Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.You are the senior auditor in Salim & Co leading the audit of your client Gazi Group. The audit for the financial year ended

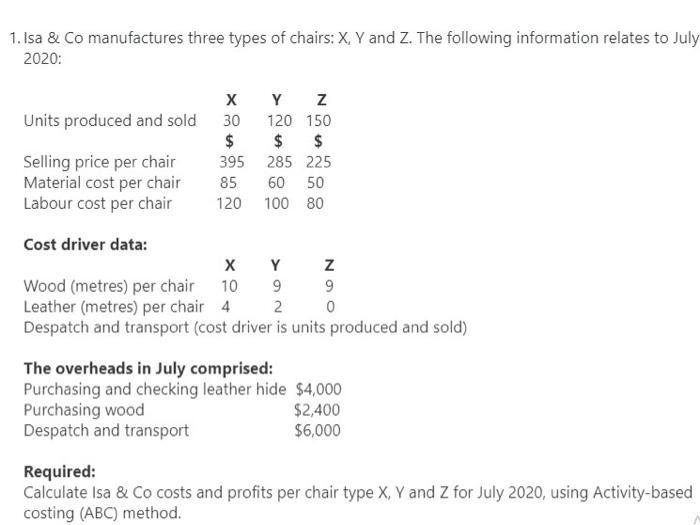

1.You are the senior auditor in Salim & Co leading the audit of your client Gazi Group. The audit for the financial year ended 31 December 2020 is at the completion stage. You have gathered the following information while reviewing your team's audit working papers: Trade receivables recognized in Gazi Group's current assets includes a balance of $600,000 relating to a specific customer called Halima Co. Audit procedures indicate that at 31 December 2020, the balance was more than 9 months overdue for payment. In relation to this balance your audit team have conducted the following audit procedures: Agreement of the balance to the Halima Co invoices and original order. Discussion with Gazi Group credit controller who confirms Halima Co is unlikely to pay back the $600,000 owing. Halima Co was included in the trade receivables direct confirmation audit procedure, but no reply was received from the company. Consequently, you have concluded that: Receivables is overstated by $600,000 Deferred tax liability is overstated by $114,000 Profit and retained earnings for 2020 are overstated by $486,000 The matter is material but not pervasive to the financial statements. Required: As the senior auditor, using the above information, write what should be included in the 'Basis for Qualified Opinion' and 'Opinion' sections of the audit report, knowing that the matter is material but not pervasive to the financial statements? 1. Isa & Co manufactures three types of chairs: X, Y and Z. The following information relates to July 2020: X Y Z Units produced and sold 30 120 150 $ $ $ 395 285 225 Selling price per chair Material cost per chair Labour cost per chair 85 120 Cost driver data: X Wood (metres) per chair 10 9 Leather (metres) per chair 4 2 0 Despatch and transport (cost driver is units produced and sold) The overheads in July comprised: Purchasing and checking leather hide $4,000 Purchasing wood $2,400 Despatch and transport $6,000 Required: Calculate Isa & Co costs and profits per chair type X, Y and Z for July 2020, using Activity-based costing (ABC) method. 60 50 100 80 Y 660 Z 9

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 As per the International Standard on Auditing 705 Modifications to the opinion in the Independent Auditors Report provides that a qualified opinion must be expressed in the auditors report when a th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started