Question

1)What is interest rate risk? Which bond has greater interest rate risk, a 10-year zero-coupon Treasury STRIPS or a 10-year Treasury Note? 2)What is the

1)What is interest rate risk? Which bond has greater interest rate risk, a 10-year zero-coupon Treasury STRIPS or a 10-year Treasury Note?

2)What is the difference between a bond's promised yield and its realized yield? Which is more relevant? When we calculate a bond's yield to maturity, which of these are we calculating?

3)Rolling Company bonds have a coupon rate of 2.50 percent, 11 years to maturity, and a current price of $1,024.24.What is the YTM? The current yield?

4)Atlantis Fisheries has issued a zero-coupon bond at a price of $700 per bond. Each bond has a face value of $1,000 at maturity in 15 years. If these zero-coupon bonds are callable in 10 years at a call price of $850, what is their yield to call?

5)Suppose the yield to maturity on a 2.75% coupon bond is 2.00%. The bond has a face value of $1,000, pays coupons semi-annually, and has a Macaulay duration of 12.91 years. Its price is 908.32. What is this bond's modified duration?

Now suppose the yield to maturity on this bond increases to 2.50%.Approximately what will be the percentage increase in the bond's price? Approximately what will the new price of the bond be? (Its actual new price would be $852.53).

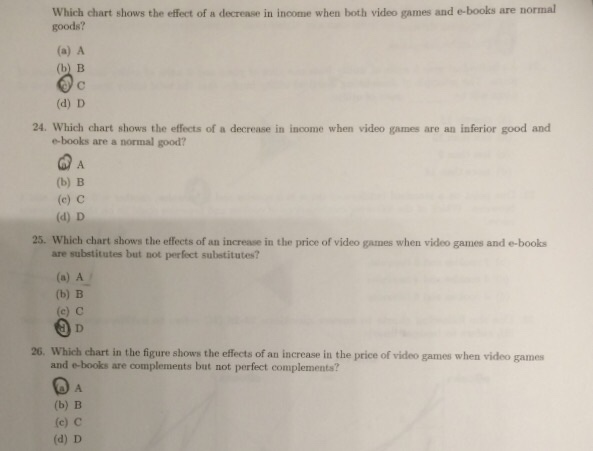

Which chart shows the effect of a decrease in income when both video games and e-books are normal goods? (a) A (b) B (d) D 24. Which chart shows the effects of a decrease in income when video games are an inferior good and e-books are a normal good? A (b) B (c) C (d) D 25. Which chart shows the effects of an increase in the price of video games when video games and e-books are substitutes but not perfect substitutes? (a) A (b) B (c) C D 26. Which chart in the figure shows the effects of an increase in the price of video games when video games and e-books are complements but not perfect complements? A (b) B (c) C (d) D

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Interest rate risk refers to the potential for changes in interest rates to affect the value of fixedincome securities such as bonds When interest rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started