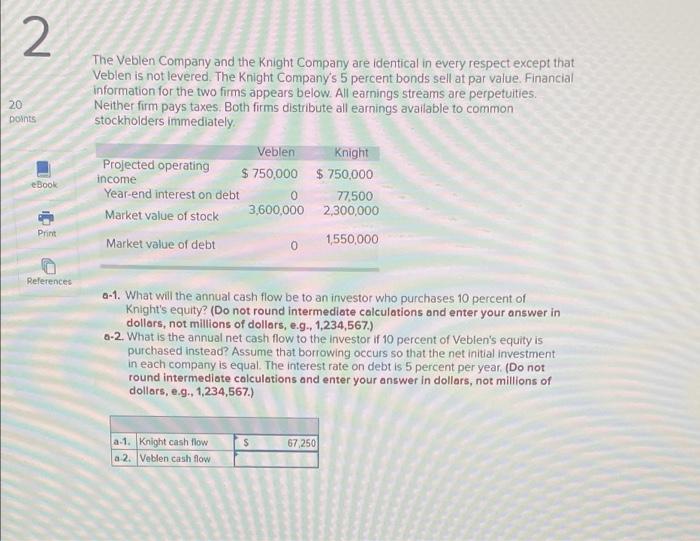

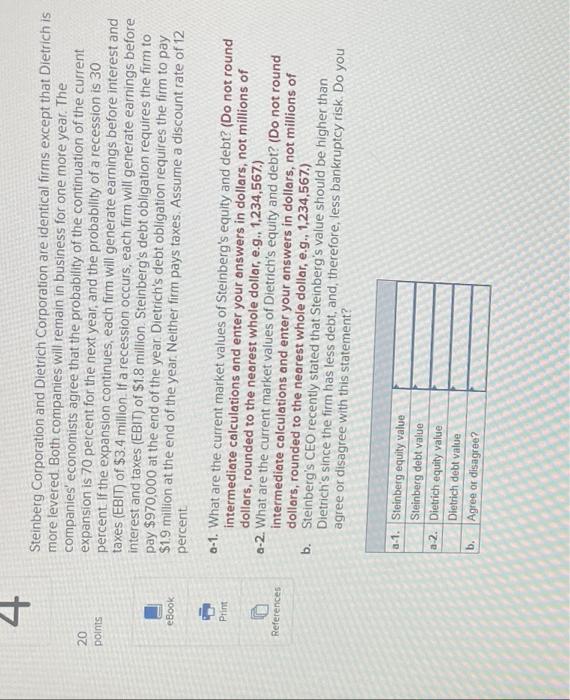

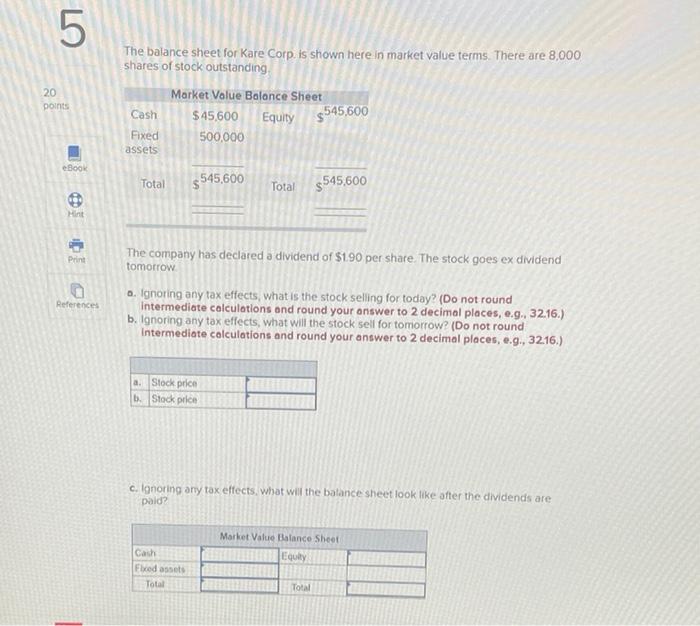

2 20 points eBook Print References The Veblen Company and the Knight Company are identical in every respect except that Veblen is not levered. The Knight Company's 5 percent bonds sell at par value. Financial information for the two firms appears below. All earnings streams are perpetuities. Neither firm pays taxes. Both firms distribute all earnings available to common stockholders immediately. Veblen Knight Projected operating $750,000 $750,000 income Year-end interest on debt 0 77,500 2,300,000 3,600,000 Market value of stock 1,550,000 Market value of debt a-1. What will the annual cash flow be to an investor who purchases 10 percent of Knight's equity? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) a-2. What is the annual net cash flow to the investor if 10 percent of Veblen's equity is purchased instead? Assume that borrowing occurs so that the net initial investment in each company is equal. The interest rate on debt is 5 percent per year. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) $ 67,250 a-1. Knight cash flow a-2. Veblen cash flow 4 20 points eBook Print References: Steinberg Corporation and Dietrich Corporation are identical firms except that Dietrich is more levered. Both companies will remain in business for one more year. The companies' economists agree that the probability of the continuation of the current expansion is 70 percent for the next year, and the probability of a recession is 30 percent. If the expansion continues, each firm will generate earnings before interest and taxes (EBIT) of $3.4 million. If a recession occurs, each firm will generate earnings before interest and taxes (EBIT) of $1.8 million. Steinberg's debt obligation requires the firm to pay $970,000 at the end of the year. Dietrich's debt obligation requires the firm to pay percent. $1.9 million at the end of the year. Neither firm pays taxes. Assume a discount rate of 12 0-1. What are the current market values of Steinberg's equity and debt? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole dollar, e.g., 1,234,567.) a-2. What are the current market values of Dietrich's equity and debt? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole dollar, e.g., 1,234,567.) b. Steinberg's CEO recently stated that Steinberg's value should be higher than agree or disagree with this statement? Dietrich's since the firm has less debt, and, therefore, less bankruptcy risk. Do you a-1. Steinberg equity value Steinberg debt value a-2. Dietrich equity value Dietrich debt value b. Agree or disagree? 5 20 points eBook Hint Print References The balance sheet for Kare Corp. is shown here in market value terms. There are 8,000 shares of stock outstanding Market Value Balance Sheet Cash $45,600 Equity $545,600 Fixed 500,000 assets Total $545.600 Total $545,600 The company has declared a dividend of $1.90 per share. The stock goes ex dividend tomorrow a. Ignoring any tax effects, what is the stock selling for today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Ignoring any tax effects, what will the stock sell for tomorrow? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Stock price b. Stock price c. Ignoring any tax effects, what will the balance sheet look like after the dividends are paid? Market Value Balance Sheet ( Equity Cash Fixed assets Total Total