Answered step by step

Verified Expert Solution

Question

1 Approved Answer

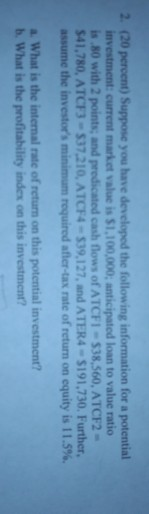

2. 20 percent) Suppose you have developed the following information for a potential investment: current market value is 51,100,000: anticipated loan to value ratio is

2. 20 percent) Suppose you have developed the following information for a potential investment: current market value is 51,100,000: anticipated loan to value ratio is 80 with 2 points and predicated cash flows of ATCFI - 538,560, ATCF2 - $41,780, ATCF3-537210, ATCF4-539,127, and ATER4-5191,730. Further, assume the investor's minimum required after-tax rate of return on equity is 11.5% What is the internal rate of return on this potential investment? b. What is the profitability index on this investment? 2. 20 percent) Suppose you have developed the following information for a potential investment: current market value is 51,100,000: anticipated loan to value ratio is 80 with 2 points and predicated cash flows of ATCFI - 538,560, ATCF2 - $41,780, ATCF3-537210, ATCF4-539,127, and ATER4-5191,730. Further, assume the investor's minimum required after-tax rate of return on equity is 11.5% What is the internal rate of return on this potential investment? b. What is the profitability index on this investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started