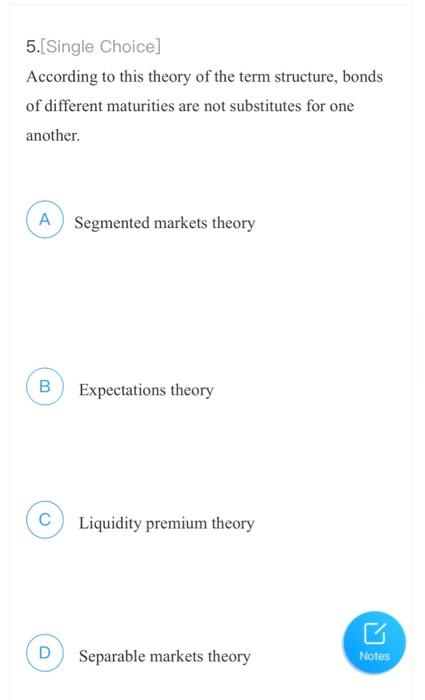

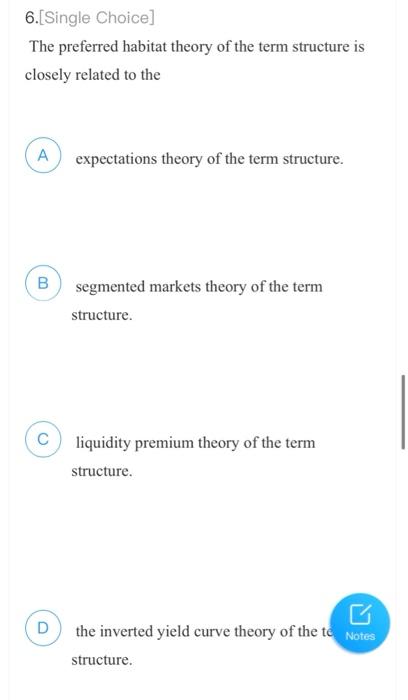

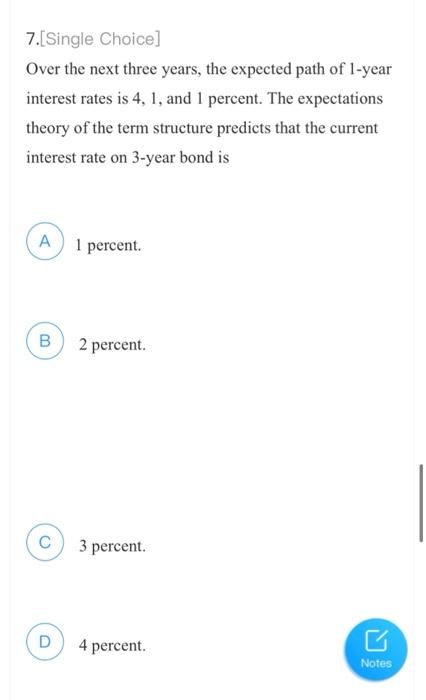

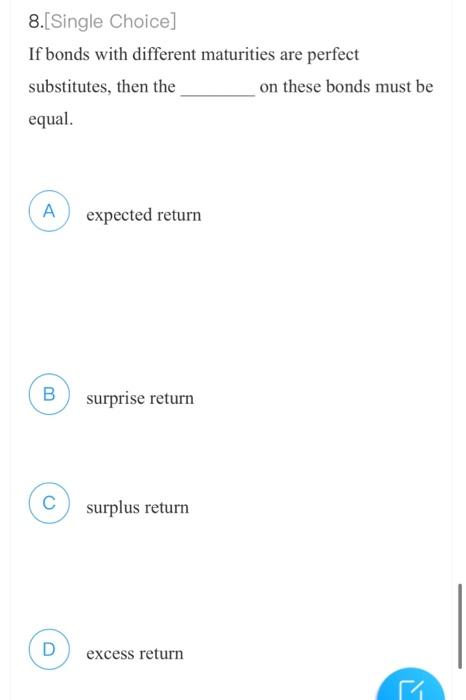

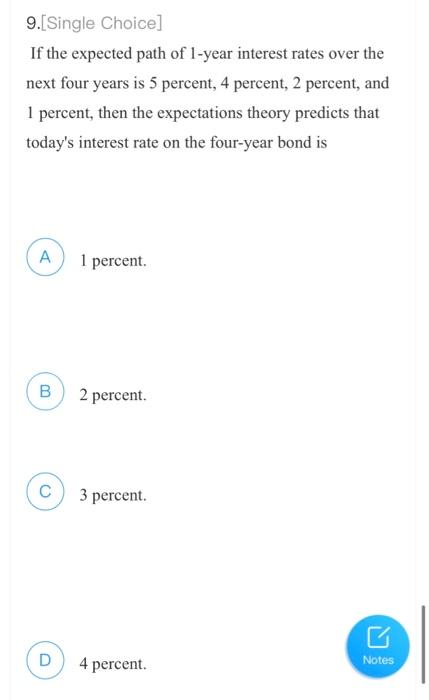

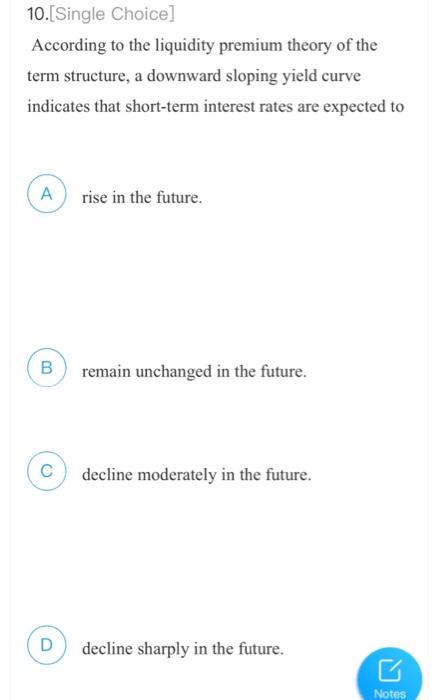

1.[Single Choice] The steeply upward sloping yield curve in the figure above indicates that interest rates are expected to in the future. A A short-term; rise B short-term; fall moderately short-term; remain unchanged D long-term; fall moderately Notes 2.[Single Choice] A particularly attractive feature of the is that it tells you what the market is predicting about future short-term interest rates by just looking at the slope of the yield curve. A segmented markets theory 00 expectations theory liquidity premium theory D separable markets theory 3.(Single Choice) Economists' attempts to explain the term structure of interest rates A illustrate how economists modify theories to improve them when they are inconsistent with the empirical evidence. 00 B illustrate how economists continue to accept theories that fail to explain observed behavior of interest rate movements. c prove that the real world is a special case that tends to get short shrift in theoretical models. Notes D have proved entirely unsatisfactory to date. 4.[Single Choice] According to the expectations theory of the term structure, the interest rate on a long-term bond will equal the of the short-term interest rates that people expect to occur over the life of the long- term bond. A average B sum C O difference D Notes multiple 5.[Single Choice] According to this theory of the term structure, bonds of different maturities are not substitutes for one another A Segmented markets theory B Expectations theory C Liquidity premium theory D Separable markets theory Notes 6.[Single Choice] The preferred habitat theory of the term structure is closely related to the A expectations theory of the term structure. B segmented markets theory of the term structure. c liquidity premium theory of the term structure. D the inverted yield curve theory of the te Notes structure. 7.(Single Choice] Over the next three years, the expected path of 1-year interest rates is 4, 1, and 1 percent. The expectations theory of the term structure predicts that the current interest rate on 3-year bond is A A 1 percent. B 2 percent c 3 percent. D 4 percent Notes 8.[Single Choice] If bonds with different maturities are perfect substitutes, then the on these bonds must be equal. A expected return B surprise return surplus return D excess return 9. Single Choice] If the expected path of 1-year interest rates over the next four years is 5 percent, 4 percent, 2 percent, and 1 percent, then the expectations theory predicts that today's interest rate on the four-year bond is . 1 percent B 2 percent. 3 percent D 4 percent Notes 10.(Single Choice] According to the liquidity premium theory of the term structure, a downward sloping yield curve indicates that short-term interest rates are expected to A rise in the future. B remain unchanged in the future. decline moderately in the future. D decline sharply in the future. Notes