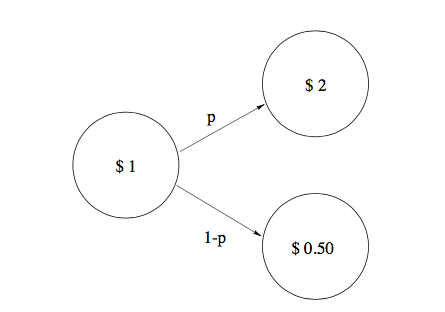

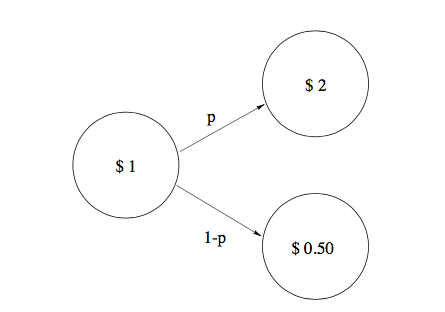

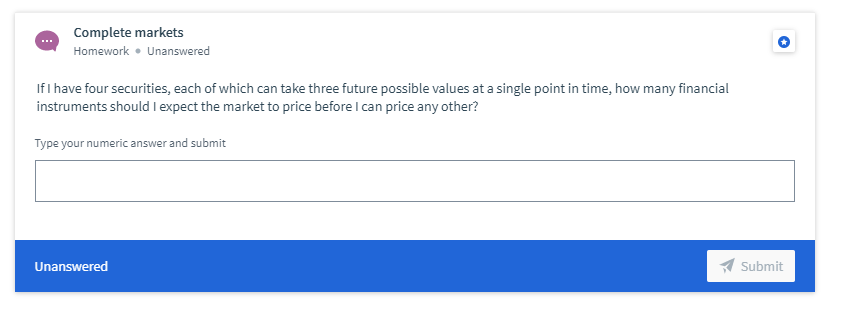

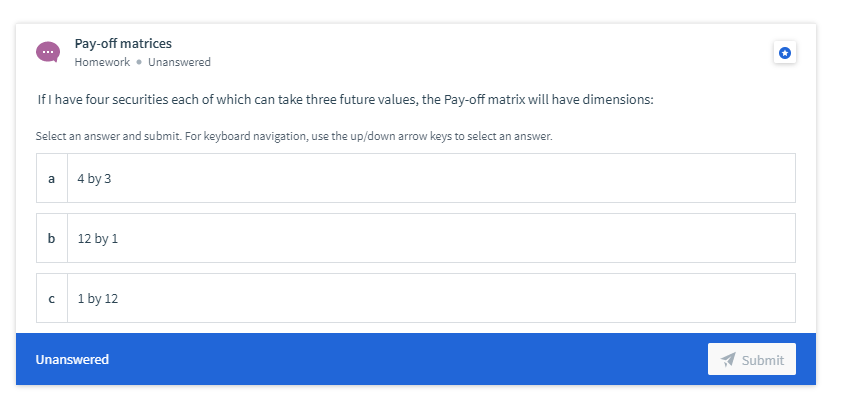

$2 $1 1-p $ 0.50 Coin flipping game Homework. Unanswered In the asset tree above, that pays $1 when the stock goes up, the fair price to play should be Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Exactly $0.50 b More than $0.50 Less than $0.50 Unanswered Submit Implied interest rates Homework. Unanswered If the risk neutral price of the option is 0.5, what are the interest rates? Type your numeric answer and submit Unanswered Submit Complete markets Homework. Unanswered If I have four securities, each of which can take three future possible values at a single point in time, how many financial instruments should I expect the market to price before I can price any other? Type your numeric answer and submit Unanswered Submit Pay-off matrices Homework. Unanswered If I have four securities each of which can take three future values, the Pay-off matrix will have dimensions: Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a 4 by 3 b 12 by 1 1 by 12 Unanswered Submit $2 $1 1-p $ 0.50 Coin flipping game Homework. Unanswered In the asset tree above, that pays $1 when the stock goes up, the fair price to play should be Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Exactly $0.50 b More than $0.50 Less than $0.50 Unanswered Submit Implied interest rates Homework. Unanswered If the risk neutral price of the option is 0.5, what are the interest rates? Type your numeric answer and submit Unanswered Submit Complete markets Homework. Unanswered If I have four securities, each of which can take three future possible values at a single point in time, how many financial instruments should I expect the market to price before I can price any other? Type your numeric answer and submit Unanswered Submit Pay-off matrices Homework. Unanswered If I have four securities each of which can take three future values, the Pay-off matrix will have dimensions: Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a 4 by 3 b 12 by 1 1 by 12 Unanswered Submit