Question

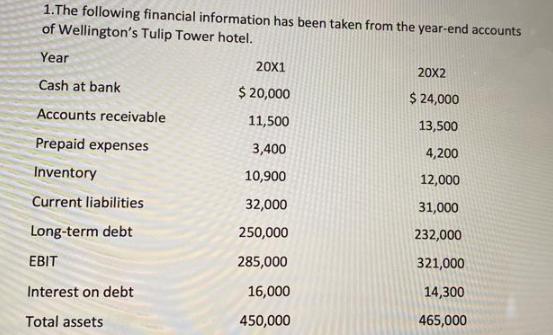

1.The following financial information has been taken from the year-end accounts of Wellington's Tulip Tower hotel. Year 20X1 20X2 Cash at bank $ 20,000

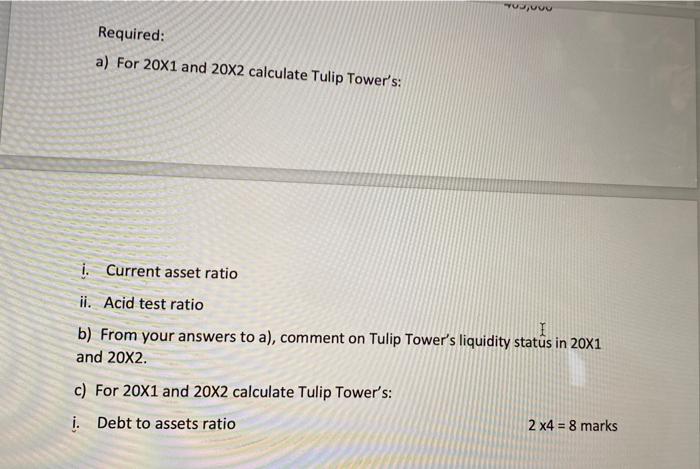

1.The following financial information has been taken from the year-end accounts of Wellington's Tulip Tower hotel. Year 20X1 20X2 Cash at bank $ 20,000 $ 24,000 Accounts receivable 11,500 13,500 Prepaid expenses 3,400 4,200 Inventory 10,900 12,000 Current liabilities 32,000 31,000 Long-term debt 250,000 232,000 EBIT 285,000 321,000 Interest on debt 16,000 14,300 Total assets 450,000 465,000 Required: a) For 20X1 and 20X2 calculate Tulip Tower's: i. Current asset ratio ii. Acid test ratio b) From your answers to a), comment on Tulip Tower's liquidity status in 20X1 and 20X2. c) For 20X1 and 20X2 calculate Tulip Tower's: 2 x4 = 8 marks i. Debt to assets ratio

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

O O Current 9sset rotio Curvent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield

15th edition

978-1118159644, 9781118562185, 1118159640, 1118147294, 978-1118147290

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App