Answered step by step

Verified Expert Solution

Question

1 Approved Answer

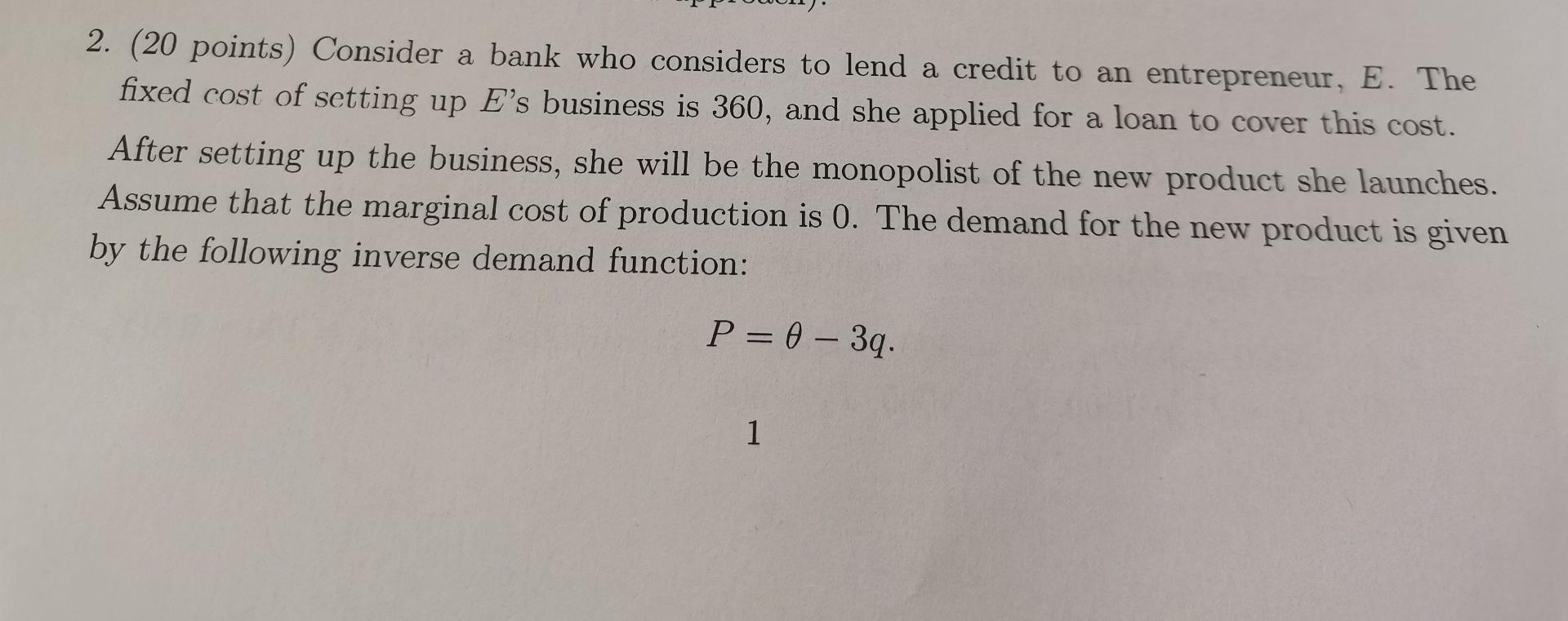

2. (20 points) Consider a bank who considers to lend a credit to an entrepreneur, E. The fixed cost of setting up E's business is

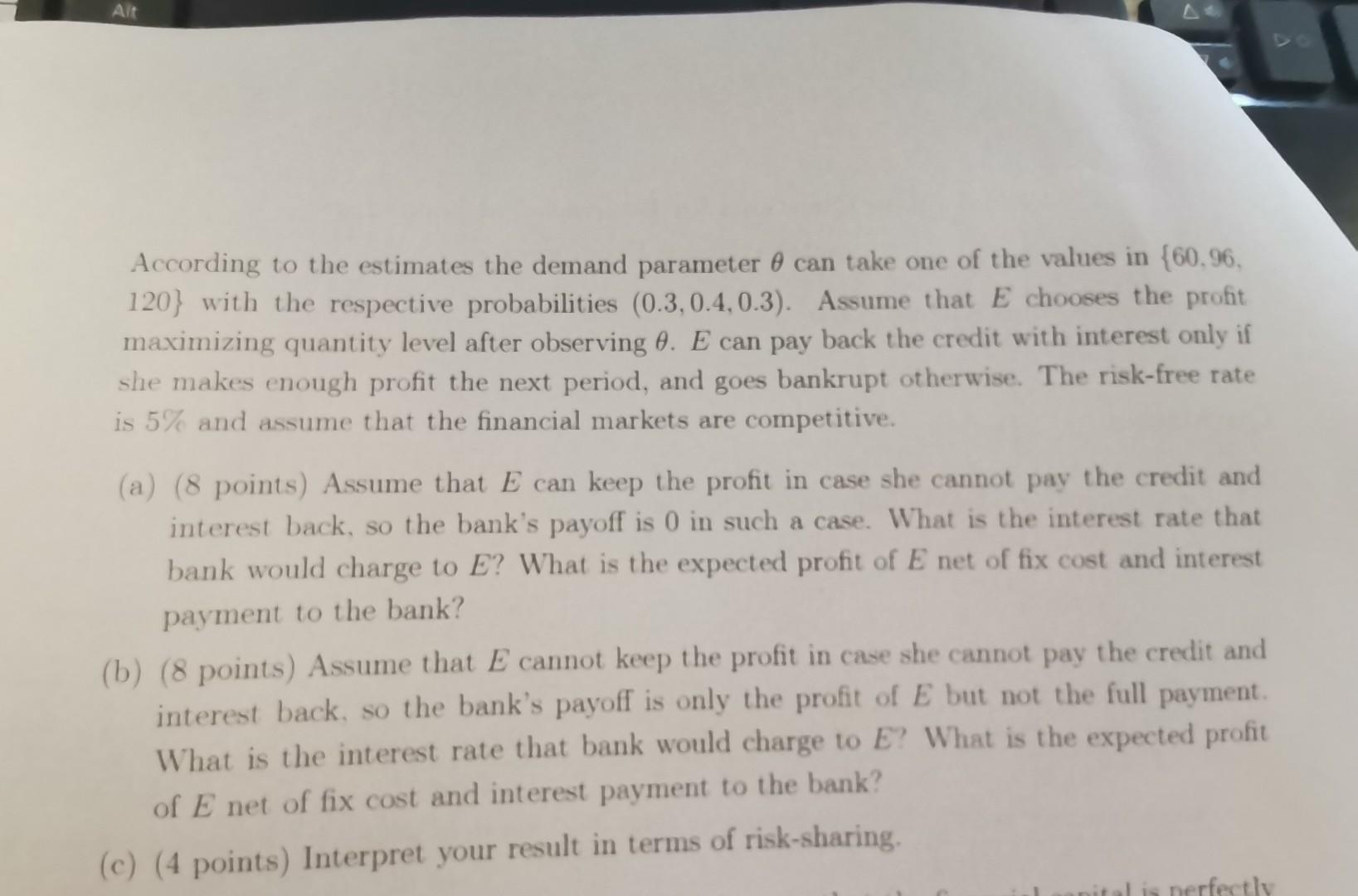

2. (20 points) Consider a bank who considers to lend a credit to an entrepreneur, E. The fixed cost of setting up E's business is 360 , and she applied for a loan to cover this cost. After setting up the business, she will be the monopolist of the new product she launches. Assume that the marginal cost of production is 0 . The demand for the new product is given by the following inverse demand function: P=3q According to the estimates the demand parameter can take one of the values in {60,96, 120} with the respective probabilities (0.3,0.4,0.3). Assume that E chooses the profit maximizing quantity level after observing .E can pay back the credit with interest only if she makes enough profit the next period, and goes bankrupt otherwise. The risk-free rate is 5% and assume that the financial markets are competitive. (a) ( 8 points) Assume that E can keep the profit in case she cannot pay the credit and interest back, so the bank's payoff is 0 in such a case. What is the interest rate that bank would charge to E ? What is the expected profit of E net of fix cost and interest payment to the bank? (b) (8 points) Assume that E cannot keep the profit in case she cannot pay the credit and interest back, so the bank's payoff is only the profit of E but not the full payment. What is the interest rate that bank would charge to E ? What is the expected profit of E net of fix cost and interest payment to the bank? (c) (4 points) Interpret your result in terms of risk-sharing. 2. (20 points) Consider a bank who considers to lend a credit to an entrepreneur, E. The fixed cost of setting up E's business is 360 , and she applied for a loan to cover this cost. After setting up the business, she will be the monopolist of the new product she launches. Assume that the marginal cost of production is 0 . The demand for the new product is given by the following inverse demand function: P=3q According to the estimates the demand parameter can take one of the values in {60,96, 120} with the respective probabilities (0.3,0.4,0.3). Assume that E chooses the profit maximizing quantity level after observing .E can pay back the credit with interest only if she makes enough profit the next period, and goes bankrupt otherwise. The risk-free rate is 5% and assume that the financial markets are competitive. (a) ( 8 points) Assume that E can keep the profit in case she cannot pay the credit and interest back, so the bank's payoff is 0 in such a case. What is the interest rate that bank would charge to E ? What is the expected profit of E net of fix cost and interest payment to the bank? (b) (8 points) Assume that E cannot keep the profit in case she cannot pay the credit and interest back, so the bank's payoff is only the profit of E but not the full payment. What is the interest rate that bank would charge to E ? What is the expected profit of E net of fix cost and interest payment to the bank? (c) (4 points) Interpret your result in terms of risk-sharing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started