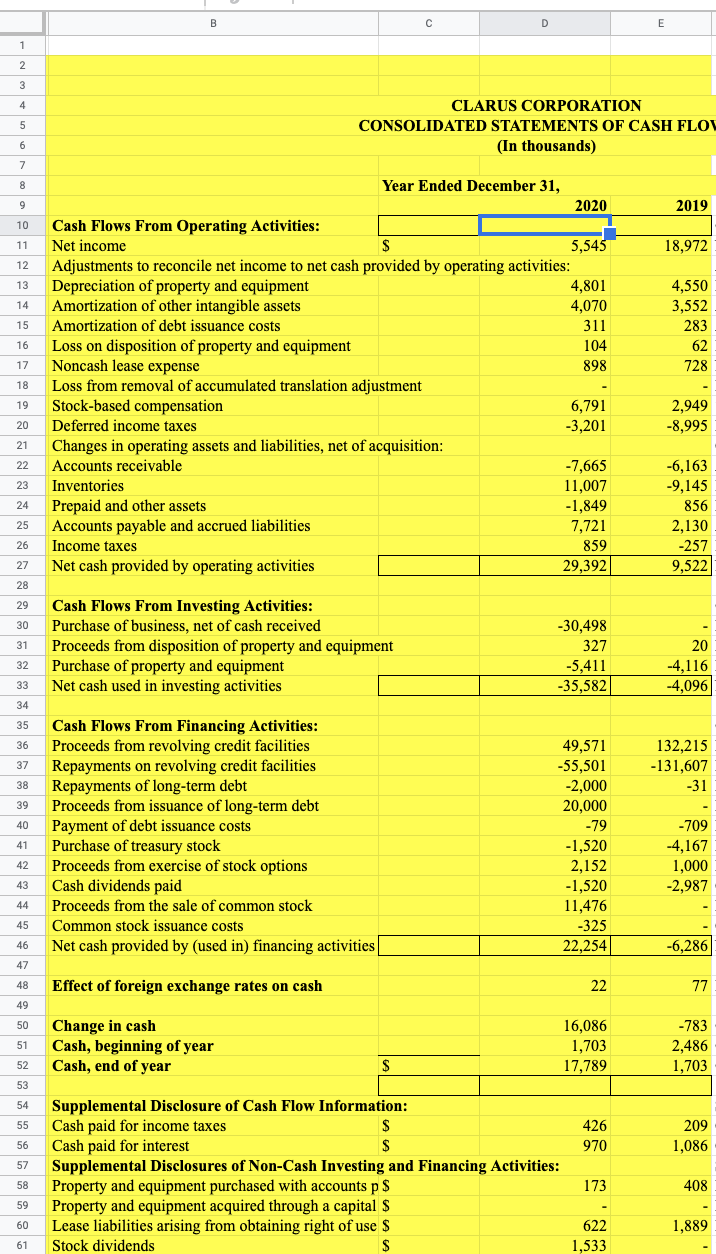

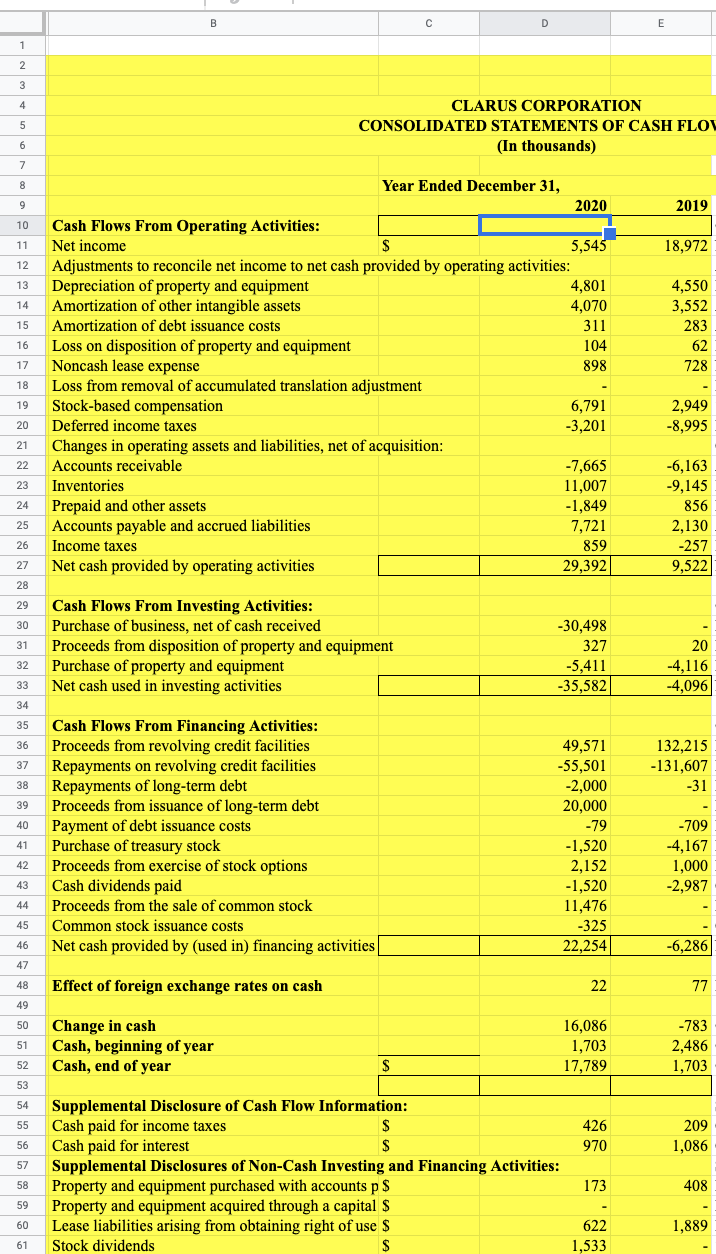

1)what is the Ratio Analysis on this Statement of Cash Flows for 2019-2020.

B D E 1 2 3 4 5 CLARUS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLO (In thousands) 6 7 8 9 2019 10 11 18,972 12 13 14 15 4,550 3,552 283 62 728 16 17 Year Ended December 31, 2020 Cash Flows From Operating Activities: Net income S 5,545 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation of property and equipment 4,801 Amortization of other intangible assets 4,070 Amortization of debt issuance costs 311 Loss on disposition of property and equipment 104 Noncash lease expense 898 Loss from removal of accumulated translation adjustment Stock-based compensation 6,791 Deferred income taxes -3,201 Changes in operating assets and liabilities, net of acquisition: Accounts receivable -7,665 Inventories 11,007 Prepaid and other assets -1,849 Accounts payable and accrued liabilities 7,721 Income taxes 859 Net cash provided by operating activities 29,392 18 19 2,949 -8,995 20 21 22 23 24 -6,163 -9,145 856 2,130 -257 9,522 25 26 27 28 29 30 31 Cash Flows From Investing Activities: Purchase of business, net of cash received Proceeds from disposition of property and equipment Purchase of property and equipment Net cash used in investing activities -30,498 327 -5,411 -35,582 32 20 -4,116 -4,096 33 34 35 36 37 132,215 -131,607 -31 38 39 40 Cash Flows From Financing Activities: Proceeds from revolving credit facilities Repayments on revolving credit facilities Repayments of long-term debt Proceeds from issuance of long-term debt Payment of debt issuance costs Purchase of treasury stock Proceeds from exercise of stock options Cash dividends paid Proceeds from the sale of common stock Common stock issuance costs Net cash provided by (used in) financing activities 41 49,571 -55,501 -2,000 20,000 -79 -1,520 2,152 -1,520 11,476 -325 22,254 -709 -4,167 1,000 -2,987 42 43 44 45 46 -6,286 47 48 Effect of foreign exchange rates on cash 22 77 49 50 51 Change in cash Cash, beginning of year Cash, end of year 16,086 1,703 17,789 -783 2,486 1,703 52 $ 53 54 55 426 970 209 1,086 56 57 Supplemental Disclosure of Cash Flow Information: Cash paid for income taxes $ Cash paid for interest S Supplemental Disclosures of Non-Cash Investing and Financing Activities: Property and equipment purchased with accounts p $ Property and equipment acquired through a capital $ Lease liabilities arising from obtaining right of use $ Stock dividends S 58 173 408 59 60 1,889 622 1,533 61 B D E 1 2 3 4 5 CLARUS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLO (In thousands) 6 7 8 9 2019 10 11 18,972 12 13 14 15 4,550 3,552 283 62 728 16 17 Year Ended December 31, 2020 Cash Flows From Operating Activities: Net income S 5,545 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation of property and equipment 4,801 Amortization of other intangible assets 4,070 Amortization of debt issuance costs 311 Loss on disposition of property and equipment 104 Noncash lease expense 898 Loss from removal of accumulated translation adjustment Stock-based compensation 6,791 Deferred income taxes -3,201 Changes in operating assets and liabilities, net of acquisition: Accounts receivable -7,665 Inventories 11,007 Prepaid and other assets -1,849 Accounts payable and accrued liabilities 7,721 Income taxes 859 Net cash provided by operating activities 29,392 18 19 2,949 -8,995 20 21 22 23 24 -6,163 -9,145 856 2,130 -257 9,522 25 26 27 28 29 30 31 Cash Flows From Investing Activities: Purchase of business, net of cash received Proceeds from disposition of property and equipment Purchase of property and equipment Net cash used in investing activities -30,498 327 -5,411 -35,582 32 20 -4,116 -4,096 33 34 35 36 37 132,215 -131,607 -31 38 39 40 Cash Flows From Financing Activities: Proceeds from revolving credit facilities Repayments on revolving credit facilities Repayments of long-term debt Proceeds from issuance of long-term debt Payment of debt issuance costs Purchase of treasury stock Proceeds from exercise of stock options Cash dividends paid Proceeds from the sale of common stock Common stock issuance costs Net cash provided by (used in) financing activities 41 49,571 -55,501 -2,000 20,000 -79 -1,520 2,152 -1,520 11,476 -325 22,254 -709 -4,167 1,000 -2,987 42 43 44 45 46 -6,286 47 48 Effect of foreign exchange rates on cash 22 77 49 50 51 Change in cash Cash, beginning of year Cash, end of year 16,086 1,703 17,789 -783 2,486 1,703 52 $ 53 54 55 426 970 209 1,086 56 57 Supplemental Disclosure of Cash Flow Information: Cash paid for income taxes $ Cash paid for interest S Supplemental Disclosures of Non-Cash Investing and Financing Activities: Property and equipment purchased with accounts p $ Property and equipment acquired through a capital $ Lease liabilities arising from obtaining right of use $ Stock dividends S 58 173 408 59 60 1,889 622 1,533 61