Question

1-year, money market account investment at 2.17 percent? (APY), a 1.16 percent inflation? rate, a 15 percent marginal tax? bracket, and a constant ?$50,000 ?balance,

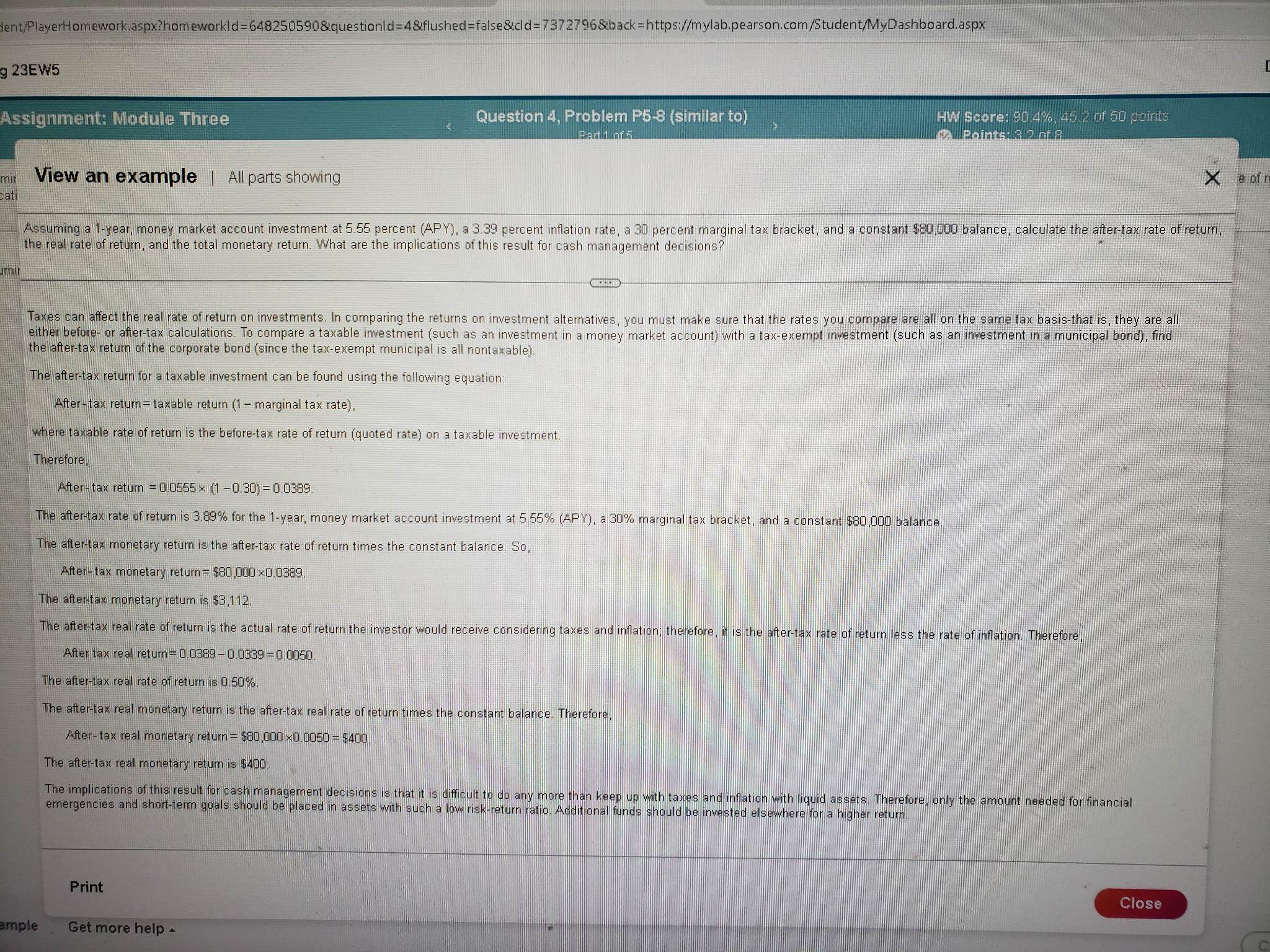

1-year, money market account investment at 2.17 percent? (APY), a 1.16 percent inflation? rate, a 15 percent marginal tax? bracket, and a constant ?$50,000 ?balance, calculate the? after-tax rate of? return, the real rate of? return, and the total monetary return. What are the implications of this result for cash management? decisions?

Assuming a? 1-year, money market account investment at 2.17?% ?(APY), a 15?% marginal tax? bracket, and a constant $50,000 ?balance, the? after-tax rate of return is ?(Round to two decimal? places.)

FYI question has 5 part answer

that an example how to do the problem

dent/PlayerHomework.aspx?homeworkId=648250590&questionId=4&flushed=false&cd=7372796&back=https://mylab.pearson.com/Student/MyDashboard.aspx g 23EW5 Assignment: Module Three mit View an example | All parts showing Dati JM Question 4, Problem P5-8 (similar to) Part 1 of 5 Assuming a 1-year, money market account investment at 5.55 percent (APY), a 3.39 percent inflation rate, a 30 percent marginal tax bracket, and a constant $80,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Taxes can affect the real rate of return on investments. In comparing the returns on investment alternatives, you must make sure that the rates you compare are all on the same tax basis-that is, they are all either before or after-tax calculations. To compare a taxable investment (such as an investment in a money market account) with a tax-exempt investment (such as an investment in a municipal bond), find the after-tax return of the corporate bond (since the tax-exempt municipal is all nontaxable). The after-tax return for a taxable investment can be found using the following equation: After-tax return= taxable return (1- marginal tax rate), where taxable rate of return is the before-tax rate of return (quoted rate) on a taxable investment. Therefore, ample HW Score: 90.4%, 45.2 of 50 points Points: 820f8 After-tax return = 0.0555 x (1 -0.30) = 0.0389. The after-tax rate of return is 3.89% for the 1-year, money market account investment at 5.55% (APY), a 30% marginal tax bracket, and a constant $80,000 balance. The after-tax monetary return is the after-tax rate of return times the constant balance. So, After-tax monetary return= $80,000 0.0389. The after-tax monetary return is $3,112. The after-tax real rate of return is the actual rate of return the investor would receive considering taxes and inflation, therefore, it is the after-tax rate of return less the rate of inflation. Therefore, After tax real return=0.0389-0.0339=0.0050. The after-tax real rate of return is 0.50%. The after-tax real monetary return is the after-tax real rate of return times the constant balance. Therefore, After-tax real monetary return = $80,000 x0.0050 = $400 The after-tax real monetary return is $400. The implications of this result for cash management decisions is that it is difficult to do an more than keep up with taxes and inflation with liquid assets. Therefore, only the amount needed for financial emergencies and short-term goals should be placed in assets with such a low risk-return ratio. Additional funds should be invested elsewhere for a higher return. Print Get more help - Close [ X e of r

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the aftertax rate of return real rate of return and total monetary return well use the given information Money market account investment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started