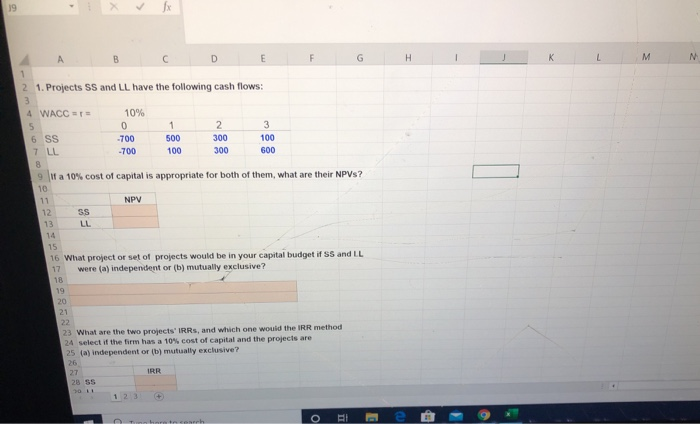

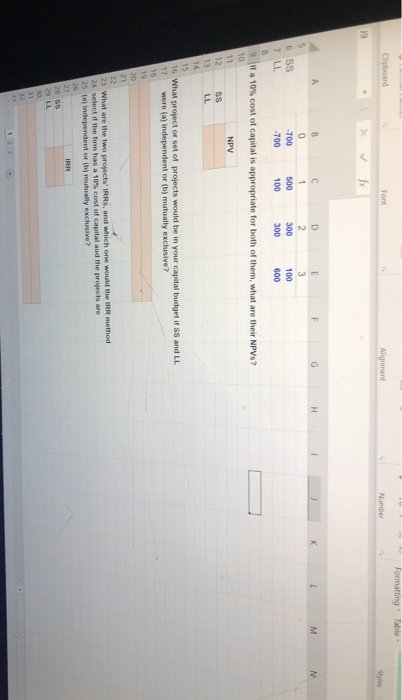

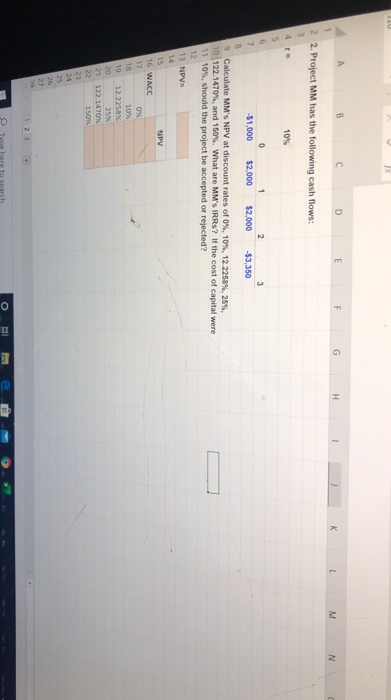

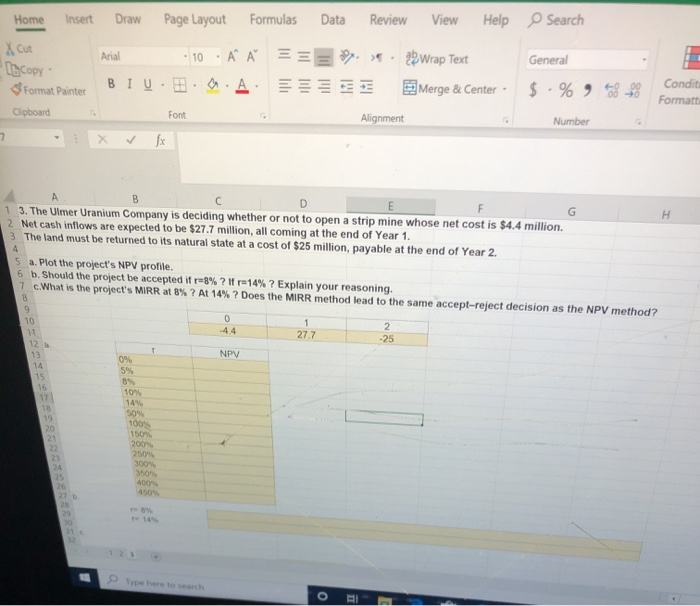

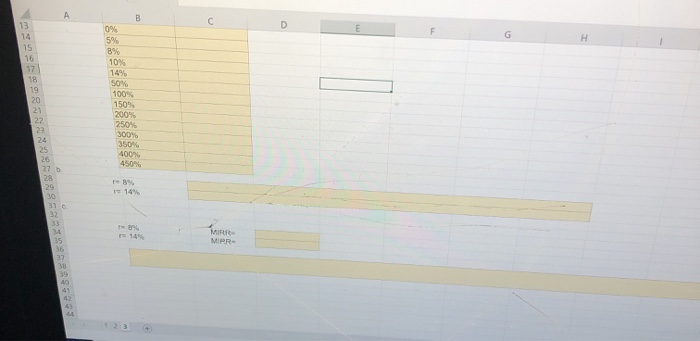

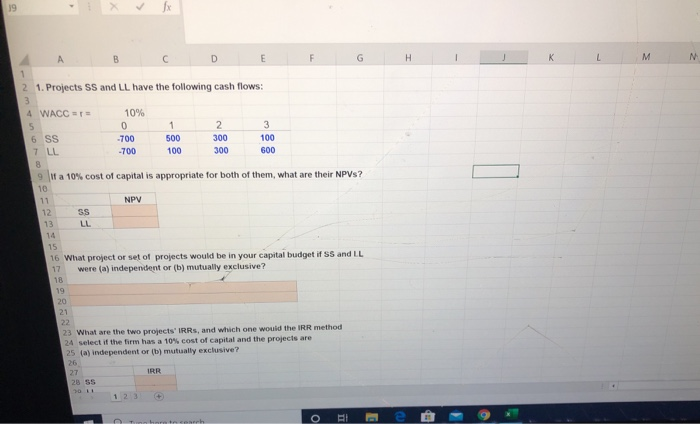

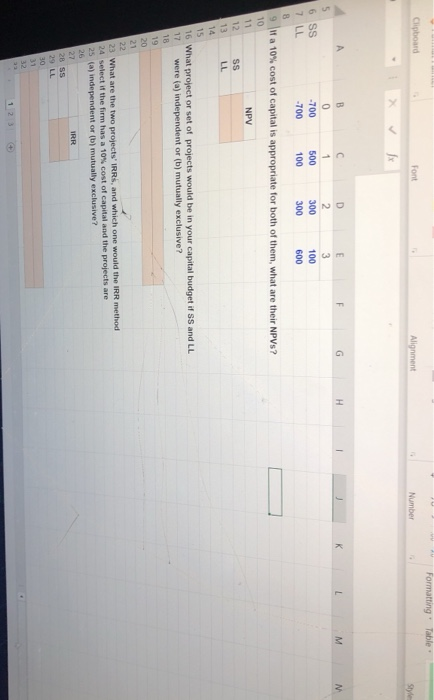

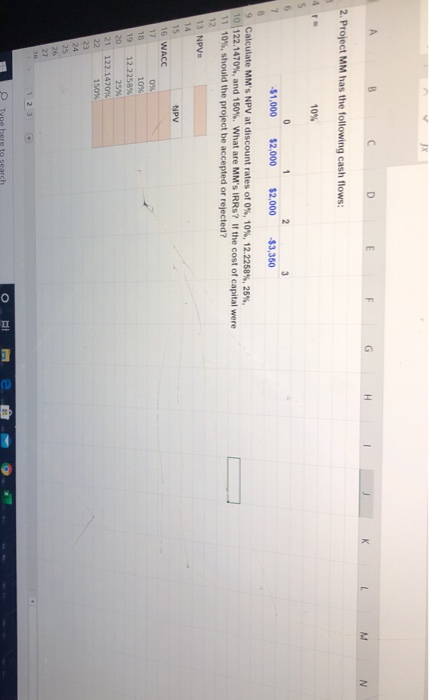

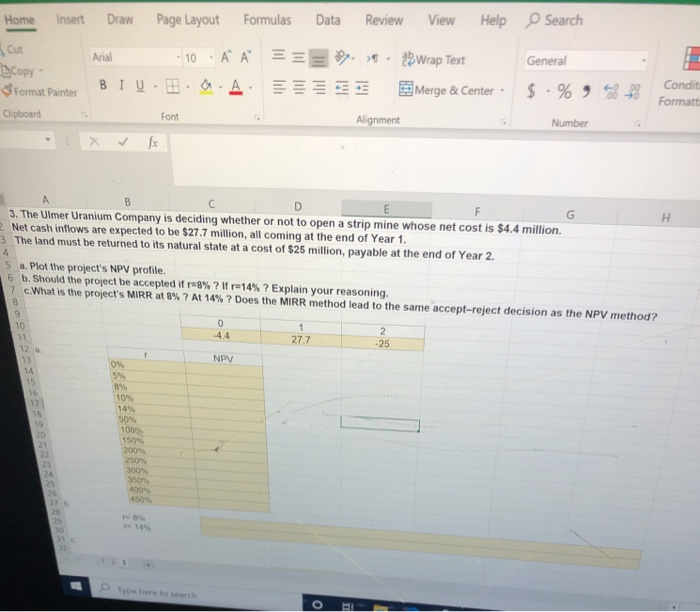

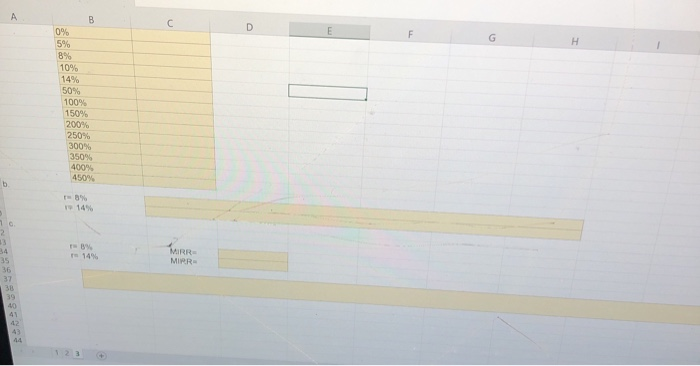

2 1. Projects SS and LL have the following cash flows: 4 WACC = 10% 300 6 SS 7 LL -700 -700 500 100 100 600 300 9 a 10% cost of capital is appropriate for both of them, what are their NPVS? NPY ss LL 14 16 What project or set of projects would be in your capital budget f S and LL 17 were (a) independent or (b) mutually exclusive? 18 23 What are the two projects IRRs, and which one would the IRR method 24 select if the firm has a 10% cost of capital and the projects are 25 (a) independent or (b) mutually exclusive? 1 2 3 Formatting Table Clipboard Alignment Number DE F K L M N 6 SS 7 LL -700 -700 9 a 10% cost of capital is appropriate for both of them, what are their NPVS? NPV LL What project or set of projects would be in your capital budget if SS and LL were (a) independent or (b) mutually exclusive? 23 What are the two projects' IRRS, and which one would the IRR method 24 select the firm has a 10% cost of capital and the projects are 25 (independent or () mutually exclusive? 29 LL K L M N 22. Project MM has the following cash flows: 10% $1,000 $2,000 $2,000 -$3,350 9 Calculate MM's NPV at discount rates of 0%, 10%, 12.2258%, 25% 10 122.1470%, and 150%. What are MM's IRRS? If the cost of capital were 11 10%, should the project be accepted or rejected? 13 NPS NPV 16 WACC 0% 12.2258% 221470 150% Tygehus 19 search Ole Insert Draw Page Layout Formulas Data Review View Help Search Home X Cut - copy == General Arial inter BIU. :10 AA .0.A. Wrap Text Merge & Center. $. % 968 Formatt Clipboard Font Alignment Number 1 3. The Ulmer Uranium Company is deciding whether or not to open a strip mine whose net cost is $4.4 million. 2 Net cash inflows are expected to be $27.7 million, all coming at the end of Year 1. 3 The land must be returned to its natural state at a cost of $25 million, payable at the end of Year 2 5 a. Plot the project's NPV profile. 6 b. Should the project be accepted it r=8%? If 14% ? Explain your reasoning. 7 c.What is the project's MIRR at 8% ? At 14% ? Does the MIRR method lead to the same accept-reject decision as the NPV method? 10 4.4 27.7 12 NPV 17 10% 14% 50% 100 150% 200 250 300 400 29 14 . . ) 10, 14 B 100, 10 700 E 100 150, 006, 5 * | * 1 MAR MIPR- 2 1. Projects SS and LL have the following cash flows: 4 WACC = 10% 6 SS 7 LL 300 -700 -700 500 100 100 600 300 9 a 10% cost of capital is appropriate for both of them, what are their NPVS? NPY SS LL 16 What project or set of projects would be in your capital budget if and LL 17 were (a) independent or (b) mutually exclusive? 23 What are the two projects IRRs, and which one would the IRR method 24 select if the firm has a 10% cost of capital and the projects are 25 (a) independent or (b) mutually exclusive? 28 55 10 1 2 3 Formatting Table Clipboard font Alignment Style F G H I J K L M N 6 SS LL -700 -700 500 100 9 W a 10% cost of capital is appropriate for both of them, what are their NPVS? NPV 16 What project or set of projects would be in your capital budget if S and LL were (a) independent or (b) mutually exclusive? 23 What are the two projects' IRRS, and which one would the IRR method 24 select if the firm has a 10% cost of capital and the projects are 25 (a) independent or (b) mutually exclusive? 2B SS 29 LL 1 2 3 - K L M N 2. Project MM has the following cash flows: 10% -$1,000 $2,000 $2,000 $3,350 9 Calculate MM's NPV at discount rates of 0%, 10%, 12.2258%, 25%, 10 122.1470%, and 150%. What are MM'S IRRs? If the cost of capital were 11 10%, should the project be accepted or rejected? 13 NPV- NPV 16 WACC 10% 12.2258% 25% 122.1470% 150% 1 2 3 4 Tyge bors 19 arch o e 0. Review View Help Search Home Insert Draw Page Layout Formulas Data 4 Cut Arial :10 AA === - Copy Format Painter BIU. .0.A. Clipboard > General Wrap Text Merge & Center - $ .% 968 Condit Formatt Font Alignment Number 3. The Ulmer Uranium Company is deciding whether or not to open a strip mine whose net cost is $4.4 million. 2 Net cash inflows are expected to be $27.7 million, all coming at the end of Year 1. 3 The land must be returned to its natural state at a cost of $25 million, payable at the end of Year 2 5 a. Plot the project's NPV profile. 6 b. Should the project be accepted it ra8%? If 14% ? Explain your reasoning. 1 c. What is the project's MIRR at 8% ? At 14% ? Does the MIRR method lead to the same accept-reject decision as the NPV method? 10 44 12 13 NPV 109 14 50 SUPUNE: 100 150 2009 2509 3005 30 400 e Type here to search 0% 5% 8% 10% 14% 50% 1000 15093 200% 250% 300% 350% 400% 450 B 14% TARR MIRR 37 2 1. Projects SS and LL have the following cash flows: 4 WACC = 10% 300 6 SS 7 LL -700 -700 500 100 100 600 300 9 a 10% cost of capital is appropriate for both of them, what are their NPVS? NPY ss LL 14 16 What project or set of projects would be in your capital budget f S and LL 17 were (a) independent or (b) mutually exclusive? 18 23 What are the two projects IRRs, and which one would the IRR method 24 select if the firm has a 10% cost of capital and the projects are 25 (a) independent or (b) mutually exclusive? 1 2 3 Formatting Table Clipboard Alignment Number DE F K L M N 6 SS 7 LL -700 -700 9 a 10% cost of capital is appropriate for both of them, what are their NPVS? NPV LL What project or set of projects would be in your capital budget if SS and LL were (a) independent or (b) mutually exclusive? 23 What are the two projects' IRRS, and which one would the IRR method 24 select the firm has a 10% cost of capital and the projects are 25 (independent or () mutually exclusive? 29 LL K L M N 22. Project MM has the following cash flows: 10% $1,000 $2,000 $2,000 -$3,350 9 Calculate MM's NPV at discount rates of 0%, 10%, 12.2258%, 25% 10 122.1470%, and 150%. What are MM's IRRS? If the cost of capital were 11 10%, should the project be accepted or rejected? 13 NPS NPV 16 WACC 0% 12.2258% 221470 150% Tygehus 19 search Ole Insert Draw Page Layout Formulas Data Review View Help Search Home X Cut - copy == General Arial inter BIU. :10 AA .0.A. Wrap Text Merge & Center. $. % 968 Formatt Clipboard Font Alignment Number 1 3. The Ulmer Uranium Company is deciding whether or not to open a strip mine whose net cost is $4.4 million. 2 Net cash inflows are expected to be $27.7 million, all coming at the end of Year 1. 3 The land must be returned to its natural state at a cost of $25 million, payable at the end of Year 2 5 a. Plot the project's NPV profile. 6 b. Should the project be accepted it r=8%? If 14% ? Explain your reasoning. 7 c.What is the project's MIRR at 8% ? At 14% ? Does the MIRR method lead to the same accept-reject decision as the NPV method? 10 4.4 27.7 12 NPV 17 10% 14% 50% 100 150% 200 250 300 400 29 14 . . ) 10, 14 B 100, 10 700 E 100 150, 006, 5 * | * 1 MAR MIPR- 2 1. Projects SS and LL have the following cash flows: 4 WACC = 10% 6 SS 7 LL 300 -700 -700 500 100 100 600 300 9 a 10% cost of capital is appropriate for both of them, what are their NPVS? NPY SS LL 16 What project or set of projects would be in your capital budget if and LL 17 were (a) independent or (b) mutually exclusive? 23 What are the two projects IRRs, and which one would the IRR method 24 select if the firm has a 10% cost of capital and the projects are 25 (a) independent or (b) mutually exclusive? 28 55 10 1 2 3 Formatting Table Clipboard font Alignment Style F G H I J K L M N 6 SS LL -700 -700 500 100 9 W a 10% cost of capital is appropriate for both of them, what are their NPVS? NPV 16 What project or set of projects would be in your capital budget if S and LL were (a) independent or (b) mutually exclusive? 23 What are the two projects' IRRS, and which one would the IRR method 24 select if the firm has a 10% cost of capital and the projects are 25 (a) independent or (b) mutually exclusive? 2B SS 29 LL 1 2 3 - K L M N 2. Project MM has the following cash flows: 10% -$1,000 $2,000 $2,000 $3,350 9 Calculate MM's NPV at discount rates of 0%, 10%, 12.2258%, 25%, 10 122.1470%, and 150%. What are MM'S IRRs? If the cost of capital were 11 10%, should the project be accepted or rejected? 13 NPV- NPV 16 WACC 10% 12.2258% 25% 122.1470% 150% 1 2 3 4 Tyge bors 19 arch o e 0. Review View Help Search Home Insert Draw Page Layout Formulas Data 4 Cut Arial :10 AA === - Copy Format Painter BIU. .0.A. Clipboard > General Wrap Text Merge & Center - $ .% 968 Condit Formatt Font Alignment Number 3. The Ulmer Uranium Company is deciding whether or not to open a strip mine whose net cost is $4.4 million. 2 Net cash inflows are expected to be $27.7 million, all coming at the end of Year 1. 3 The land must be returned to its natural state at a cost of $25 million, payable at the end of Year 2 5 a. Plot the project's NPV profile. 6 b. Should the project be accepted it ra8%? If 14% ? Explain your reasoning. 1 c. What is the project's MIRR at 8% ? At 14% ? Does the MIRR method lead to the same accept-reject decision as the NPV method? 10 44 12 13 NPV 109 14 50 SUPUNE: 100 150 2009 2509 3005 30 400 e Type here to search 0% 5% 8% 10% 14% 50% 1000 15093 200% 250% 300% 350% 400% 450 B 14% TARR MIRR 37