1st question answer -

2nd question answer

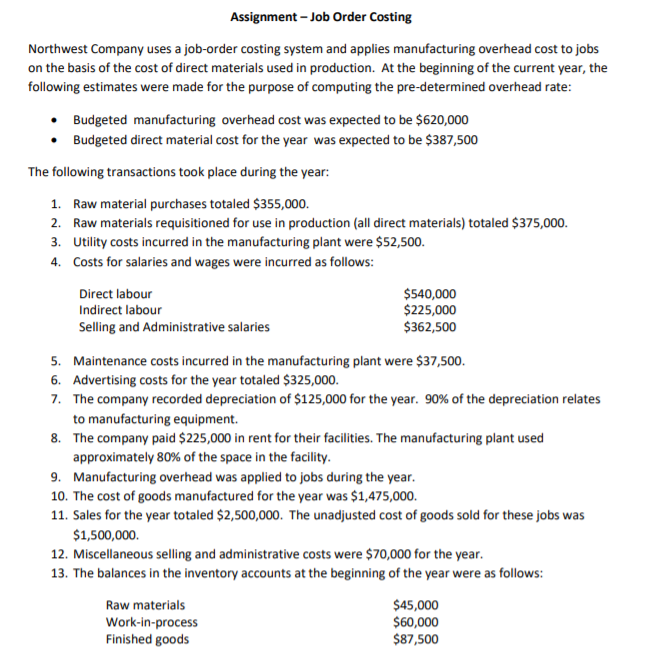

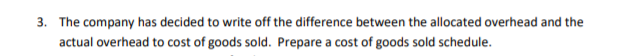

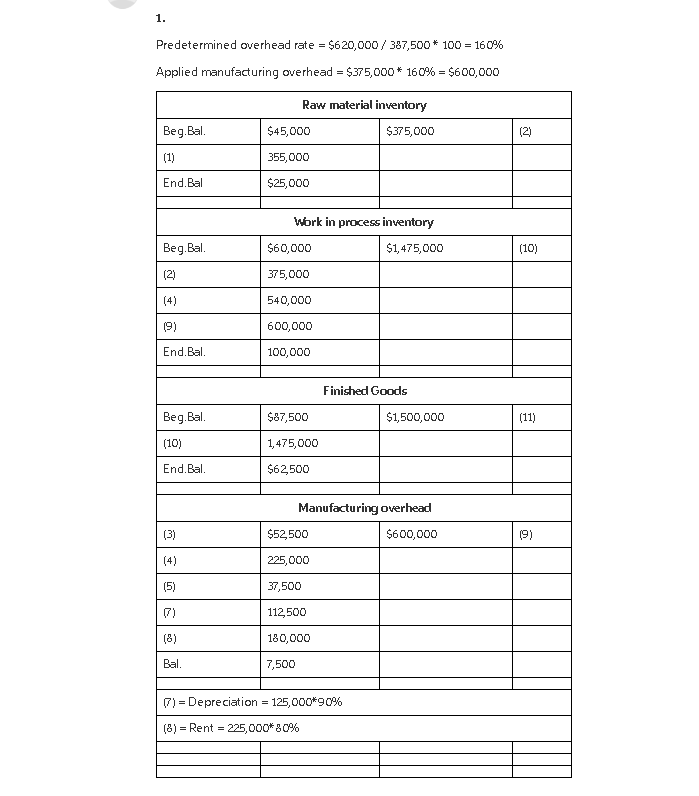

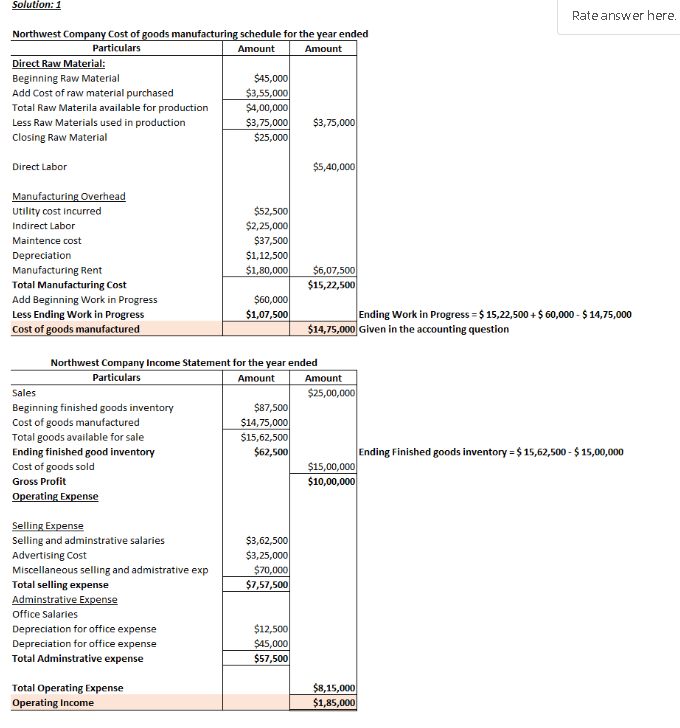

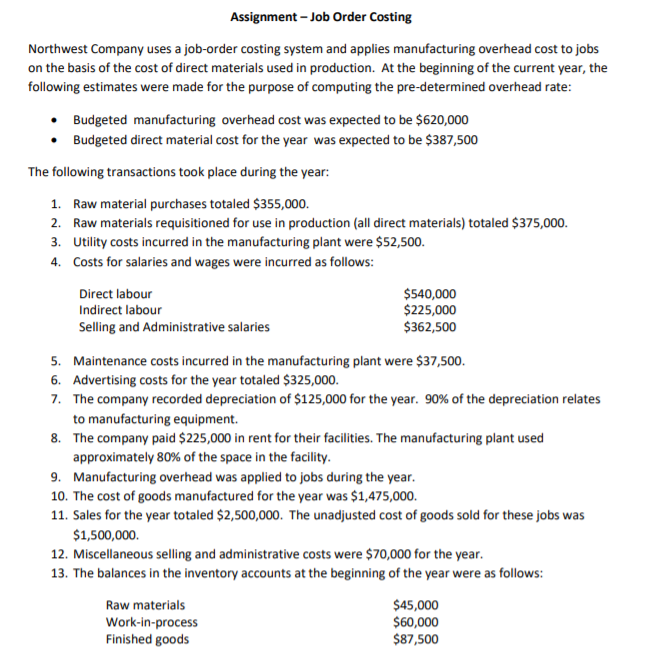

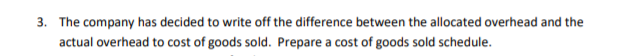

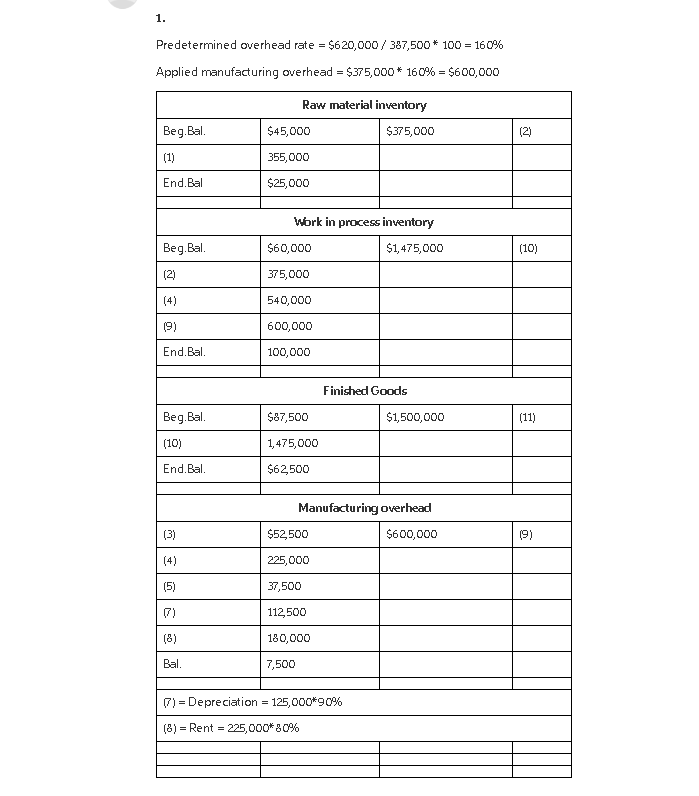

Assignment -Job Order Costing Northwest Company uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the cost of direct materials used in production. At the beginning of the current year, the following estimates were made for the purpose of computing the pre-determined overhead rate: S Budgeted manufacturing overhead cost was expected to be $620,000 Budgeted direct material cost for the year was expected to be $387,500 The following transactions took place during the year: Raw material purchases totaled $355,000. Raw materials requisitioned for use in production (all direct materials) totaled $375,000. 1. 2. Utility costs incurred in the manufacturing plant were $52,500 Costs for salaries and wages were incurred as follows: 3. 4. $540,000 $225,000 $362,500 Direct labour Indirect labour Selling and Administrative salaries Maintenance costs incurred in the manufacturing plant were $37,500. Advertising costs for the year totaled $325,000. The company recorded depreciation of $125,000 for the year. 90% of the depreciation relates 5. 6. 7. to manufacturing equipment. The company paid $225,000 in rent for their facilities. The manufacturing plant used approximately 80% of the space in the facility. 8. 9 Manufacturing overhead was applied to jobs during the year. 10. The cost of goods manufactured for the year was $1,475,000. 11. Sales for the year totaled $2,500,000. The unadjusted cost of goods sold for these jobs was $1,500,000. 12. Miscellaneous selling and administrative costs were $70,000 for the year. 13. The balances in the inventory accounts at the beginning of the year were as follows: $45,000 $60,000 $87,500 Raw materials Work-in-process Finished goods The company has decided to write off the difference between the allocated overhead and the 3. actual overhead to cost of goods sold. Prepare a cost of goods sold schedule 1. $620,000 387,500* 100 160 % Predetermined overhead rate Applied manufacturing overhead $375,000 1609% = $600,000 Raw material inventory Beg.Bal. $45,000 $375,000 (2) (1) 355,000 End.Bal $25,000 Work in process inventory Beg.Bal. $60,000 $1,475,000 (10) (2) 375,000 (4) 540,000 600,000 (9) End.Bal. 100,000 Finished Goods Beg.Bal. $87,500 $1,500,000 (11) (10) 1,475,000 End Bal $62500 Manufacturing overhead $52,500 $600,000 (3) (9) (4) 225,000 (5) 37,500 112,500 (8) 180,000 Bal. 7,500 F) Depreciation 125,000 90% (8) Rent 225,000*80% Solution:1 Rate answer here. Northwest Company Cost of goods manufacturing schedule for the year ended Particulars Amount Amount Direct Raw Material: Beginning Raw Material Add Cost of raw material purchased $45,000 $3,55,000 $4,00,000 $3,75,000 Total Raw Materila available for production Less Raw Materials used in production Closing Raw Material $3,75,000 $25,000 $5,40,000 Direct Labor Manufacturing Overhead $52,500 Utility cost incurred $2,25,000 $37,500 Indirect Labor Maintence cost $1,12,500 Depreciation $6,07,500 $15,22,500 $1,80,000 Manufacturing Rent Total Manufacturing Cost $60,000 $1,07,500 Add Beginning Work in Progress Ending Work in Progress $15,22,500+ $ 60,000- $ 14,75,000 Less Ending Work in Progress Cost of goods manufactured $14,75,000 Given in the accounting question Northwest Company Income Statement for the year ended Particulars Amount Amount $25,00,000 Sales $87,500 Beginning finished goods inventory Cost of goods manufactured Total goods available for sale $14,75,000 $15, 2,500 Ending Finished goods inventory $15,62,500-$15,00,000 $62,500 Ending finished good inventory Cost of goods sold $15,00,000 Gross Profit $10,00,000 Operating Expense Selling Expense Selling and adminstrative salaries Advertising Cost Miscellaneous selling and admistrative exp Total selling expense Adminstrative Expense office Salaries $3,62,500 $3,25,000 $70,000 $7,57,500 $12,500 $45,000 $57,500 Depreciation for office expense Depreciation for office expense Total Adminstrative expense $8,15,000 $1,85,000 Total Operating Expense Operating Income Assignment -Job Order Costing Northwest Company uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the cost of direct materials used in production. At the beginning of the current year, the following estimates were made for the purpose of computing the pre-determined overhead rate: S Budgeted manufacturing overhead cost was expected to be $620,000 Budgeted direct material cost for the year was expected to be $387,500 The following transactions took place during the year: Raw material purchases totaled $355,000. Raw materials requisitioned for use in production (all direct materials) totaled $375,000. 1. 2. Utility costs incurred in the manufacturing plant were $52,500 Costs for salaries and wages were incurred as follows: 3. 4. $540,000 $225,000 $362,500 Direct labour Indirect labour Selling and Administrative salaries Maintenance costs incurred in the manufacturing plant were $37,500. Advertising costs for the year totaled $325,000. The company recorded depreciation of $125,000 for the year. 90% of the depreciation relates 5. 6. 7. to manufacturing equipment. The company paid $225,000 in rent for their facilities. The manufacturing plant used approximately 80% of the space in the facility. 8. 9 Manufacturing overhead was applied to jobs during the year. 10. The cost of goods manufactured for the year was $1,475,000. 11. Sales for the year totaled $2,500,000. The unadjusted cost of goods sold for these jobs was $1,500,000. 12. Miscellaneous selling and administrative costs were $70,000 for the year. 13. The balances in the inventory accounts at the beginning of the year were as follows: $45,000 $60,000 $87,500 Raw materials Work-in-process Finished goods The company has decided to write off the difference between the allocated overhead and the 3. actual overhead to cost of goods sold. Prepare a cost of goods sold schedule 1. $620,000 387,500* 100 160 % Predetermined overhead rate Applied manufacturing overhead $375,000 1609% = $600,000 Raw material inventory Beg.Bal. $45,000 $375,000 (2) (1) 355,000 End.Bal $25,000 Work in process inventory Beg.Bal. $60,000 $1,475,000 (10) (2) 375,000 (4) 540,000 600,000 (9) End.Bal. 100,000 Finished Goods Beg.Bal. $87,500 $1,500,000 (11) (10) 1,475,000 End Bal $62500 Manufacturing overhead $52,500 $600,000 (3) (9) (4) 225,000 (5) 37,500 112,500 (8) 180,000 Bal. 7,500 F) Depreciation 125,000 90% (8) Rent 225,000*80% Solution:1 Rate answer here. Northwest Company Cost of goods manufacturing schedule for the year ended Particulars Amount Amount Direct Raw Material: Beginning Raw Material Add Cost of raw material purchased $45,000 $3,55,000 $4,00,000 $3,75,000 Total Raw Materila available for production Less Raw Materials used in production Closing Raw Material $3,75,000 $25,000 $5,40,000 Direct Labor Manufacturing Overhead $52,500 Utility cost incurred $2,25,000 $37,500 Indirect Labor Maintence cost $1,12,500 Depreciation $6,07,500 $15,22,500 $1,80,000 Manufacturing Rent Total Manufacturing Cost $60,000 $1,07,500 Add Beginning Work in Progress Ending Work in Progress $15,22,500+ $ 60,000- $ 14,75,000 Less Ending Work in Progress Cost of goods manufactured $14,75,000 Given in the accounting question Northwest Company Income Statement for the year ended Particulars Amount Amount $25,00,000 Sales $87,500 Beginning finished goods inventory Cost of goods manufactured Total goods available for sale $14,75,000 $15, 2,500 Ending Finished goods inventory $15,62,500-$15,00,000 $62,500 Ending finished good inventory Cost of goods sold $15,00,000 Gross Profit $10,00,000 Operating Expense Selling Expense Selling and adminstrative salaries Advertising Cost Miscellaneous selling and admistrative exp Total selling expense Adminstrative Expense office Salaries $3,62,500 $3,25,000 $70,000 $7,57,500 $12,500 $45,000 $57,500 Depreciation for office expense Depreciation for office expense Total Adminstrative expense $8,15,000 $1,85,000 Total Operating Expense Operating Income