Answered step by step

Verified Expert Solution

Question

1 Approved Answer

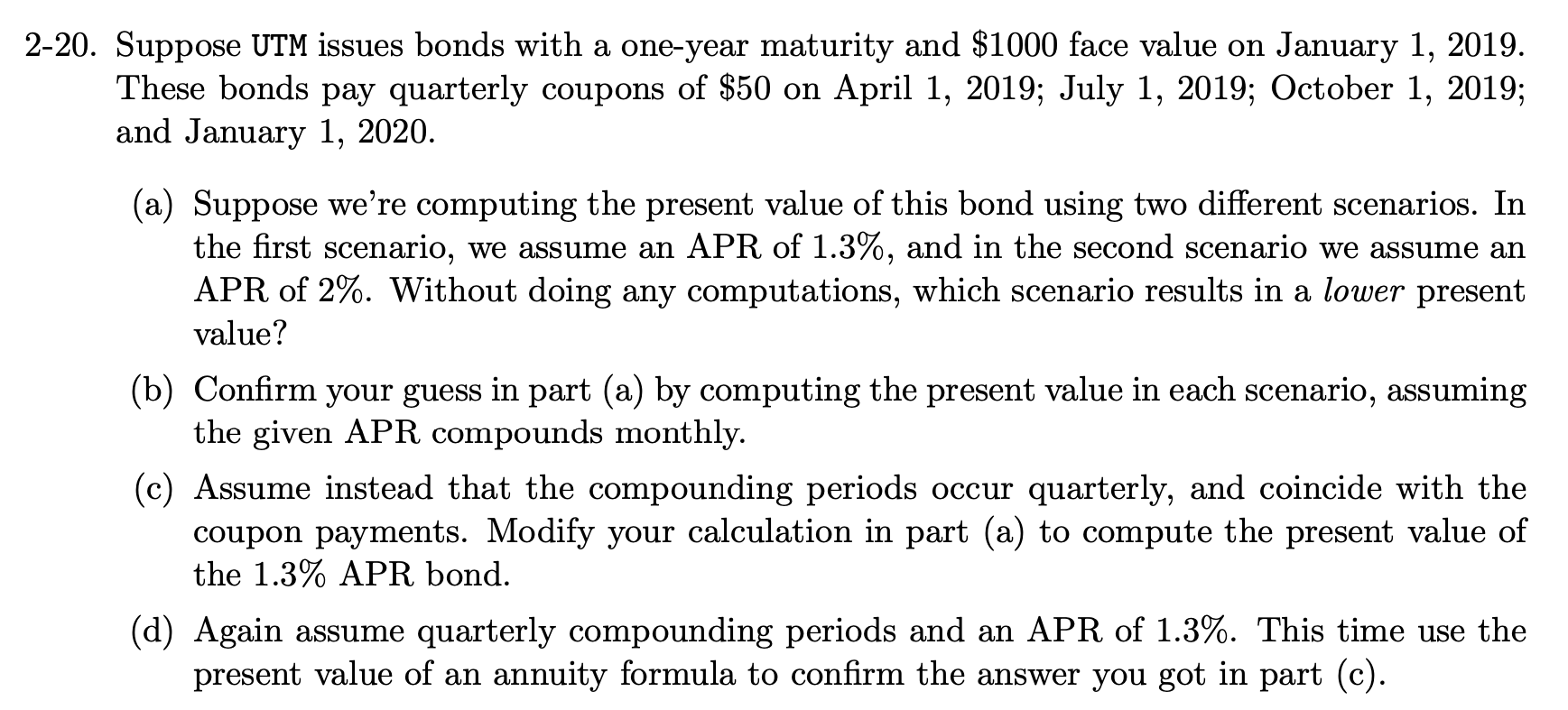

2 - 2 0 . Suppose UTM issues bonds with a one - year maturity and $ 1 0 0 0 face value on January

Suppose UTM issues bonds with a oneyear maturity and $ face value on January

These bonds pay quarterly coupons of $ on April ; July ; October ;

and January

a Suppose we're computing the present value of this bond using two different scenarios. In

the first scenario, we assume an APR of and in the second scenario we assume an

APR of Without doing any computations, which scenario results in a lower present

value?

b Confirm your guess in part a by computing the present value in each scenario, assuming

the given APR compounds monthly.

c Assume instead that the compounding periods occur quarterly, and coincide with the

coupon payments. Modify your calculation in part a to compute the present value of

the APR bond.

d Again assume quarterly compounding periods and an APR of This time use the

present value of an annuity formula to confirm the answer you got in part c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started