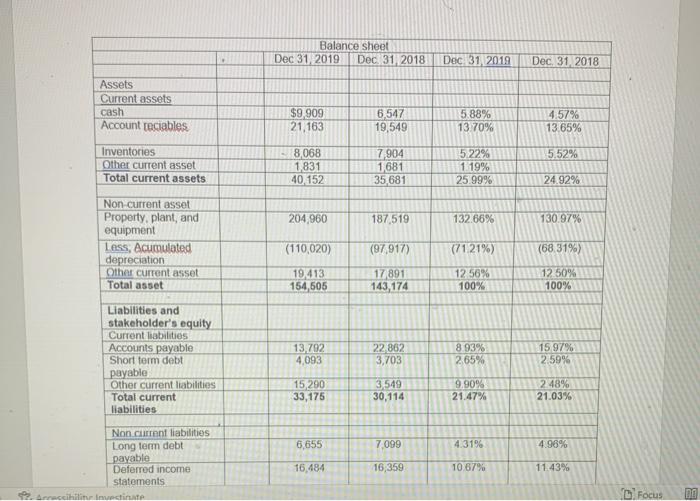

I have some procces but I dont know if its wrong

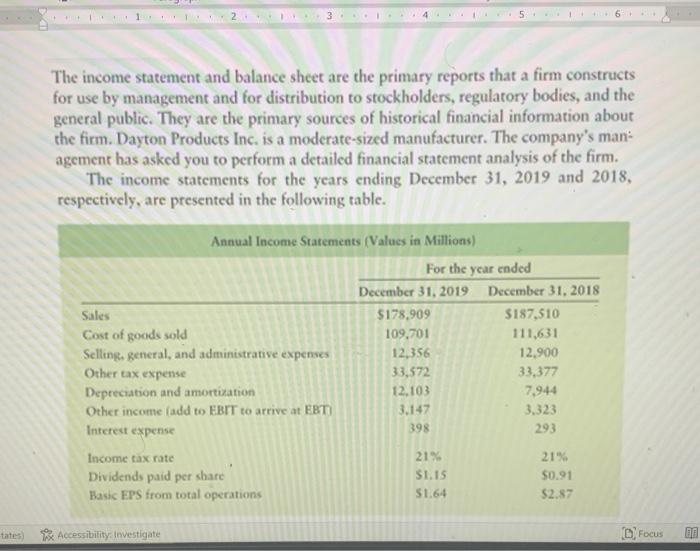

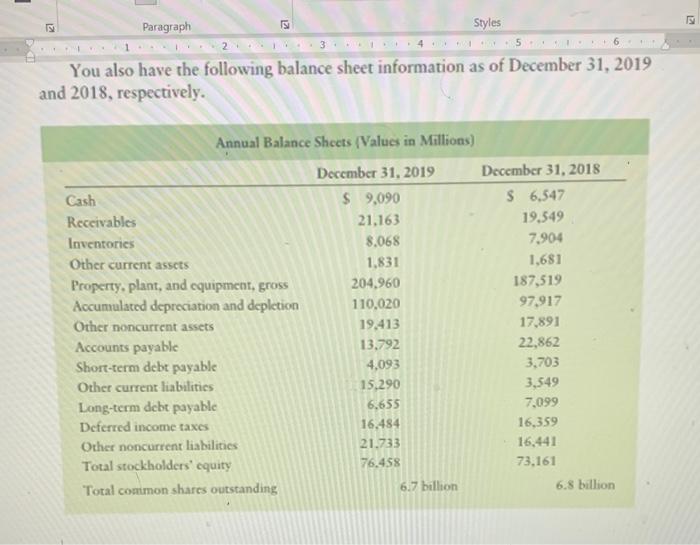

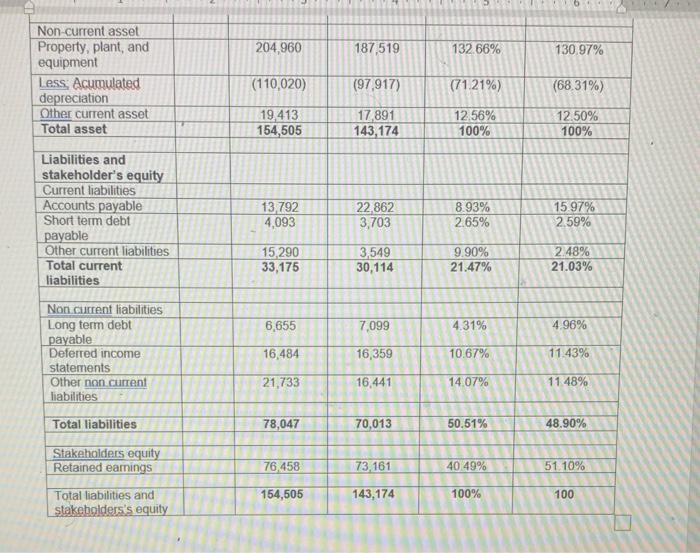

T 3 5 + 6 The income statement and balance sheet are the primary reports that a firm constructs for use by management and for distribution to stockholders, regulatory bodies, and the general public. They are the primary sources of historical financial information about the firm. Dayton Products Inc. is a moderate-sized manufacturer. The company's man agement has asked you to perform a detailed financial statement analysis of the firm. The income statements for the years ending December 31, 2019 and 2018, respectively, are presented in the following table. Annual Income Statements (Values in Millions) For the year ended December 31, 2019 December 31, 2018 Sales $178,909 $187,510 Cost of goods sold 109.701 111,631 Selling, general, and administrative expenses 12,356 12.900 Other tax expense 33,572 33,377 Depreciation and amortization 12.103 7,944 Other income (add to EBIT to arrive at EBT) 3.147 3.323 Interest expense 398 293 Income tax rate 21% 21% Dividends paid per share S1.15 $0.91 Basic EPS from total operations 51.64 $2.87 tates Accessibility: Investigate D) Focus Paragraph K1 is Styles 4 2 5 6 1 You also have the following balance sheet information as of December 31, 2019 and 2018, respectively. Annual Balance Sheets (Values in Millions) December 31, 2019 December 31, 2018 Cash $ 9,090 S 6,547 Receivables 21.163 19.549 Inventories 8.068 7,904 Other current assets 1.831 1,681 Property, plant, and equipment, gross 204,960 187,519 Accumulated depreciation and depletion 110,020 97,917 Other noncurrent assets 19,413 17,891 Accounts payable 13,792 22,862 Short-term debt payable 4,093 3,703 Other current liabilities 15,290 3,549 Long-term debt payable 6,655 7,099 Deferred income taxes 16,484 16,359 Other noncurrent liabilities 21.733 16,441 Total stockholders' equity 76.458 73,161 Total common shares outstanding 6.7 billion 6.8 billion TO DO a. Create a spreadsheet similar to Table 3.1 to model the following: (1) A multiple-step comparative income statement for Dayton Inc. for the peri- ods ending December 31, 2019 and 2018. You must calculate the cost of goods sold for the year 2019. (2) A common-size income statement for Dayton Inc. covering the years 2019 and 2018. b. Create a spreadsheet similar to Table 3.2 to model the following: (1) A detailed, comparative balance sheet for Dayton Inc. for the years ended December 31, 2019 and 2018. (2) A common size balance sheet for Dayton Inc. covering the years 2019 and 2018. c. Create a spreadsheet similar to Table 3.10 to perform the following analysis: (1) Create a table that reflects both 2019 and 2018 operating ratios for Dayton Inc., segmented into (a) liquidity, (b) activity, (c) debt, (d) profitability, and (c) market. Assume that the current market price for the stock is 590. (2) Compare the 2019 ratios to the 2018 ratios. Indicate whether the results "outperformed the prior year" or "underperformed relative to the prior year." a Balance sheet Dec 31, 2019 Dec 31 2018 Dec 31, 2018 Dec 31, 2018 Assets Current assets cash Account taciables $9.909 21,163 6,547 19,549 5.88% 13 70% 4.57% 13.65% 5.52% Inventories Other current asset Total current assets 8,068 1,831 40.152 7.904 1681 35,681 5.22% 1 19% 25 99% 24.92% 204,960 187 519 132.66% 130.97% Non current asset Property, plant, and equipment Less, Acumulated depreciation Other current asset Total asset (110,020) (97 917) (7121%) (68.31%) 19,413 154,505 17 891 143, 174 12 56% 100% 12 50% 100% Liabilities and stakeholder's equity Current liabilities Accounts payable Short term debt payable Other current liabilities Total current liabilities 13,792 4,093 22 862 3,703 8 93% 2.65% 15.97% 2.59% 15,290 33,175 3,549 30,114 9.90% 21.47% 2.48% 21.03% 6,655 7099 4.3196 4.98% Non current liabilities Long term debt payable Deferred income statements 16,484 16,359 10 67% 11.43% muncit D Focus 204,960 187,519 132.66% 130.97% Non-current asset Property, plant, and equipment Less: Acumulated depreciation Other current asset Total asset (110,020) (97,917) (71.21%) (68.31%) 19 413 154,505 17 891 143,174 12.56% 100% 12.50% 100% Liabilities and stakeholder's equity Current liabilities Accounts payable Short term debt payable Other current liabilities Total current liabilities 13,792 4,093 22.862 3,703 8.93% 2.65% 15.97% 2.59% 15,290 33,175 3,549 30,114 9.90% 21.47% 2.48% 21.03% 6,655 7,099 4.31% 4.96% Non current liabilities Long term debt payable Deferred income statements Other non current liabilities 16,484 16,359 10.67% 11.43% 21,733 16,441 14.07% 11 48% Total liabilities 78,047 70,013 50.51% 48.90% Stakeholders equity Retained earings 76,458 73.161 40 49% 51. 10% 154,505 143,174 100% 100 Total liabilities and stakebolders's equity T 3 5 + 6 The income statement and balance sheet are the primary reports that a firm constructs for use by management and for distribution to stockholders, regulatory bodies, and the general public. They are the primary sources of historical financial information about the firm. Dayton Products Inc. is a moderate-sized manufacturer. The company's man agement has asked you to perform a detailed financial statement analysis of the firm. The income statements for the years ending December 31, 2019 and 2018, respectively, are presented in the following table. Annual Income Statements (Values in Millions) For the year ended December 31, 2019 December 31, 2018 Sales $178,909 $187,510 Cost of goods sold 109.701 111,631 Selling, general, and administrative expenses 12,356 12.900 Other tax expense 33,572 33,377 Depreciation and amortization 12.103 7,944 Other income (add to EBIT to arrive at EBT) 3.147 3.323 Interest expense 398 293 Income tax rate 21% 21% Dividends paid per share S1.15 $0.91 Basic EPS from total operations 51.64 $2.87 tates Accessibility: Investigate D) Focus Paragraph K1 is Styles 4 2 5 6 1 You also have the following balance sheet information as of December 31, 2019 and 2018, respectively. Annual Balance Sheets (Values in Millions) December 31, 2019 December 31, 2018 Cash $ 9,090 S 6,547 Receivables 21.163 19.549 Inventories 8.068 7,904 Other current assets 1.831 1,681 Property, plant, and equipment, gross 204,960 187,519 Accumulated depreciation and depletion 110,020 97,917 Other noncurrent assets 19,413 17,891 Accounts payable 13,792 22,862 Short-term debt payable 4,093 3,703 Other current liabilities 15,290 3,549 Long-term debt payable 6,655 7,099 Deferred income taxes 16,484 16,359 Other noncurrent liabilities 21.733 16,441 Total stockholders' equity 76.458 73,161 Total common shares outstanding 6.7 billion 6.8 billion TO DO a. Create a spreadsheet similar to Table 3.1 to model the following: (1) A multiple-step comparative income statement for Dayton Inc. for the peri- ods ending December 31, 2019 and 2018. You must calculate the cost of goods sold for the year 2019. (2) A common-size income statement for Dayton Inc. covering the years 2019 and 2018. b. Create a spreadsheet similar to Table 3.2 to model the following: (1) A detailed, comparative balance sheet for Dayton Inc. for the years ended December 31, 2019 and 2018. (2) A common size balance sheet for Dayton Inc. covering the years 2019 and 2018. c. Create a spreadsheet similar to Table 3.10 to perform the following analysis: (1) Create a table that reflects both 2019 and 2018 operating ratios for Dayton Inc., segmented into (a) liquidity, (b) activity, (c) debt, (d) profitability, and (c) market. Assume that the current market price for the stock is 590. (2) Compare the 2019 ratios to the 2018 ratios. Indicate whether the results "outperformed the prior year" or "underperformed relative to the prior year." a Balance sheet Dec 31, 2019 Dec 31 2018 Dec 31, 2018 Dec 31, 2018 Assets Current assets cash Account taciables $9.909 21,163 6,547 19,549 5.88% 13 70% 4.57% 13.65% 5.52% Inventories Other current asset Total current assets 8,068 1,831 40.152 7.904 1681 35,681 5.22% 1 19% 25 99% 24.92% 204,960 187 519 132.66% 130.97% Non current asset Property, plant, and equipment Less, Acumulated depreciation Other current asset Total asset (110,020) (97 917) (7121%) (68.31%) 19,413 154,505 17 891 143, 174 12 56% 100% 12 50% 100% Liabilities and stakeholder's equity Current liabilities Accounts payable Short term debt payable Other current liabilities Total current liabilities 13,792 4,093 22 862 3,703 8 93% 2.65% 15.97% 2.59% 15,290 33,175 3,549 30,114 9.90% 21.47% 2.48% 21.03% 6,655 7099 4.3196 4.98% Non current liabilities Long term debt payable Deferred income statements 16,484 16,359 10 67% 11.43% muncit D Focus 204,960 187,519 132.66% 130.97% Non-current asset Property, plant, and equipment Less: Acumulated depreciation Other current asset Total asset (110,020) (97,917) (71.21%) (68.31%) 19 413 154,505 17 891 143,174 12.56% 100% 12.50% 100% Liabilities and stakeholder's equity Current liabilities Accounts payable Short term debt payable Other current liabilities Total current liabilities 13,792 4,093 22.862 3,703 8.93% 2.65% 15.97% 2.59% 15,290 33,175 3,549 30,114 9.90% 21.47% 2.48% 21.03% 6,655 7,099 4.31% 4.96% Non current liabilities Long term debt payable Deferred income statements Other non current liabilities 16,484 16,359 10.67% 11.43% 21,733 16,441 14.07% 11 48% Total liabilities 78,047 70,013 50.51% 48.90% Stakeholders equity Retained earings 76,458 73.161 40 49% 51. 10% 154,505 143,174 100% 100 Total liabilities and stakebolders's equity