Answered step by step

Verified Expert Solution

Question

1 Approved Answer

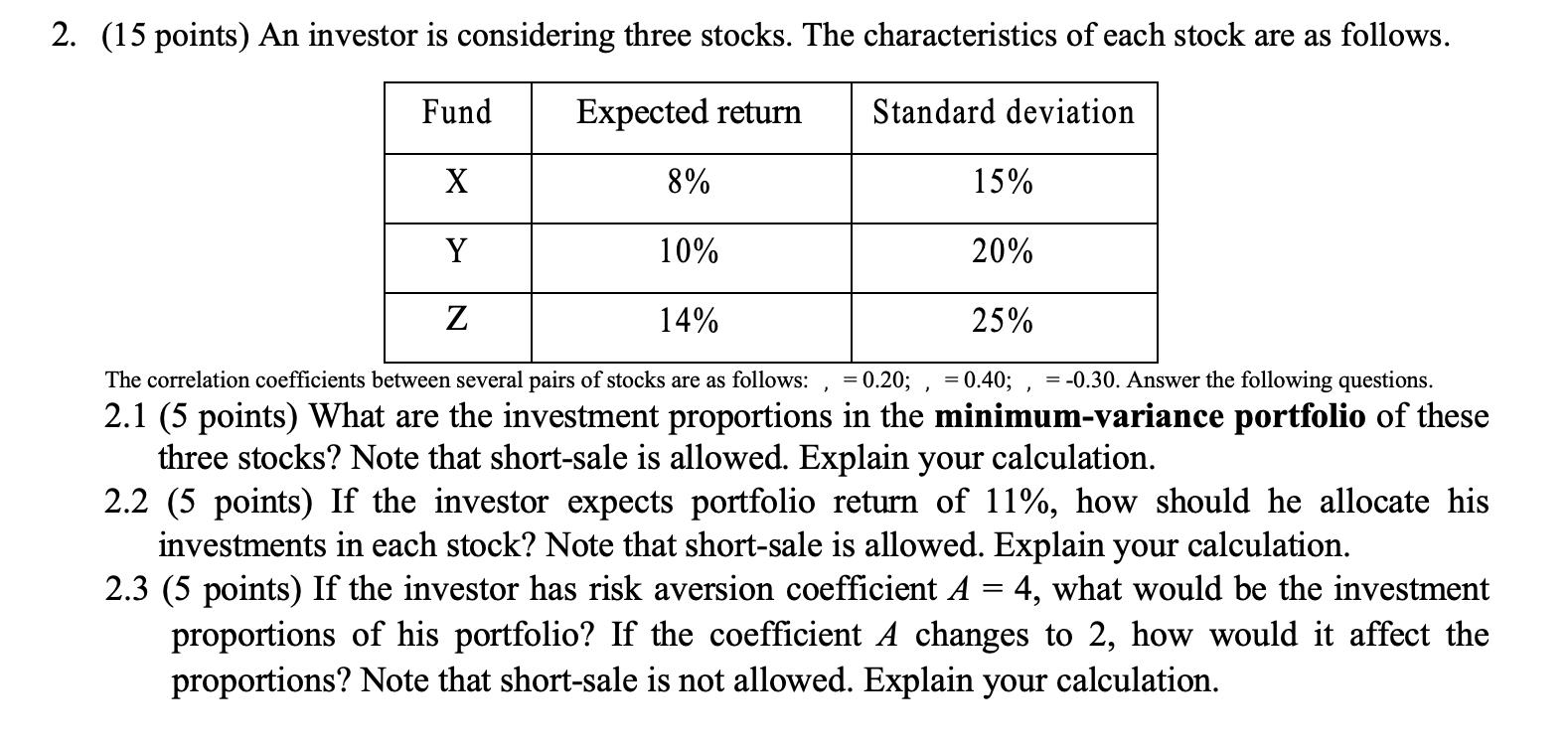

2. (15 points) An investor is considering three stocks. The characteristics of each stock are as follows. Fund Expected return Standard deviation X Y

2. (15 points) An investor is considering three stocks. The characteristics of each stock are as follows. Fund Expected return Standard deviation X Y Z 8% 15% 10% 20% 14% 25% = 0.40; = -0.30. Answer the following questions. The correlation coefficients between several pairs of stocks are as follows: = 0.20; 2.1 (5 points) What are the investment proportions in the minimum-variance portfolio of these three stocks? Note that short-sale is allowed. Explain your calculation. 2.2 (5 points) If the investor expects portfolio return of 11%, how should he allocate his investments in each stock? Note that short-sale is allowed. Explain your calculation. 2.3 (5 points) If the investor has risk aversion coefficient A = 4, what would be the investment proportions of his portfolio? If the coefficient A changes to 2, how would it affect the proportions? Note that short-sale is not allowed. Explain your calculation.

Step by Step Solution

★★★★★

3.37 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

21 5 points To find the minimumvariance portfolio we set up and solve the optimizatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started