Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Shakil is uncertain about the applicability of the cost principle to plant assets. Explain the principle to Shakil. 2.Prity, an accounting major, is working on

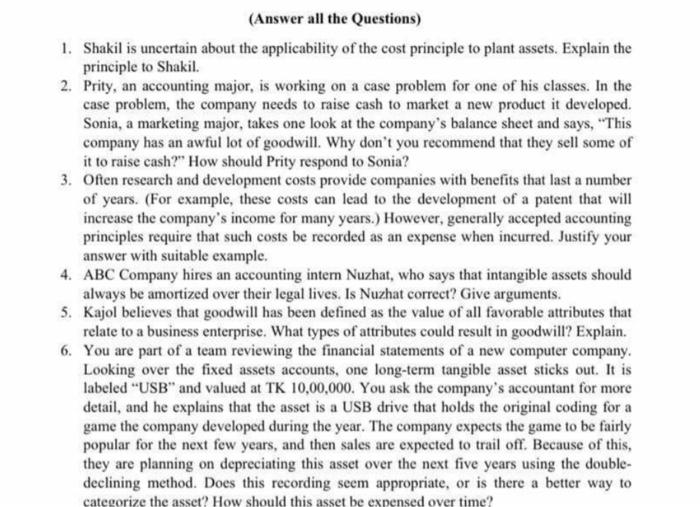

1.Shakil is uncertain about the applicability of the cost principle to plant assets. Explain the

principle to Shakil.

2.Prity, an accounting major, is working on a case problem for one of his classes. In the

case problem, the company needs to raise cash to market a new product it developed.

Sonia, a marketing major, takes one look at the company's balance sheet and says, "This

company has an awful lot of goodwill. Why don't you recommend that they sell some of

it to raise cash?" How should Prity respond to Sonia?

3. Often research and development costs provide companies with benefits that last a number

of years. (For example, these costs can lead to the development of a patent that will

increase the company's income for many years.) However, generally accepted accounting

principles require that such costs be recorded as an expense when incurred. Justity your

answer with suitable example.

4.ABC Company hires an accounting intern Nuzhat, who says that intangible assets should

always be amortized over their legal lives. Is Nuzhat correct? Give arguments.

5. Kajol believes that goodwill has been defined as the value of all favorable attributes that

relate to a business enterprise. What types of attributes could result in goodwill? Explain.

6.You are part of a team reviewing the financial statements of a new computer company

Looking over the fixed assets accounts, one long-term tangible asset sticks out. It 15

labeled "USB" and valued at TK 10,00,000. You ask the company's accountant for more

detail, and he explains that the asset is a USB drive that holds the original coding for a

game the company developed during the year. The company expects the game to be fairly

popular for the next few years, and then sales are expected to trail off. Because of this,

they are planning on depreciating this asset over the next five years using the double-

declining method. Does this recording seem appropriate, or is there a better way to

categorize the asset? How should this asset be expensed over time?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started