Question

1.You have won lottery! You will receive $20,000 next year and $30,000 the year after. What is the value of these two future amounts to

1.You have won lottery! You will receive $20,000 next year and $30,000 the year after. What is the value of these two future amounts to you today if the interest rate is 8 percent?

2.

You have borrowed $74,765.30 for five years. Payments will start from next year. The loan shark has charged you 20 percent interest for the loan. This means that you will have to make five payments of dollars each to the guy for five years.

Give me a nice round number.

3.

On January 2020 you buy a 10-year coupon bond with coupon payments of $10,000 per year and a final value of $100,000. The yield to maturity of this bond is 10 percent.

On January 2021 you collect your first coupon and sell the bond in the bond market. On January 2021 the yield to maturity of this bond increases to 11 percent.

Therefore, your one-year holding period return equals percent.

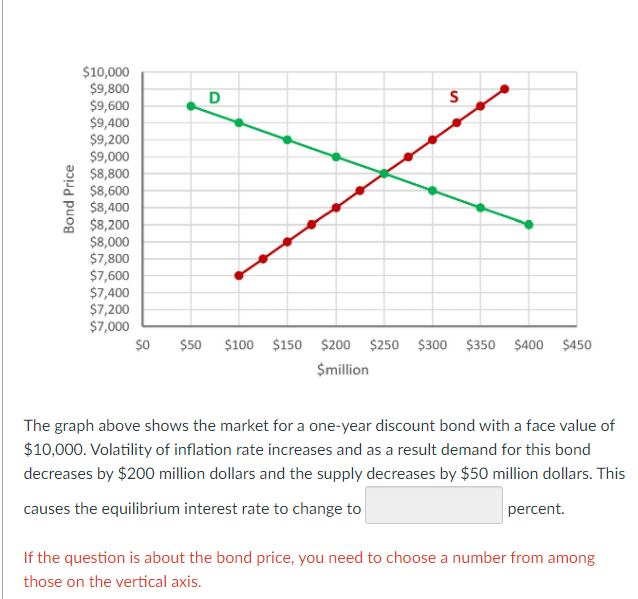

4.The graph above shows the market for a one-year discount bond with a face value of $10,000. Volatility of inflation rate increases and as a result demand for this bond decreases by $200 million dollars and the supply decreases by $50 million dollars. This causes the equilibrium interest rate to change to percent.

5.

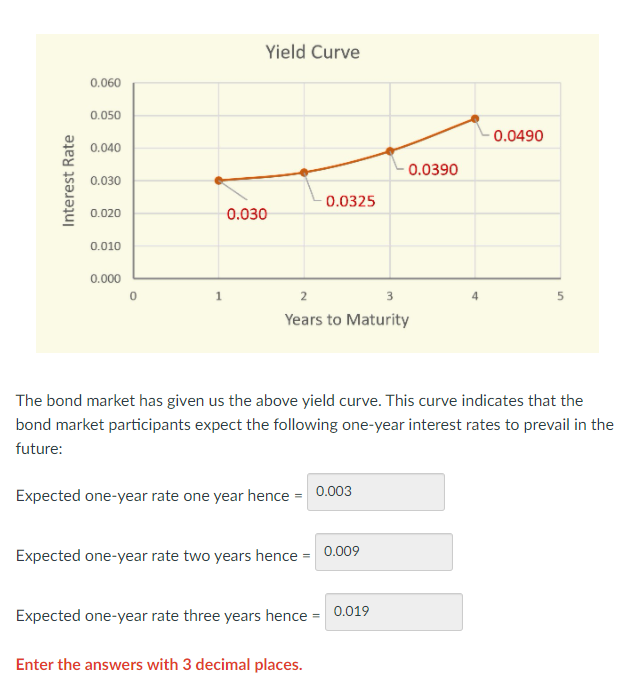

The bond market has given us the above yield curve. This curve indicates that the bond market participants expect the following one-year interest rates to prevail in the future:

Expected one-year rate one year hence =

Expected one-year rate two years hence =

Expected one-year rate three years hence =

Please Help me with these questions !! Thank You!

You have won lottery! You will receive $20,000 next year and $30,000 the year after. What is the value of these two future amounts to you today if the interest rate is 8 percent? Value today = 54000.00 dollars. You have borrowed $74,765.30 for five years. Payments will start from next year. The loan shark has charged you 20 percent interest for the loan. This means that you will have to make five payments of 17943.67 dollars each to the guy for five years. Give me a nice round number. On January 2020 you buy a 10-year coupon bond with coupon payments of $10,000 per year and a final value of $100,000. The yield to maturity of this bond is 10 percent. On January 2021 you collect your first coupon and sell the bond in the bond market. On January 2021 the yield to maturity of this bond increases to 11 percent. Therefore, your one-year holding period return equals 10.00 percent. D S Bond Price $10,000 $9,800 $9,600 $9,400 $9,200 $9,000 $8,800 $8,600 $8,400 $8,200 $8,000 $7,800 $7,600 $7,400 $7,200 $7,000 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $million The graph above shows the market for a one-year discount bond with a face value of $10,000. Volatility of inflation rate increases and as a result demand for this bond decreases by $200 million dollars and the supply decreases by $50 million dollars. This causes the equilibrium interest rate to change to percent. If the question is about the bond price, you need to choose a number from among those on the vertical axis. Yield Curve 0.060 0.050 0.0490 0.040 0.0390 Interest Rate 0.030 0.0325 0.020 0.030 0.010 0.000 1 4 5 2 3 Years to Maturity The bond market has given us the above yield curve. This curve indicates that the bond market participants expect the following one-year interest rates to prevail in the future: Expected one-year rate one year hence = 0.003 Expected one-year rate two years hence = 0.009 Expected one-year rate three years hence = 0.019 Enter the answers with 3 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started