Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1st pic 1st question // 2nd and 3rd pic 2nd question // 4th and 5th pic 3rd question help please!! Entries for Factory costs and

1st pic 1st question // 2nd and 3rd pic 2nd question // 4th and 5th pic 3rd question

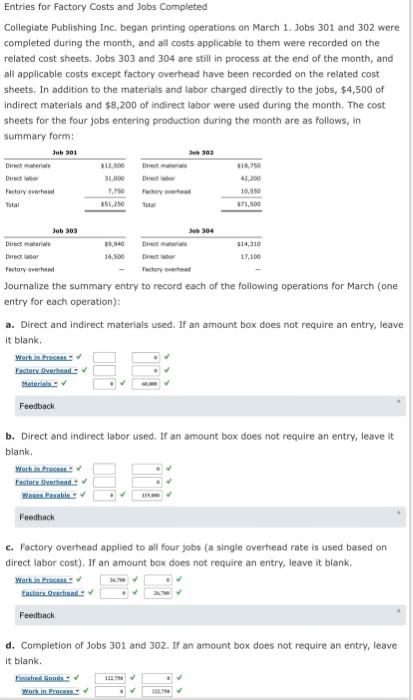

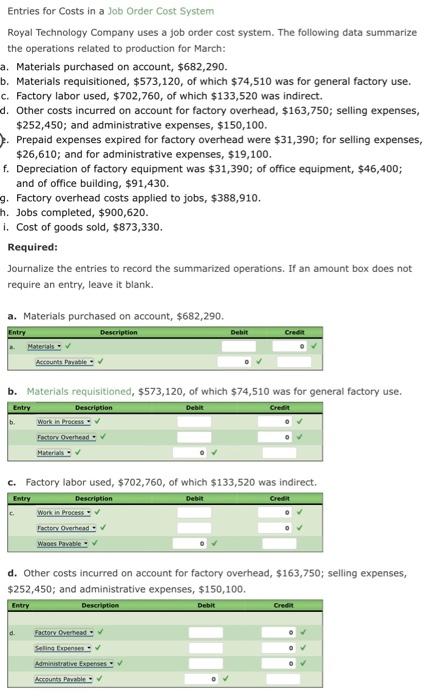

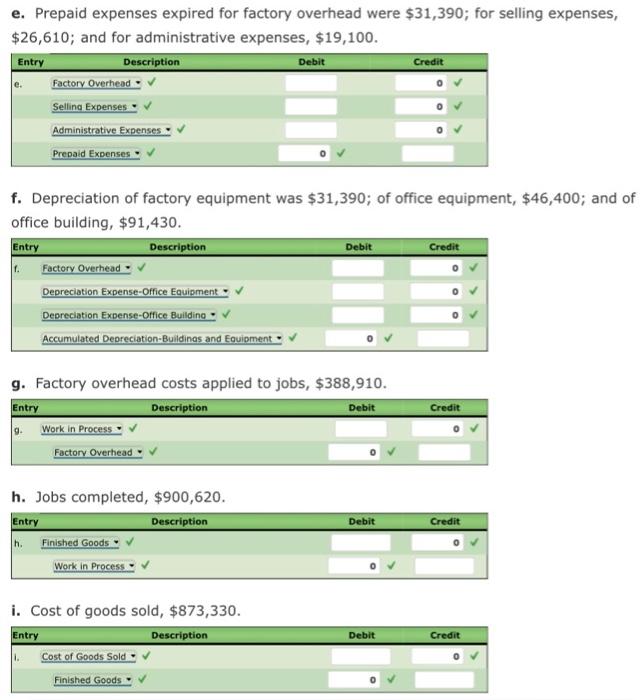

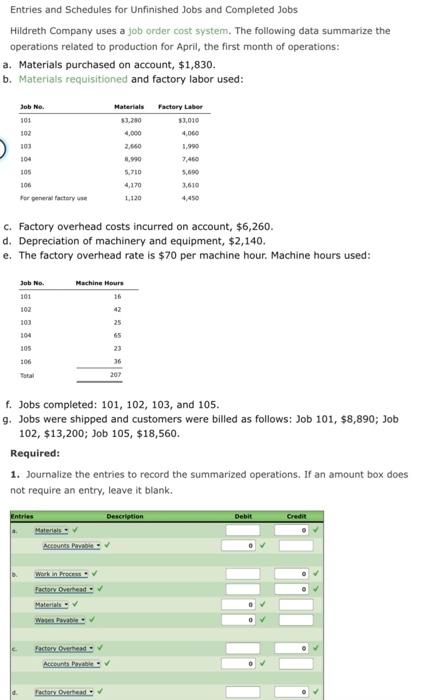

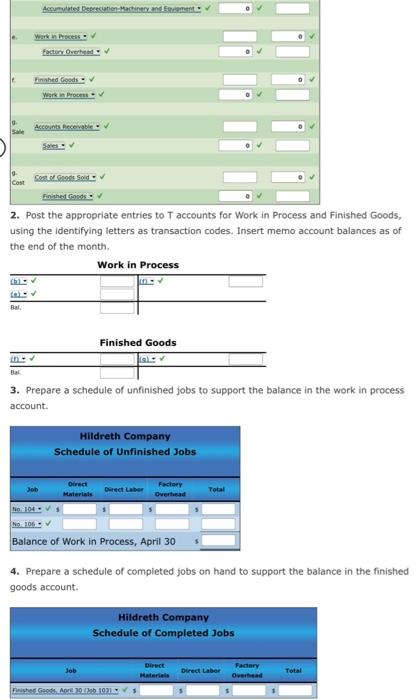

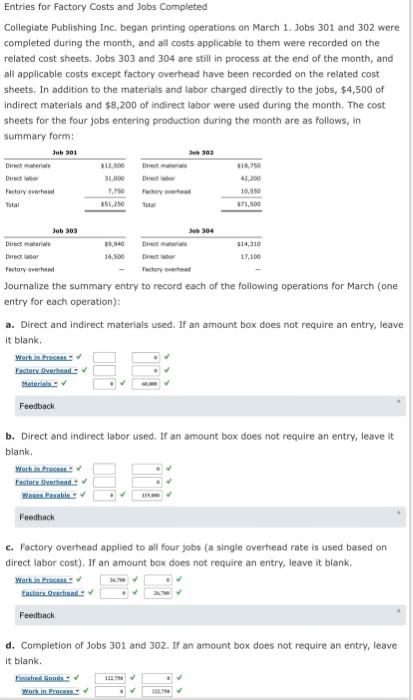

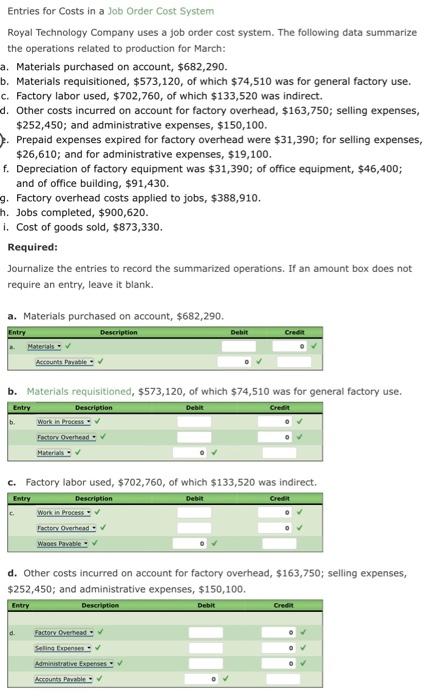

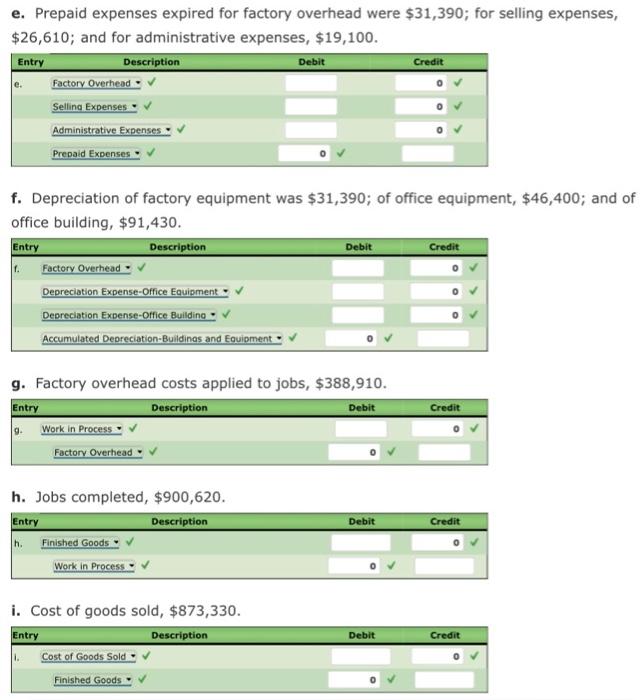

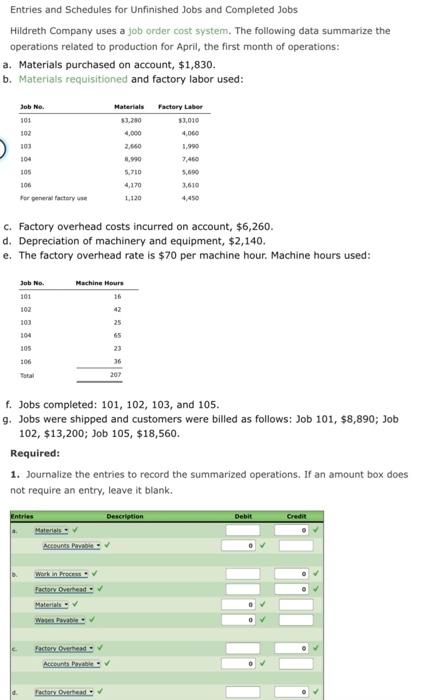

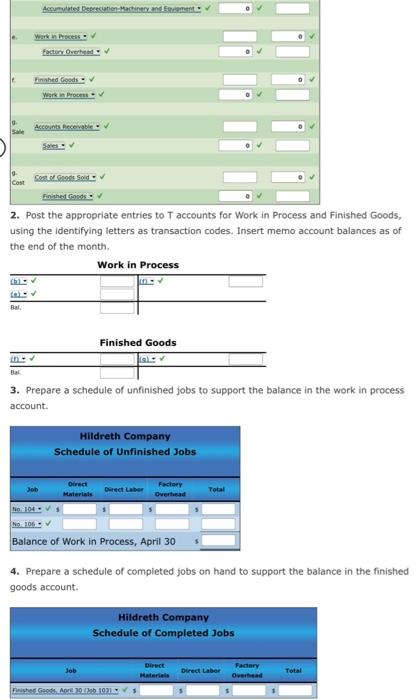

Entries for Factory costs and Jobs Completed Collegiate Publishing Inc. began printing operations on March 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets, Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $4,500 of indirect materials and $8,200 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: Jol 301 302 Die $12,00 11,000 118.750 42,200 10.50 Factory over 351,250 Job 304 514,310 17,100 Job 303 Direct 39,540 cm Director 16.500 Factory weet Journalize the summary entry to record each of the following operations for March (one entry for each operation): a. Direct and indirect materials used. If an amount box does not require an entry, leave it blank Work in Preces Factory Overheads Feedback b. Direct and indirect labor used. If an amount box does not require an entry, leave it blank wat in Easty. Feedback c. Factory overhead applied to all four jobs (a single overhead rate is used based on direct labor cost). If an amount box does not require an entry, leave it blank Worki tacter Drached Feedback d. Completion of Jobs 301 and 302. Tf an amount box does not require an entry, leave it blank. Work in Process Entries for Costs in a Job Order Cost System Royal Technology Company uses a job order cost system. The following data summarize the operations related to production for March: a. Materials purchased on account, $682,290. b. Materials requisitioned, $573,120, of which $74,510 was for general factory use. c. Factory labor used, $702,760, of which $133,520 was indirect. d. Other costs incurred on account for factory overhead, $163,750; selling expenses, $252,450; and administrative expenses, $150,100. Prepaid expenses expired for factory overhead were $31,390; for selling expenses, $26,610; and for administrative expenses, $19,100. f. Depreciation of factory equipment was $31,390; of office equipment, $46,400; and of office building, $91,430. g. Factory overhead costs applied to jobs, $388,910. h. Jobs completed, $900,620. i. Cost of goods sold, $873,330. Required: Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it blank. a. Materials purchased on account, $682,290. Entry Description Debit Creo Accounts Payable b. Materials requisitioned, $573,120, of which $74,510 was for general factory use. Entry Debit Crec Description Work in process Faster Overhead Materials Debit c. Factory labor used, $702,760, of which $133,520 was indirect. Entry Description Cred Work in Process Factory Overhead Wars Payable d. Other costs incurred on account for factory overhead, $163,750; selling expenses, $252,450; and administrative expenses, $150,100. Entry Description Debit Credit d. Factory Other Saling penses Administrative Expenses Accountable e. Prepaid expenses expired for factory overhead were $31,390; for selling expenses, $26,610; and for administrative expenses, $19,100. Entry Description Debit Credit Factory Overhead Selling Expenses Administrative Expenses Prepaid Expenses e Debit Credit f. Depreciation of factory equipment was $31,390; of office equipment, $46,400; and of office building, $91,430. Entry Description 1. Factory Overhead Depreciation Expense-Office Equipment Depreciation Expense-Office Building Accumulated Depreciation-Buildings and Equipment Debit Credit g. Factory overhead costs applied to jobs, $388,910. Entry Description Work in Process Factory Overhead Debit Credit h. Jobs completed, $900,620. Entry Description . Finished Goods Work in Process i. Cost of goods sold, $873,330. Entry Description Debit Credit 1. Cost of Goods Sold Finished Goods Entries and Schedules for Unfinished Jobs and Completed Jobs Hildreth Company uses a job order cost system. The following data summarize the operations related to production for April, the first month of operations: a. Materials purchased on account, $1,830. b. Materials requisitioned and factory labor used: 4.000 Job Ne 101 102 103 104 105 106 For generat factory se Materials Factory Labor 52.280 $1,010 4.000 2/660 1,990 3.990 5.710 5.690 4,170 1,610 1.120 c. Factory overhead costs incurred on account, $6,260. d. Depreciation of machinery and equipment, $2,140. e. The factory overhead rate is $70 per machine hour. Machine hours used: Machine Hours Job No. 101 102 103 104 105 106 42 25 65 23 36 207 f. Jobs completed: 101, 102, 103, and 105. 9. Jobs were shipped and customers were billed as follows: Job 101, $8,890; Job 102, $13,200; Job 105, $18,560. Required: 1. Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it blank. Description Debit Crede Entries Materi ACES Factory Overhead Materials Factory Overhede Account Factory Dread Accumulate Depreciation Machinery and Event warrinho Factory Over Finned Goods Work in Proce Accounts Receivable Com Costel Finished Gonds 2. Post the appropriate entries to Taccounts for Work in Process and Finished Goods, using the identifying letters as transaction codes. Insert memo account balances as of the end of the month. Work in Process Bal Finished Goods SL Bal 3. Prepare a schedule of unfinished jobs to support the balance in the work in process account. Hildreth Company Schedule of Unfinished Jobs Direct Direct Labor Factory Overhead Total Balance of Work in Process, April 30 4. Prepare a schedule of completed jobs on hand to support the balance in the finished goods account Hildreth Company Schedule of Completed Jobs Job Direct Material Direct Labor Faciary Overhead Total Fished Goods Are 2013 10 help please!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started