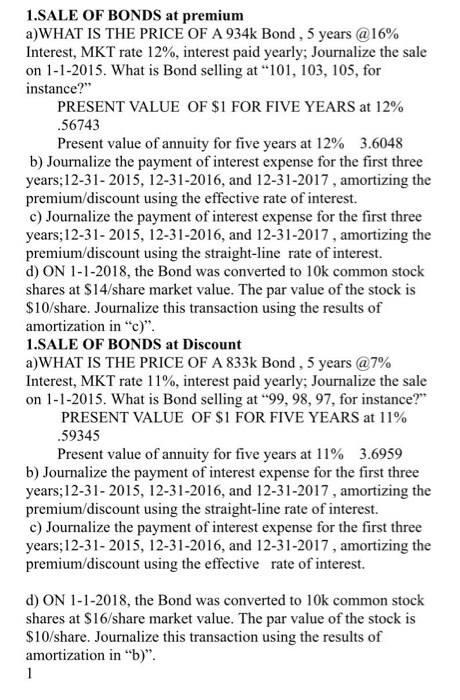

1.SALE OF BONDS at premium a)WHAT IS THE PRICE OF A 934k Bond, 5 years @16% Interest, MKT rate 12%, interest paid yearly; Journalize the sale on 1-1-2015. What is Bond selling at 101, 103, 105, for instance?" PRESENT VALUE OF $1 FOR FIVE YEARS at 12% .56743 Present value of annuity for five years at 12% 3.6048 b) Journalize the payment of interest expense for the first three years;12-31-2015, 12-31-2016, and 12-31-2017, amortizing the premium/discount using the effective rate of interest. c) Journalize the payment of interest expense for the first three years;12-31-2015, 12-31-2016, and 12-31-2017, amortizing the premium/discount using the straight-line rate of interest. d) ON 1-1-2018, the Bond was converted to 10k common stock shares at $14/share market value. The par value of the stock is $10/share. Journalize this transaction using the results of amortization in "c)". 1.SALE OF BONDS at Discount a)WHAT IS THE PRICE OF A 833k Bond, 5 years @7% Interest, MKT rate 11%, interest paid yearly; Journalize the sale on 1-1-2015. What is Bond selling at "99, 98, 97, for instance?" PRESENT VALUE OF $1 FOR FIVE YEARS at 11% .59345 Present value of annuity for five years at 11% 3.6959 b) Journalize the payment of interest expense for the first three years;12-31-2015, 12-31-2016, and 12-31-2017, amortizing the premium/discount using the straight-line rate of interest. c) Journalize the payment of interest expense for the first three years;12-31-2015, 12-31-2016, and 12-31-2017, amortizing the premium/discount using the effective rate of interest. d) ON 1-1-2018, the Bond was converted to 10k common stock shares at $16/share market value. The par value of the stock is $10/share. Journalize this transaction using the results of amortization in "b)". 1 1.SALE OF BONDS at premium a)WHAT IS THE PRICE OF A 934k Bond, 5 years @16% Interest, MKT rate 12%, interest paid yearly; Journalize the sale on 1-1-2015. What is Bond selling at 101, 103, 105, for instance?" PRESENT VALUE OF $1 FOR FIVE YEARS at 12% .56743 Present value of annuity for five years at 12% 3.6048 b) Journalize the payment of interest expense for the first three years;12-31-2015, 12-31-2016, and 12-31-2017, amortizing the premium/discount using the effective rate of interest. c) Journalize the payment of interest expense for the first three years;12-31-2015, 12-31-2016, and 12-31-2017, amortizing the premium/discount using the straight-line rate of interest. d) ON 1-1-2018, the Bond was converted to 10k common stock shares at $14/share market value. The par value of the stock is $10/share. Journalize this transaction using the results of amortization in "c)". 1.SALE OF BONDS at Discount a)WHAT IS THE PRICE OF A 833k Bond, 5 years @7% Interest, MKT rate 11%, interest paid yearly; Journalize the sale on 1-1-2015. What is Bond selling at "99, 98, 97, for instance?" PRESENT VALUE OF $1 FOR FIVE YEARS at 11% .59345 Present value of annuity for five years at 11% 3.6959 b) Journalize the payment of interest expense for the first three years;12-31-2015, 12-31-2016, and 12-31-2017, amortizing the premium/discount using the straight-line rate of interest. c) Journalize the payment of interest expense for the first three years;12-31-2015, 12-31-2016, and 12-31-2017, amortizing the premium/discount using the effective rate of interest. d) ON 1-1-2018, the Bond was converted to 10k common stock shares at $16/share market value. The par value of the stock is $10/share. Journalize this transaction using the results of amortization in "b)". 1