Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 : 2 4 AM Sun Dec 3 Guillain is an example of what kind of investor? At each funding stage prior to the IPO

: AM Sun Dec

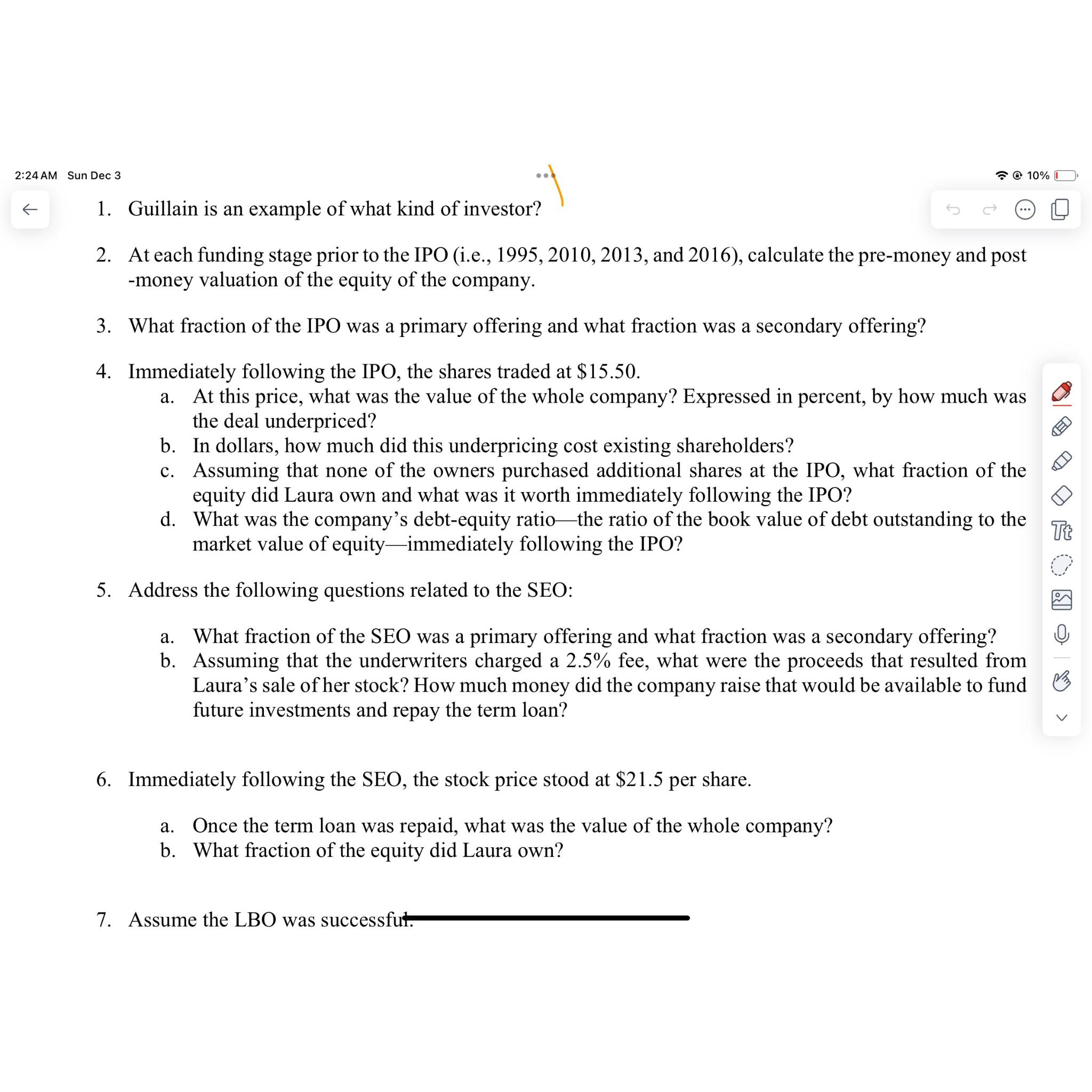

Guillain is an example of what kind of investor?

At each funding stage prior to the IPO ie and calculate the premoney and post money valuation of the equity of the company.

What fraction of the IPO was a primary offering and what fraction was a secondary offering?

Immediately following the IPO, the shares traded at $

a At this price, what was the value of the whole company? Expressed in percent, by how much was the deal underpriced?

b In dollars, how much did this underpricing cost existing shareholders?

c Assuming that none of the owners purchased additional shares at the IPO, what fraction of the equity did Laura own and what was it worth immediately following the IPO?

d What was the company's debtequity ratio the ratio of the book value of debt outstanding to the market value of equityimmediately following the IPO?

Address the following questions related to the SEO:

a What fraction of the SEO was a primary offering and what fraction was a secondary offering?

b Assuming that the underwriters charged a fee, what were the proceeds that resulted from Laura's sale of her stock? How much money did the company raise that would be available to fund future investments and repay the term loan?

Immediately following the SEO, the stock price stood at $ per share.

a Once the term loan was repaid, what was the value of the whole company?

b What fraction of the equity did Laura own?

Assume the LBO was successfur.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started