Answered step by step

Verified Expert Solution

Question

1 Approved Answer

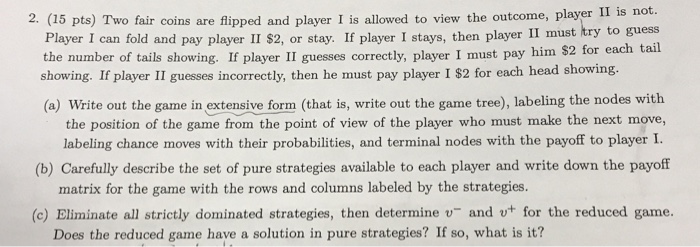

2. (15 pts) Two fair coins are flipped and player I is allowed to view the outcome, player II is not. Player I can

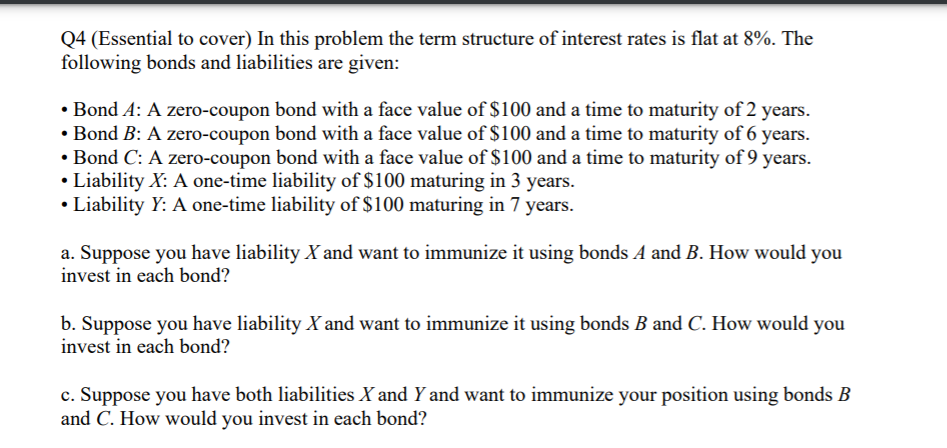

2. (15 pts) Two fair coins are flipped and player I is allowed to view the outcome, player II is not. Player I can fold and pay player II $2, or stay. If player I stays, then player II must try to guess the number of tails showing. If player II guesses correctly, player I must pay him $2 for each tail showing. If player II guesses incorrectly, then he must pay player I $2 for each head showing. (a) Write out the game in extensive form (that is, write out the game tree), labeling the nodes with the position of the game from the point of view of the player who must make the next move, labeling chance moves with their probabilities, and terminal nodes with the payoff to player I. (b) Carefully describe the set of pure strategies available to each player and write down the payoff matrix for the game with the rows and columns labeled by the strategies. (c) Eliminate all strictly dominated strategies, then determine u and ut for the reduced game. Does the reduced game have a solution in pure strategies? If so, what is it? Q4 (Essential to cover) In this problem the term structure of interest rates is flat at 8%. The following bonds and liabilities are given: Bond A: A zero-coupon bond with a face value of $100 and a time to maturity of 2 years. Bond B: A zero-coupon bond with a face value of $100 and a time to maturity of 6 years. Bond C: A zero-coupon bond with a face value of $100 and a time to maturity of 9 years. Liability X: A one-time liability of $100 maturing in 3 years. Liability Y: A one-time liability of $100 maturing in 7 years. a. Suppose you have liability X and want to immunize it using bonds A and B. How would you invest in each bond? b. Suppose you have liability X and want to immunize it using bonds B and C. How would you invest in each bond? c. Suppose you have both liabilities X and Y and want to immunize your position using bonds B and C. How would you invest in each bond?

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a The game in extensive form can be represented as follows I views outcome fold stay Pay II 2 II guesses tails II guesses 0 II guesses 1 Pay I 2 for e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started