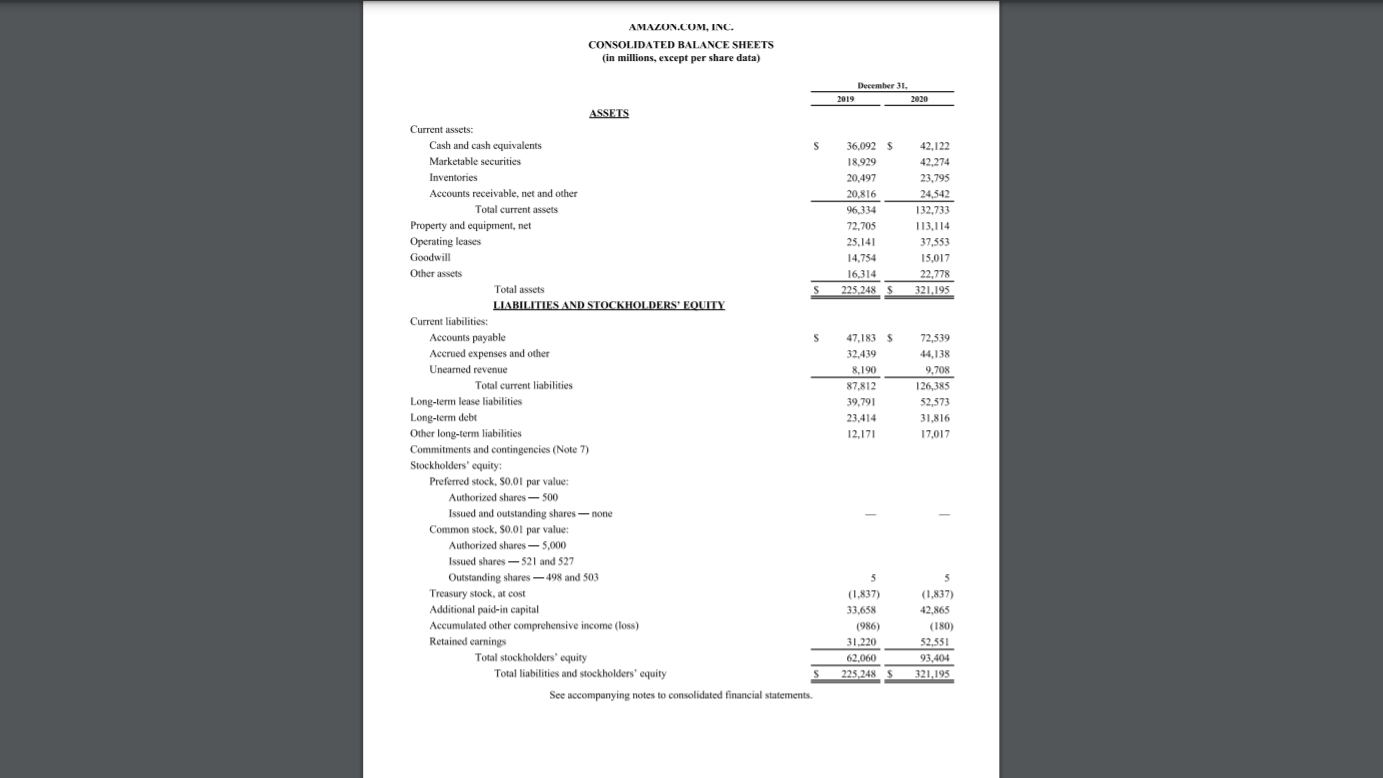

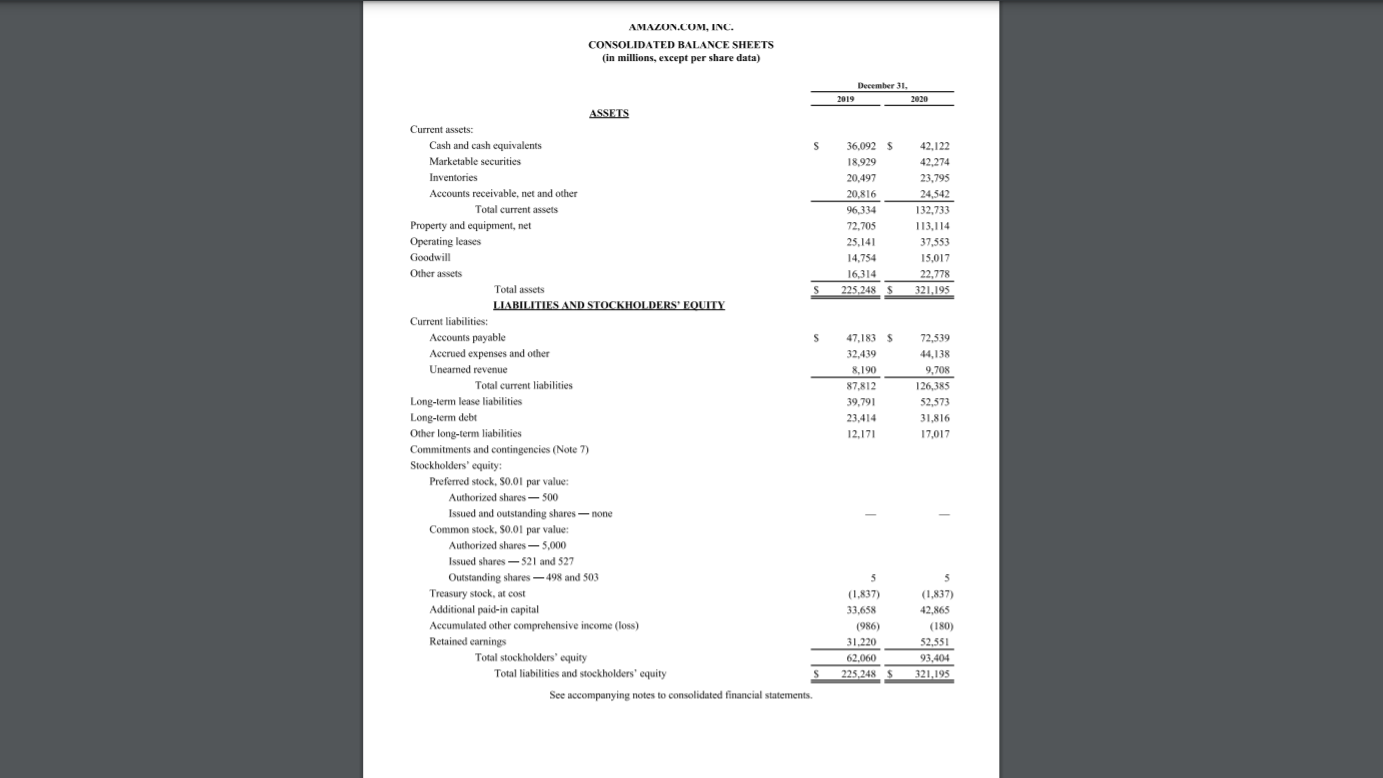

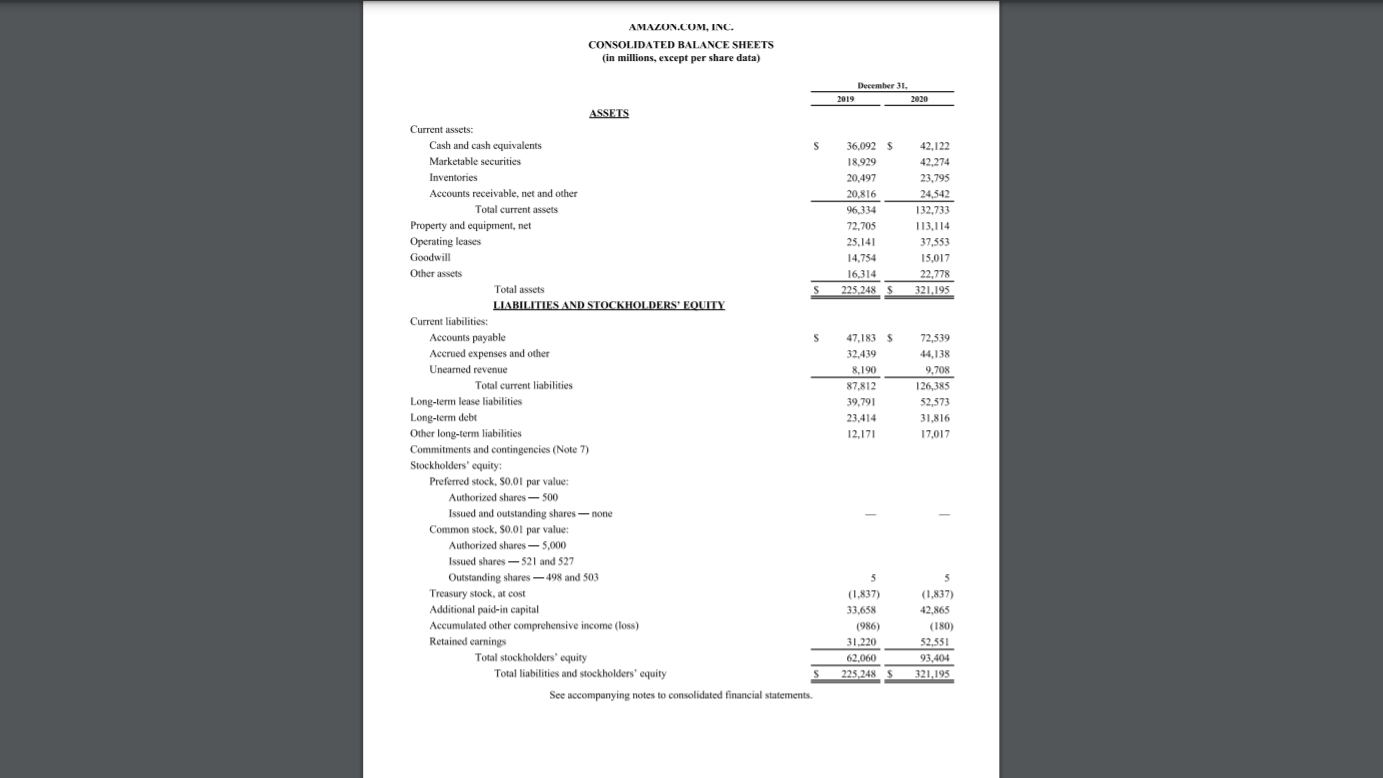

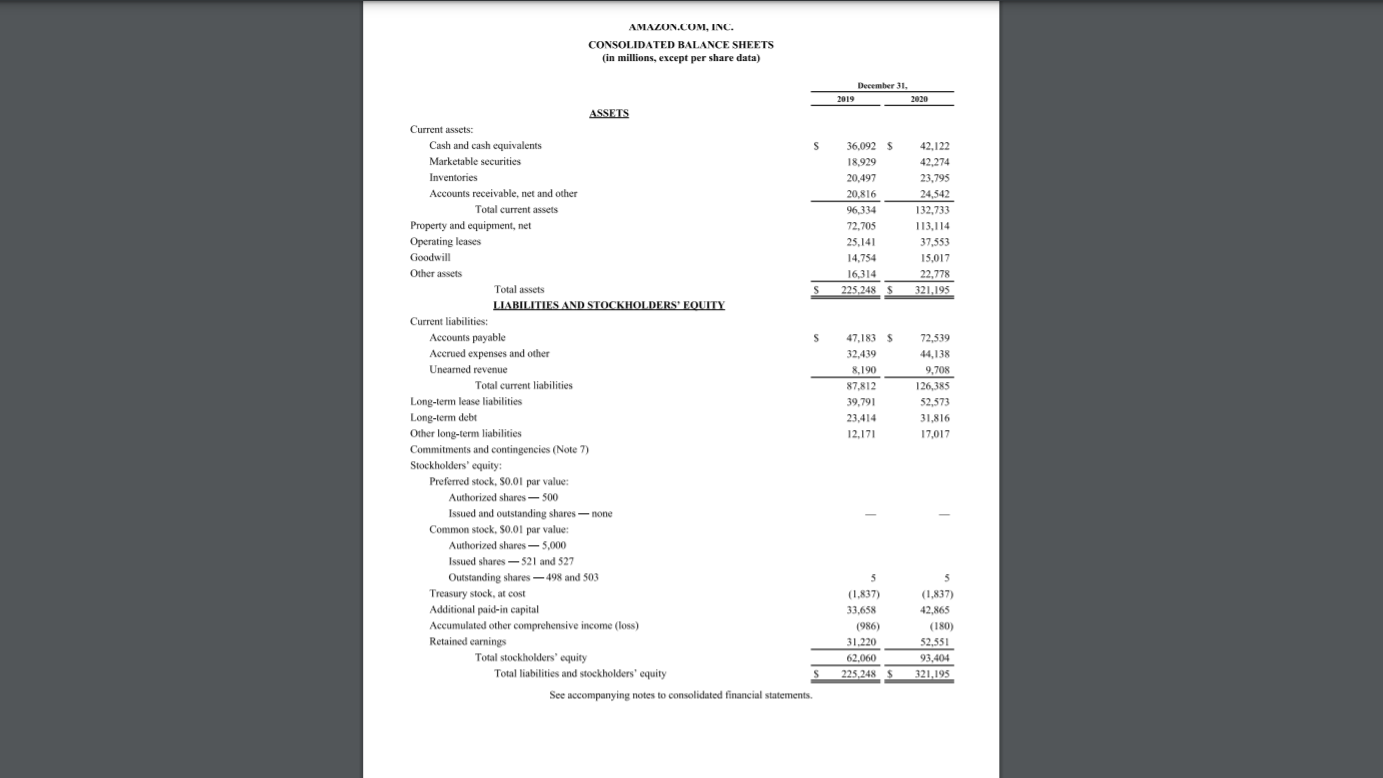

1)What are the largest assets included in the companys balance sheet? Why would a company of this type (size and industry) have a large investment in this particular type of asset?

2)In a review of the companys statement of cash flows: What are the primary sources and uses of cash from investing activities?

In a review of the companys statement of cash flows: 1. What are the primary sources and uses of cash from investing activities?

In a review of the companys statement of cash flows: 1. What are the primary sources and uses of cash from investing activities?

AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) December 31. 2019 2020 36,0925 18.929 20,497 20 816 2. 96,334 20 72,705 25.141 14754 14,754 42.122 42.274 23,795 24,542 129 222 132.733 112 113,114 29 37,553 15,017 16,314 22.778 225.248 321,195 ASSETS Current assets: Cash and cash equivalents S Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Operating leases Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable S Accrued expenses and other Uneamed revenue Total current liabilities Long-term lease liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, 50.01 par value: Authorized shares - 500 Issued and outstanding shares - none Common stock, S0.01 par value: Authorized shares - 5,000 Issued shares - 521 and 527 Outstanding shares - 498 and 503 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity ' See accompanying notes to consolidated financial statements, . 47,1835 32,439 8,190 87,812 39,791 23,414 12,171 72,539 44,138 9,708 126,385 52,573 31.816 17,017 5 (1.837) 33,658 (986) 31.220 62,060 225.248 $ 5 (1.837) 42,865 (180) 52,351 93,404 321,195 AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) December 31. 2019 2020 36,0925 18.929 20,497 20 816 2. 96,334 20 72,705 25.141 14754 14,754 42.122 42.274 23,795 24,542 129 222 132.733 112 113,114 29 37,553 15,017 16,314 22.778 225.248 321,195 ASSETS Current assets: Cash and cash equivalents S Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Operating leases Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable S Accrued expenses and other Uneamed revenue Total current liabilities Long-term lease liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, 50.01 par value: Authorized shares - 500 Issued and outstanding shares - none Common stock, S0.01 par value: Authorized shares - 5,000 Issued shares - 521 and 527 Outstanding shares - 498 and 503 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity ' See accompanying notes to consolidated financial statements, . 47,1835 32,439 8,190 87,812 39,791 23,414 12,171 72,539 44,138 9,708 126,385 52,573 31.816 17,017 5 (1.837) 33,658 (986) 31.220 62,060 225.248 $ 5 (1.837) 42,865 (180) 52,351 93,404 321,195

In a review of the companys statement of cash flows: 1. What are the primary sources and uses of cash from investing activities?

In a review of the companys statement of cash flows: 1. What are the primary sources and uses of cash from investing activities?