Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Taxpayer, a cash method, calendar year taxpayer, engaged in the following transactions in shares of stock. Consider the amount and character of T's gain

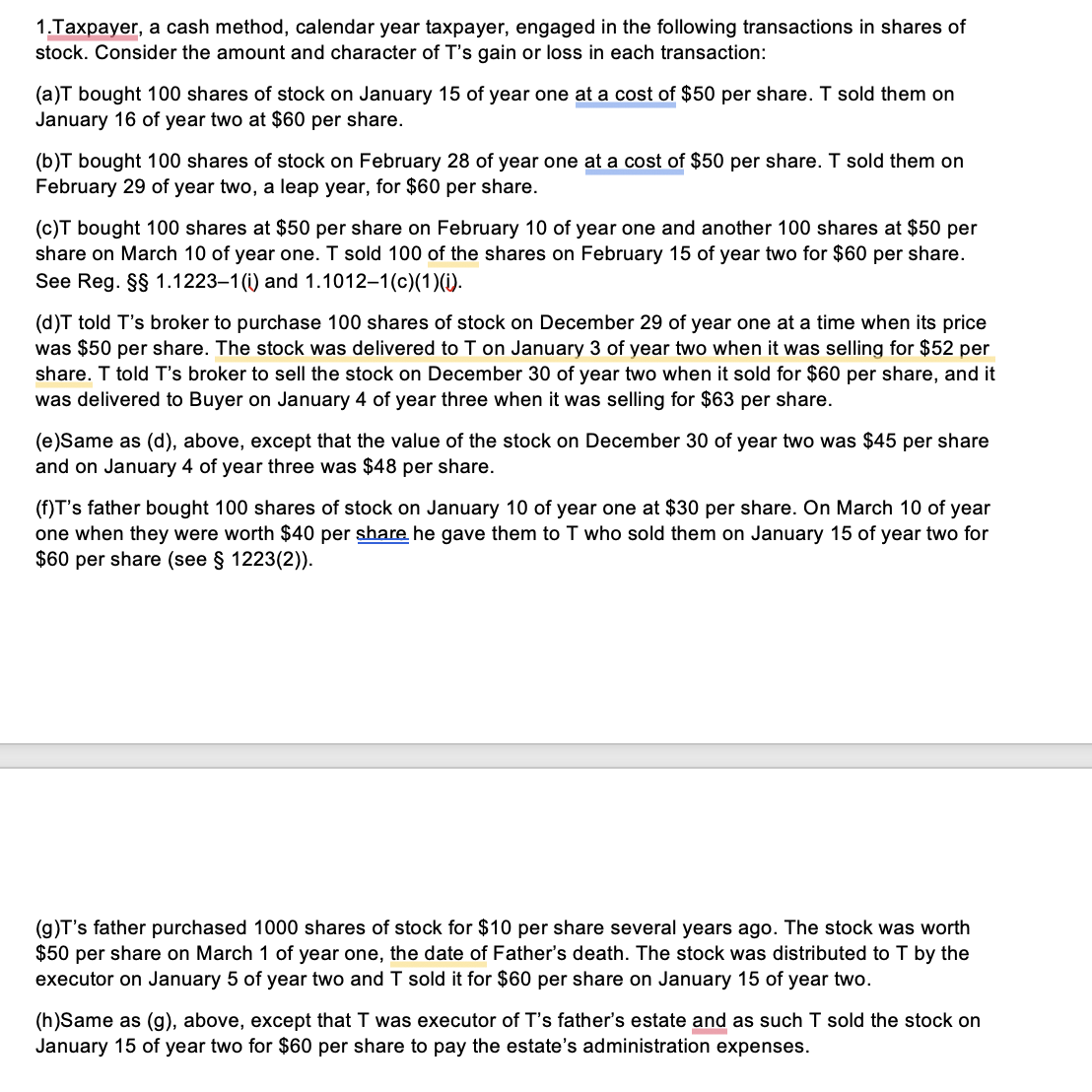

1.Taxpayer, a cash method, calendar year taxpayer, engaged in the following transactions in shares of stock. Consider the amount and character of T's gain or loss in each transaction: (a)T bought 100 shares of stock on January 15 of year one at a cost of $50 per share. T sold them on January 16 of year two at $60 per share. (b)T bought 100 shares of stock on February 28 of year one at a cost of $50 per share. T sold them on February 29 of year two, a leap year, for $60 per share. (c)T bought 100 shares at $50 per share on February 10 of year one and another 100 shares at $50 per share on March 10 of year one. T sold 100 of the shares on February 15 of year two for $60 per share. See Reg. 1.1223-1 (i) and 1.1012-1(c)(1)(i). (d)T told T's broker to purchase 100 shares of stock on December 29 of year one at a time when its price was $50 per share. The stock was delivered to T on January 3 of year two when it was selling for $52 per share. T told T's broker to sell the stock on December 30 of year two when it sold for $60 per share, and it was delivered to Buyer on January 4 of year three when it was selling for $63 per share. (e) Same as (d), above, except that the value of the stock on December 30 of year two was $45 per share and on January 4 of year three was $48 per share. (f) T's father bought 100 shares of stock on January 10 of year one at $30 per share. On March 10 of year one when they were worth $40 per share he gave them to T who sold them on January 15 of year two for $60 per share (see 1223(2)). (g)T's father purchased 1000 shares of stock for $10 per share several years ago. The stock was worth $50 per share on March 1 of year one, the date of Father's death. The stock was distributed to T by the executor on January 5 of year two and T sold it for $60 per share on January 15 of year two. (h) Same as (g), above, except that T was executor of T's father's estate and as such T sold the stock on January 15 of year two for $60 per share to pay the estate's administration expenses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Transaction a T bought 100 shares of stock on January 15 of year one at 50 per share and sold them on January 16 of year two at 60 per share Gain per share 60 50 10 Total gain 100 shares 10 1000 Chara...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started