Answered step by step

Verified Expert Solution

Question

1 Approved Answer

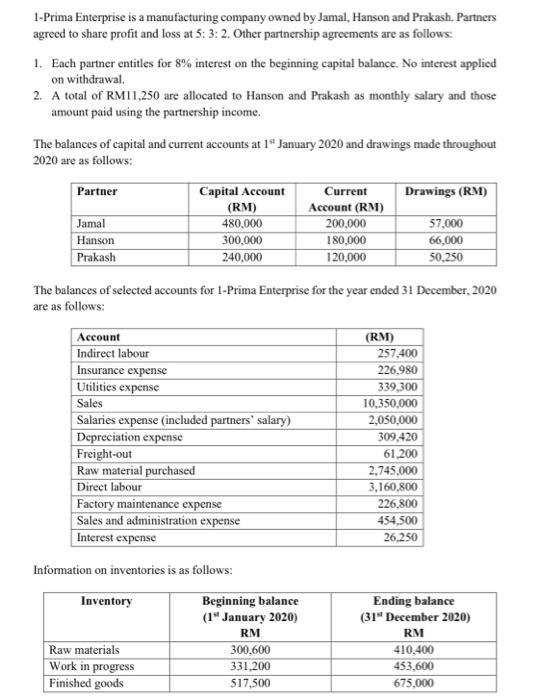

1-Prima Enterprise is a manufacturing company owned by Jamal, Hanson and Prakash. Partners agreed to share profit and loss at 5: 3: 2. Other

1-Prima Enterprise is a manufacturing company owned by Jamal, Hanson and Prakash. Partners agreed to share profit and loss at 5: 3: 2. Other partnership agreements are as follows: 1. Each partner entitles for 8% interest on the beginning capital balance. No interest applicd on withdrawal. 2. A total of RMI1,250 are allocated to Hanson and Prakash as monthly salary and those amount paid using the partnership income. The balances of capital and current accounts at 1" January 2020 and drawings made throughout 2020 are as follows: Partner Capital Account (RM) Current Account (RM) 200,000 180,000 120,000 Drawings (RM) Jamal 480,000 57,000 Hanson 300,000 66,000 Prakash 240,000 50,250 The balances of selected accounts for 1-Prima Enterprise for the year ended 31 December, 2020 are as follows: (RM) 257,400 226,980 339,300 10,350,000 2,050,000 309,420 Account Indirect labour Insurance expense Utilities expense Sales Salaries expense (included partners' salary) Depreciation expense Freight-out Raw material purchased Direct labour Factory maintenance expense Sales and administration expense Interest expense 61.200 2,745,000 3,160,800 226,800 454,500 26,250 Information on inventories is as follows: Beginning balance (1" January 2020) Ending balance (31" December 2020) Inventory RM RM Raw materials Work in progress Finished goods 300,600 410,400 331,200 453,600 517,500 675,000 Additional information: 1. RM150,480 of insurance expense is for the factory and the remainder is for the office use. 2. RM181,800 of utilities expense is for the factory and the remainder is for the office use. 3. RM169,920 of depreciation expense is for the factory's machines and the remainder is for the office's building and equipment. Required: a) Prepare Cost of Goods Manufactured Schedule for 1-Prima Enterprise for the year ended 31 December 2020. b) Prepare Income Statement for 1-Prima Enterprise for the year ended 31 December 2020. c) Prepare Income Allocation Schedule for 1-Prima Enterprise for the year ended 31 December 2020. d) Prepare partners' current accounts for 1-Prima Enterprise on 31 December 2020.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Paga No Date It Bcime Enterfucse Schedule of Cost t Pasetcalares D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started