Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1st Drop Box (Should or Should Not) 2nd Drop Box (At the Money, In the Money, or Out of the Money) Now suppose the stock

1st Drop Box (Should or Should Not) 2nd Drop Box (At the Money, In the Money, or Out of the Money)

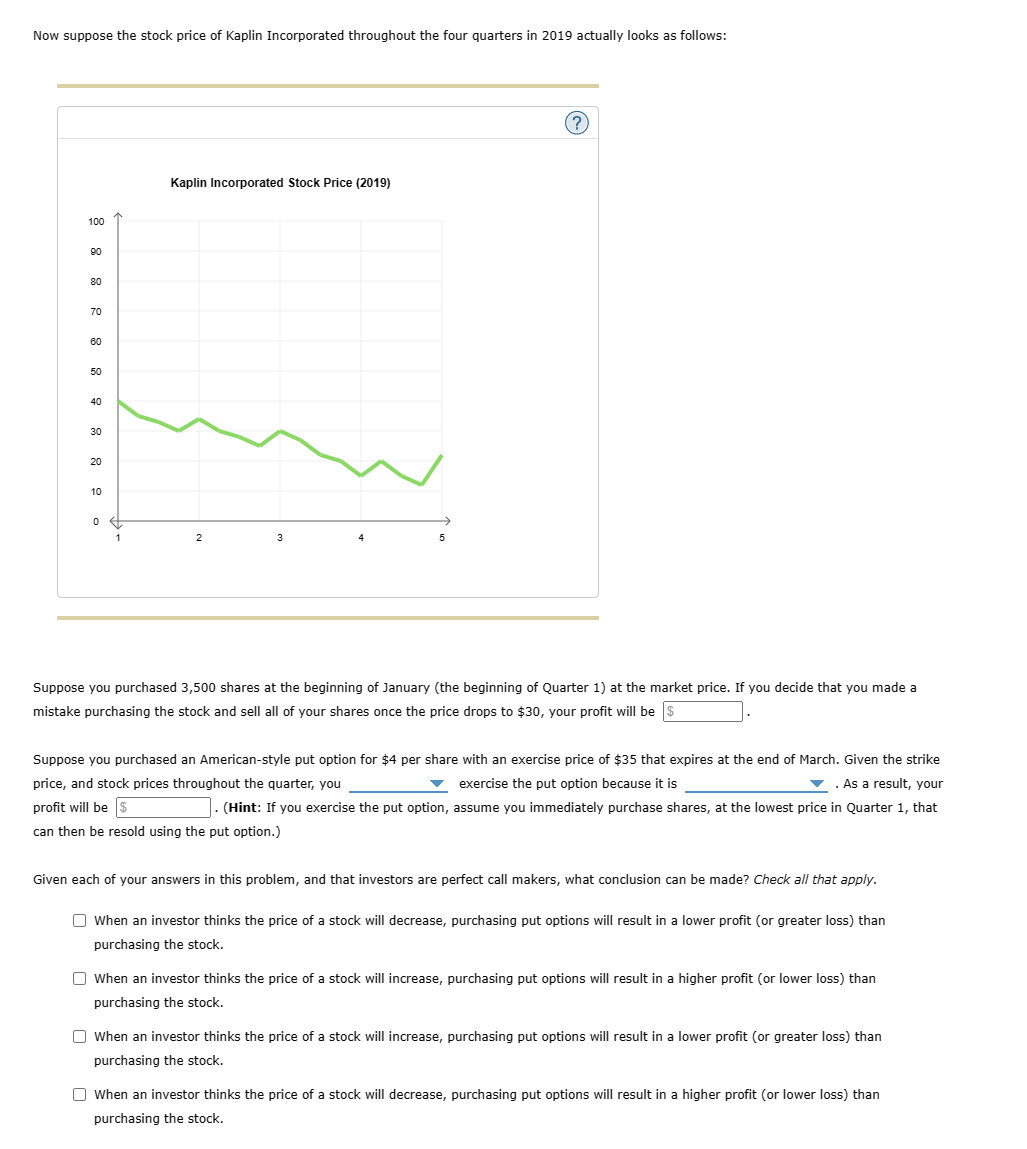

Now suppose the stock price of Kaplin Incorporated throughout the four quarters in 2019 actually looks as follows: (?) Suppose you purchased 3,500 shares at the beginning of January (the beginning of Quarter 1 ) at the market price. If you decide that you made a mistake purchasing the stock and sell all of your shares once the price drops to $30, your profit will be Suppose you purchased an American-style put option for $4 per share with an exercise price of $35 that expires at the end of March. Given the strike price, and stock prices throughout the quarter, you exercise the put option because it is . As a result, your profit will be . (Hint: If you exercise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1 , that can then be resold using the put option.) Given each of your answers in this problem, and that investors are perfect call makers, what conclusion can be made? Check all that apply. When an investor thinks the price of a stock will decrease, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. When an investor thinks the price of a stock will increase, purchasing put options will result in a higher profit (or lower loss) than purchasing the stock. When an investor thinks the price of a stock will increase, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. When an investor thinks the price of a stock will decrease, purchasing put options will result in a higher profit (or lower loss) than purchasing the stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started