Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1st and 2nd. Give the full explanation please. I will rate! -. To make an investment, a company has borrowed TL 8,000,000 annually for 10

1st and 2nd. Give the full explanation please. I will rate!

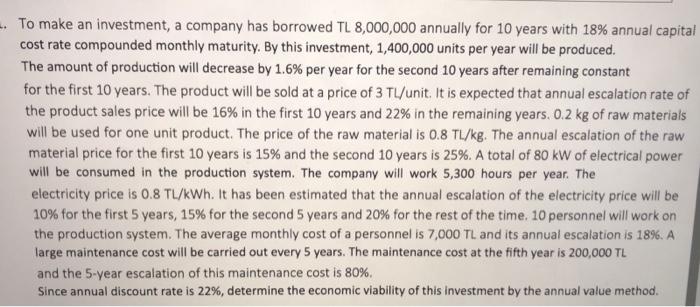

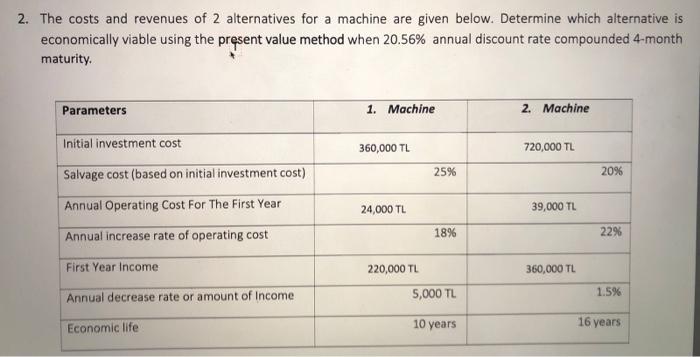

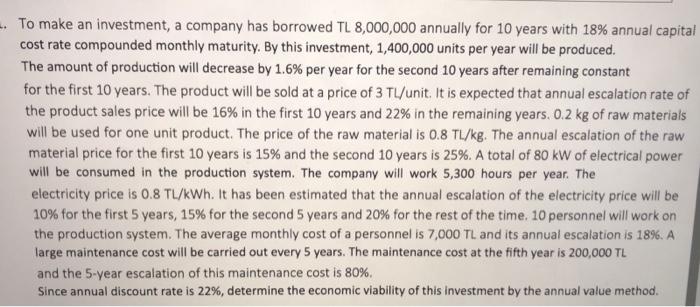

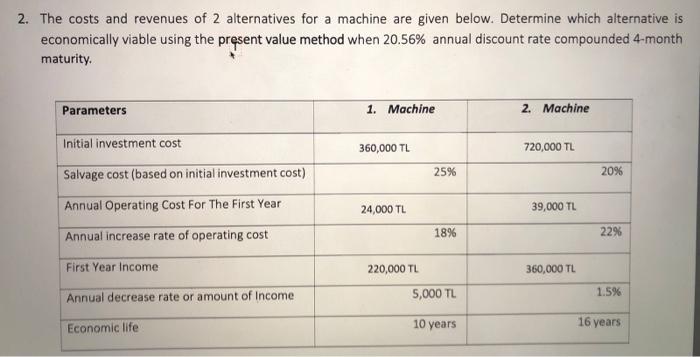

-. To make an investment, a company has borrowed TL 8,000,000 annually for 10 years with 18% annual capital cost rate compounded monthly maturity. By this investment, 1,400,000 units per year will be produced. The amount of production will decrease by 1.6% per year for the second 10 years after remaining constant for the first 10 years. The product will be sold at a price of 3 TL/unit. It is expected that annual escalation rate of the product sales price will be 16% in the first 10 years and 22% in the remaining years. 0.2 kg of raw materials will be used for one unit product. The price of the raw material is 0.8 TL/kg. The annual escalation of the raw material price for the first 10 years is 15% and the second 10 years is 25%. A total of 80 kW of electrical power will be consumed in the production system. The company will work 5,300 hours per year. The electricity price is 0.8 TL/kWh. It has been estimated that the annual escalation of the electricity price will be 10% for the first 5 years, 15% for the second 5 years and 20% for the rest of the time. 10 personnel will work on the production system. The average monthly cost of a personnel is 7,000 TL and its annual escalation is 1896. A large maintenance cost will be carried out every 5 years. The maintenance cost at the fifth year is 200,000 TL and the 5-year escalation of this maintenance cost is 80%. Since annual discount rate is 22%, determine the economic viability of this investment by the annual value method. 2. The costs and revenues of 2 alternatives for a machine are given below. Determine which alternative is economically viable using the present value method when 20.56% annual discount rate compounded 4-month maturity, Parameters 1. Machine 2. Machine Initial investment cost 360,000 TL 720,000 TL Salvage cost (based on initial investment cost) 25% 20% Annual Operating Cost For The First Year 24,000 TL 39,000 TL Annual increase rate of operating cost 18% 2% First Year Income 220,000 TL 360,000 TL 5,000 TL 1.5% Annual decrease rate or amount of Income Economic life 10 years 16 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started