Question

1.The CEO wants to know which of the three centres is the most successful. Discuss with a commentary on Return on Investment (ROI), Residual Income

1.The CEO wants to know which of the three centres is the most successful. Discuss with a

commentary on Return on Investment (ROI), Residual Income (RI), and Economic Value Added (EVA) as a measure of financial performance. (Hints: You can make own assumption for the definition in these measures but need to be logical and consistent across the same measure) (9 marks)

2. A consultant of the company is recommending a proposal to each division manager to invest

$600,000 in a new computerized production system. It is estimated that the new system will

increase annual divisional sales of $1,600,000 and will incur divisional fixed expenses of $520,000 annually. Variable costs of the new system will average 60% of total revenue.

a) Which centre manager (s) will be more likely to accept or reject this proposal? Why?

(3 marks)

b) Do you expect any goal conflict between each center and corporation based on the current

performance evaluation system? Explain. (4 marks)

3 The marketing director stated that the number of compliant received from clients is the

most important performance measure the company should include. Do you agree? Explain.

(4 marks)

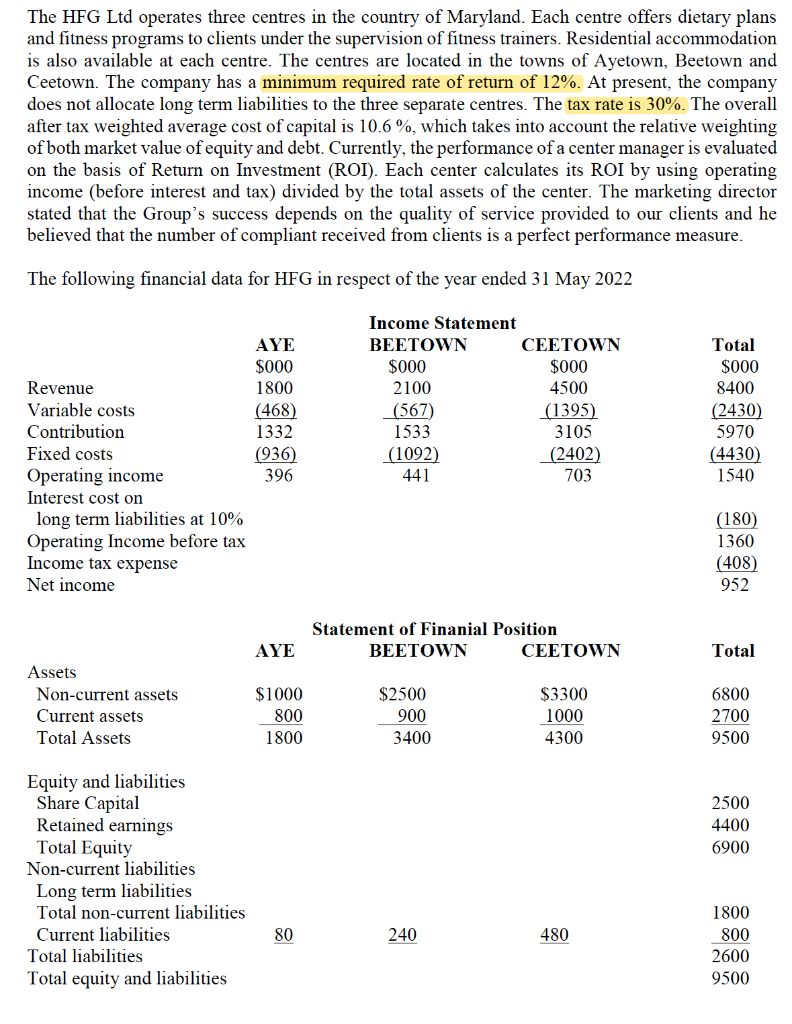

The HFG Ltd operates three centres in the country of Maryland. Each centre offers dietary plans and fitness programs to clients under the supervision of fitness trainers. Residential accommodation is also available at each centre. The centres are located in the towns of Ayetown, Beetown and Ceetown. The company has a minimum required rate of return of 12%. At present, the company does not allocate long term liabilities to the three separate centres. The tax rate is 30%. The overall after tax weighted average cost of capital is 10.6 %, which takes into account the relative weighting of both market value of equity and debt. Currently, the performance of a center manager is evaluated on the basis of Return on Investment (ROI). Each center calculates its ROI by using operating income (before interest and tax) divided by the total assets of the center. The marketing director stated that the Group's success depends on the quality of service provided to our clients and he believed that the number of compliant received from clients is a perfect performance measure. The following financial data for HFG in respect of the year ended 31 May 2022 AYE $000 Revenue 1800 Variable costs (468) Contribution 1332 Fixed costs (936) Operating income 396 Interest cost on long term liabilities at 10% Operating Income before tax Income tax expense Net income Income Statement BEETOWN CEETOWN $000 $000 2100 4500 (567) (1395) 1533 3105 (1092) (2402) 441 703 Total $000 8400 (2430) 5970 (4430) 1540 (180) 1360 (408) 952 Statement of Finanial Position BEETOWN CEETOWN AYE Total Assets Non-current assets Current assets Total Assets $1000 800 1800 $2500 900 3400 $3300 1000 4300 6800 2700 9500 2500 4400 6900 Equity and liabilities Share Capital Retained earnings Total Equity Non-current liabilities Long term liabilities Total non-current liabilities Current liabilities Total liabilities Total equity and liabilities 80 240 480 1800 800 2600 9500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started