Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 0 2 3 to June 2 7 , 2 0 2 3 . The producer employs corn futures contracts that expire June 2 7

to June The producer employs corn futures contracts that expire June Daily

historical data reveals the following

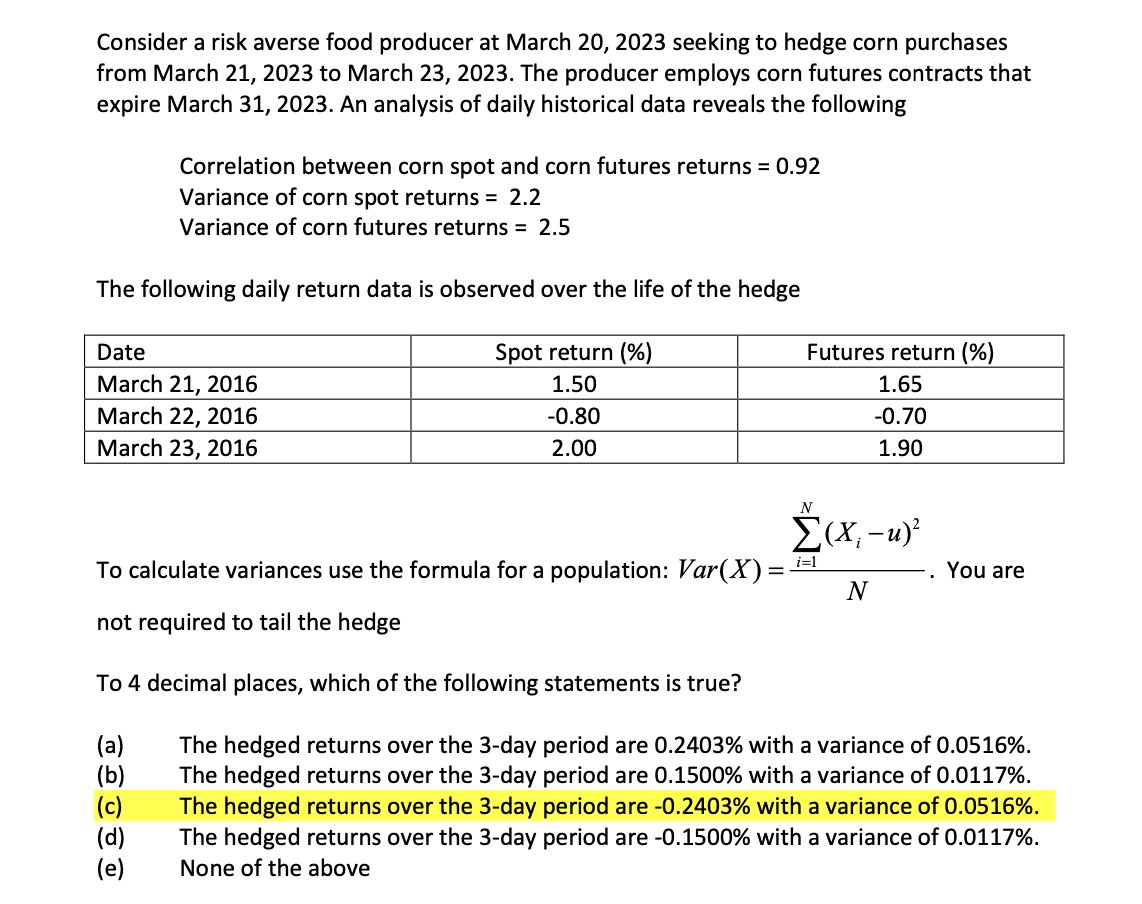

Correlation between corn spot and corn futures returns

Variance of corn spot returns

Variance of corn futures returns

The following daily returns are observed over the life of the hedge

To calculate variances use the formula for a population: Var You are not required

to tail the hedge.

To decimal places, which of the following statements is true?

a The hedged returns over the day period are with a variance of

b The hedged returns over the day period are with a variance of

c The hedged returns over the day period are with a variance of

d The hedged returns over the day period are with a variance of

e None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started