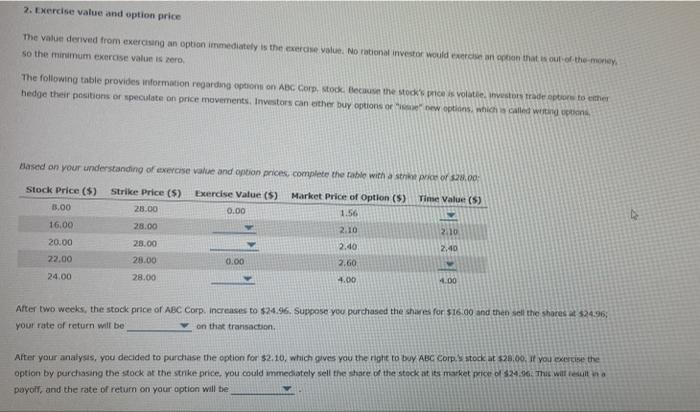

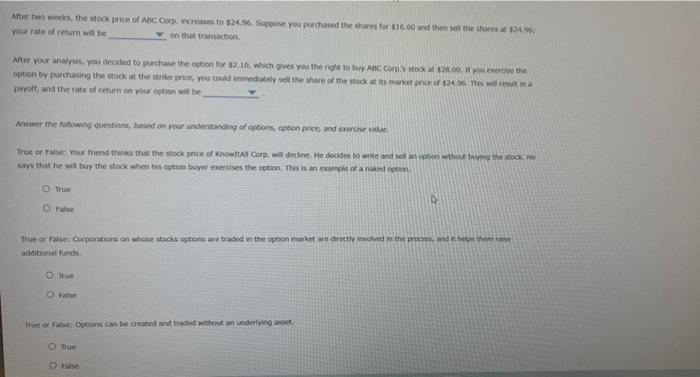

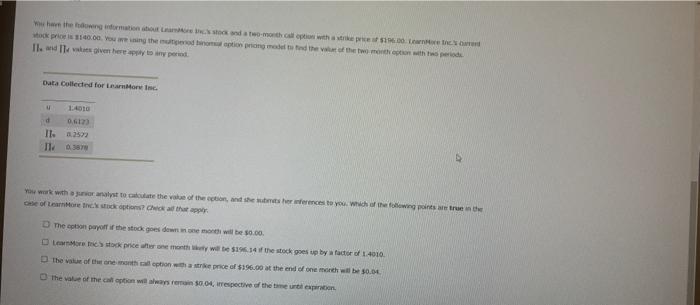

2. Exercise value and option price The value derived from exercising an option immediately is the exercise value Notional investor would ever on that is out of the-money so the minimum exercise value is zero. The following table provides information regarding options on ABC Corp, stock. Because the sock's price is voltestostrade option to the hedge their positions or speculate on price movements. Investors another buy options of options, which is called stand upon Based on your understanding of exercise value and option prices, complete the table with a strike price of $28.00 Strike Price (5) Exercise Value (S) 0.00 Market Price of Option (5) 1.56 Tine Value (5) Stock Price (5) 13.00 16.00 20.00 28.00 28.00 2.10 2:10 28.00 2.40 2,40 22.00 28.00 0.00 2.60 24.00 28.00 4.00 4.00 After two weeks, the stock price of ABC Corp increases to $24.96. Suppose you purchased the shares for $16.00 and then sell the shares at $24.95 your rate of return will be on that transaction After your analysis, you decided to purchase the option for $2.10, which gives you the right to buy ABC Corp. stock at $28.00. you exercise the option by purchasing the stock at the strike price, you could immediately sell the share of the stock at its market price of $24.56. This will resulta payoff, and the rate of return on your option will be Aer two weeks, the stock price of ABC Corp. ces to $24.56. Suppose you purchased the shares for $16.00 and then the shes Your rate of return will be on that transaction After your analysis. you decided to purchase the option for 2.10, which gives you the right to buy Arc Corp.stock 1200. If you were the option by purchasing the stock at the strike price, you could immediately the share of the stock at its market price of 24.06 The wait pavolt, and the rate of return on your option will be Answer the following questions, sed on your understanding of options, option price, and encre value True or raise your friend think that the stock price of Know It All Corp will decine. He decides to wise bilan in without the store says that he will buy the stock whenus option buyerses the action. This is an example of an indien O true Orale The or Fuse Corporations on whose stod options are traded in the option market are directly involved in the proces dhe thonic additional funds Tue Orale True or Fase Options can be created and traded without an underlying Orale where the good worth the Wok pri 160.00 ming the motion pong mat tied the two montation periode Il.de given here to reperit Data Collected for Loc. u 14010 0.61 II. II. 387 You work with or analyst to the value of the action, and the frences to you. Which of the following points the of learn More captions? Chathat apply The stron payoff the stock goes down on the 0.00 Loretok price for month will be 1964 the stock goes up by a factor of 4010 the value of the month on the ice of $15.00 the end of one month will be so the value of the caption was 0.0%, respective of the turtleton 2. Exercise value and option price The value derived from exercising an option immediately is the exercise value Notional investor would ever on that is out of the-money so the minimum exercise value is zero. The following table provides information regarding options on ABC Corp, stock. Because the sock's price is voltestostrade option to the hedge their positions or speculate on price movements. Investors another buy options of options, which is called stand upon Based on your understanding of exercise value and option prices, complete the table with a strike price of $28.00 Strike Price (5) Exercise Value (S) 0.00 Market Price of Option (5) 1.56 Tine Value (5) Stock Price (5) 13.00 16.00 20.00 28.00 28.00 2.10 2:10 28.00 2.40 2,40 22.00 28.00 0.00 2.60 24.00 28.00 4.00 4.00 After two weeks, the stock price of ABC Corp increases to $24.96. Suppose you purchased the shares for $16.00 and then sell the shares at $24.95 your rate of return will be on that transaction After your analysis, you decided to purchase the option for $2.10, which gives you the right to buy ABC Corp. stock at $28.00. you exercise the option by purchasing the stock at the strike price, you could immediately sell the share of the stock at its market price of $24.56. This will resulta payoff, and the rate of return on your option will be Aer two weeks, the stock price of ABC Corp. ces to $24.56. Suppose you purchased the shares for $16.00 and then the shes Your rate of return will be on that transaction After your analysis. you decided to purchase the option for 2.10, which gives you the right to buy Arc Corp.stock 1200. If you were the option by purchasing the stock at the strike price, you could immediately the share of the stock at its market price of 24.06 The wait pavolt, and the rate of return on your option will be Answer the following questions, sed on your understanding of options, option price, and encre value True or raise your friend think that the stock price of Know It All Corp will decine. He decides to wise bilan in without the store says that he will buy the stock whenus option buyerses the action. This is an example of an indien O true Orale The or Fuse Corporations on whose stod options are traded in the option market are directly involved in the proces dhe thonic additional funds Tue Orale True or Fase Options can be created and traded without an underlying Orale where the good worth the Wok pri 160.00 ming the motion pong mat tied the two montation periode Il.de given here to reperit Data Collected for Loc. u 14010 0.61 II. II. 387 You work with or analyst to the value of the action, and the frences to you. Which of the following points the of learn More captions? Chathat apply The stron payoff the stock goes down on the 0.00 Loretok price for month will be 1964 the stock goes up by a factor of 4010 the value of the month on the ice of $15.00 the end of one month will be so the value of the caption was 0.0%, respective of the turtleton