Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 2.85 points Problem 15-19 (Algo) Initial direct costs; sales-type lease [LO15-2, 15-7] Bidwell Leasing purchased a single-engine plane for its fair value of $571,220

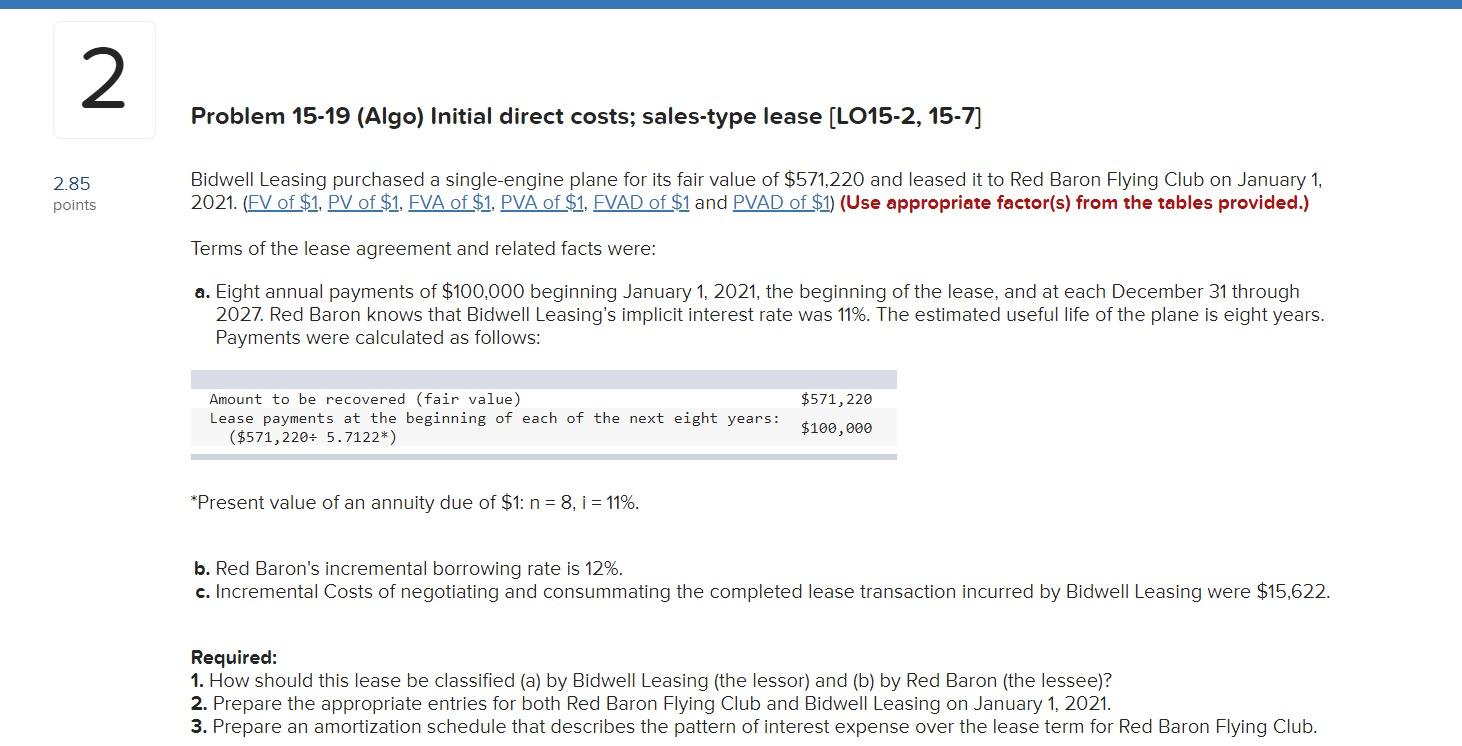

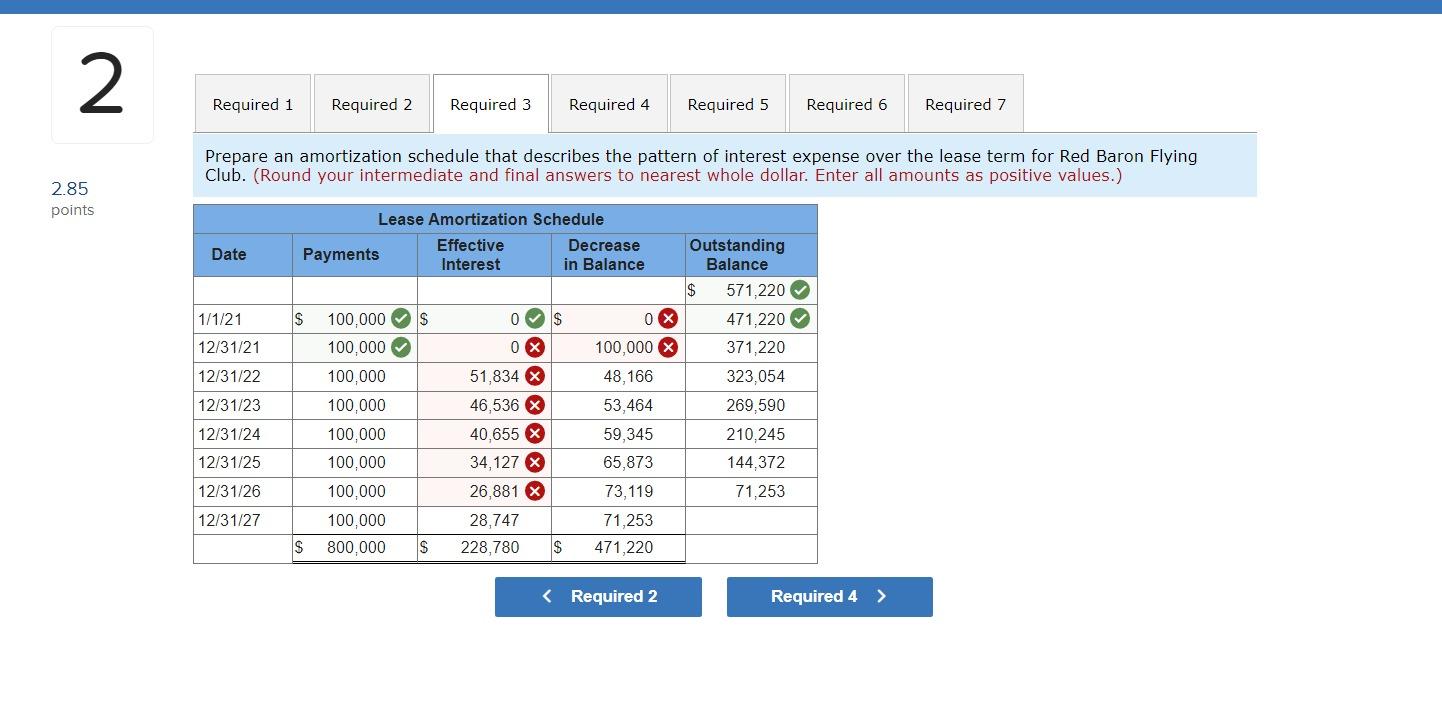

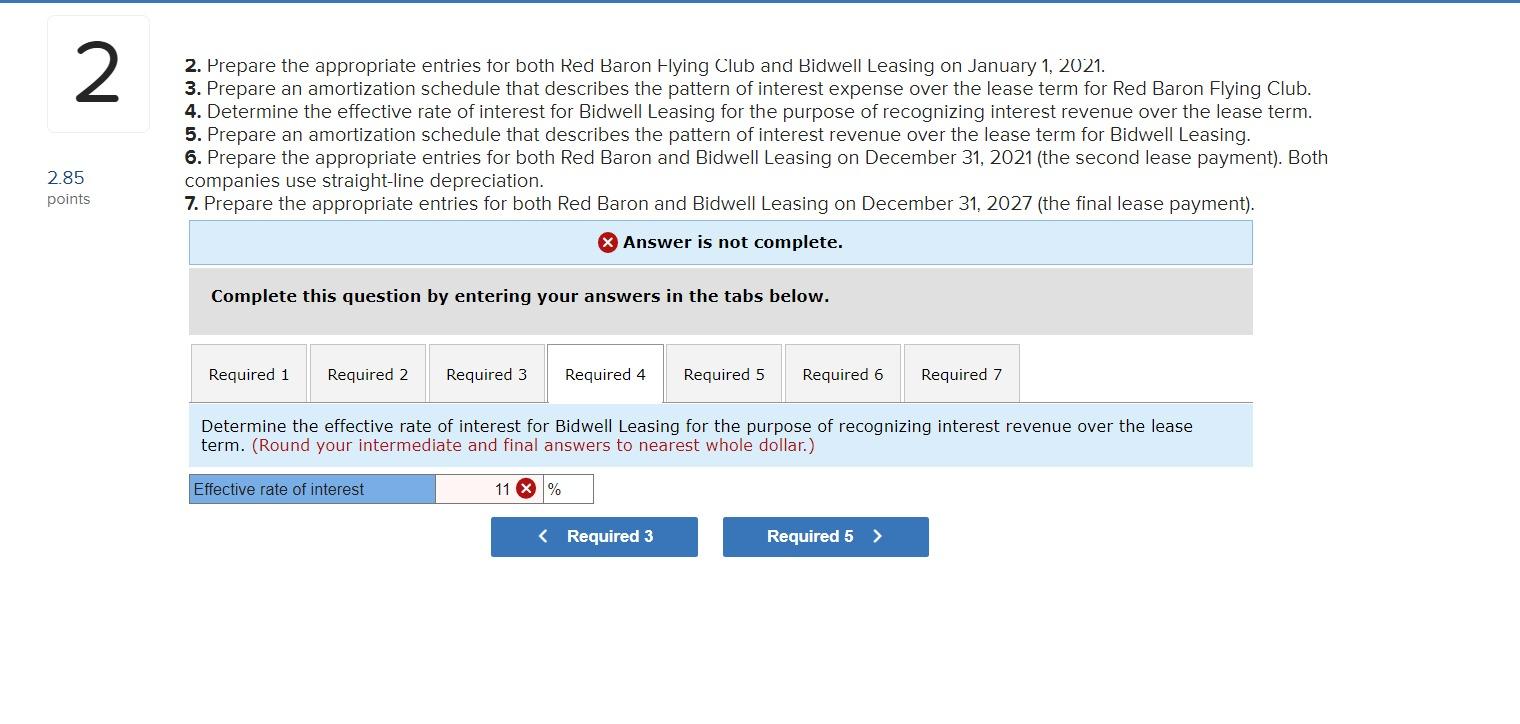

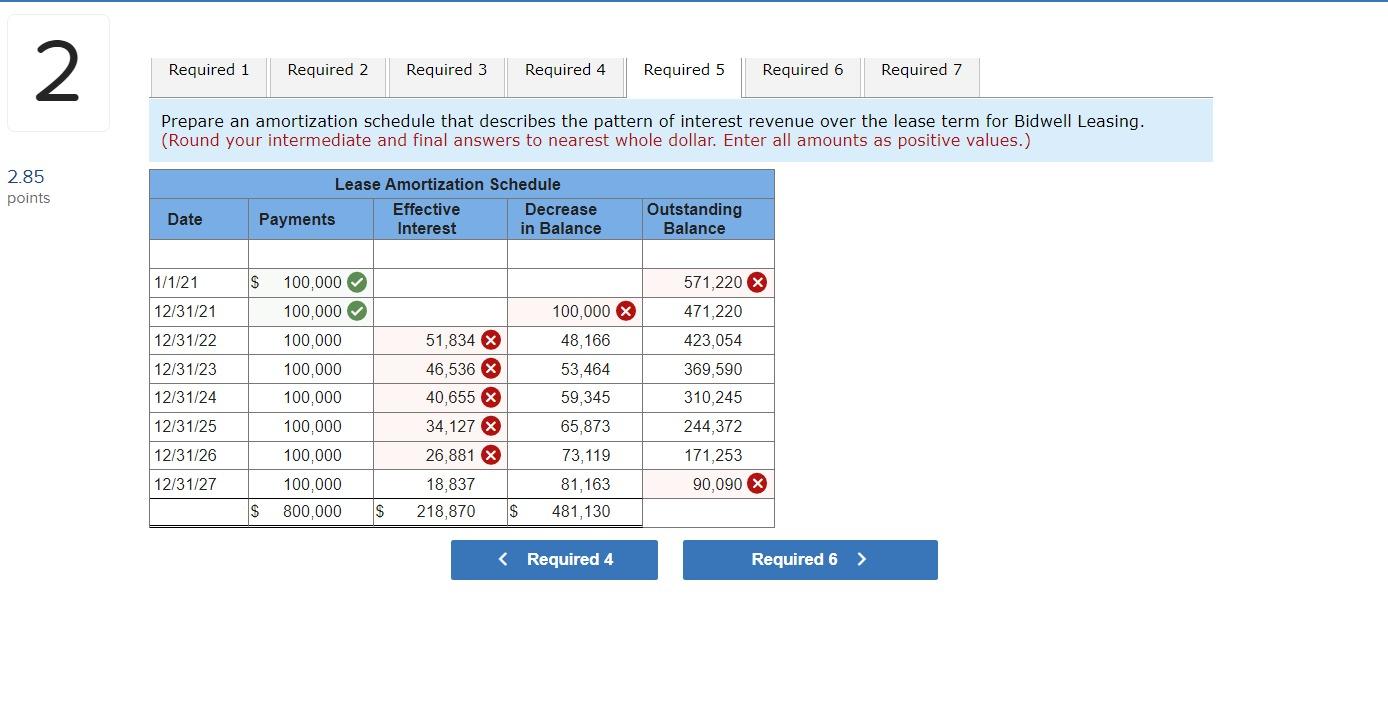

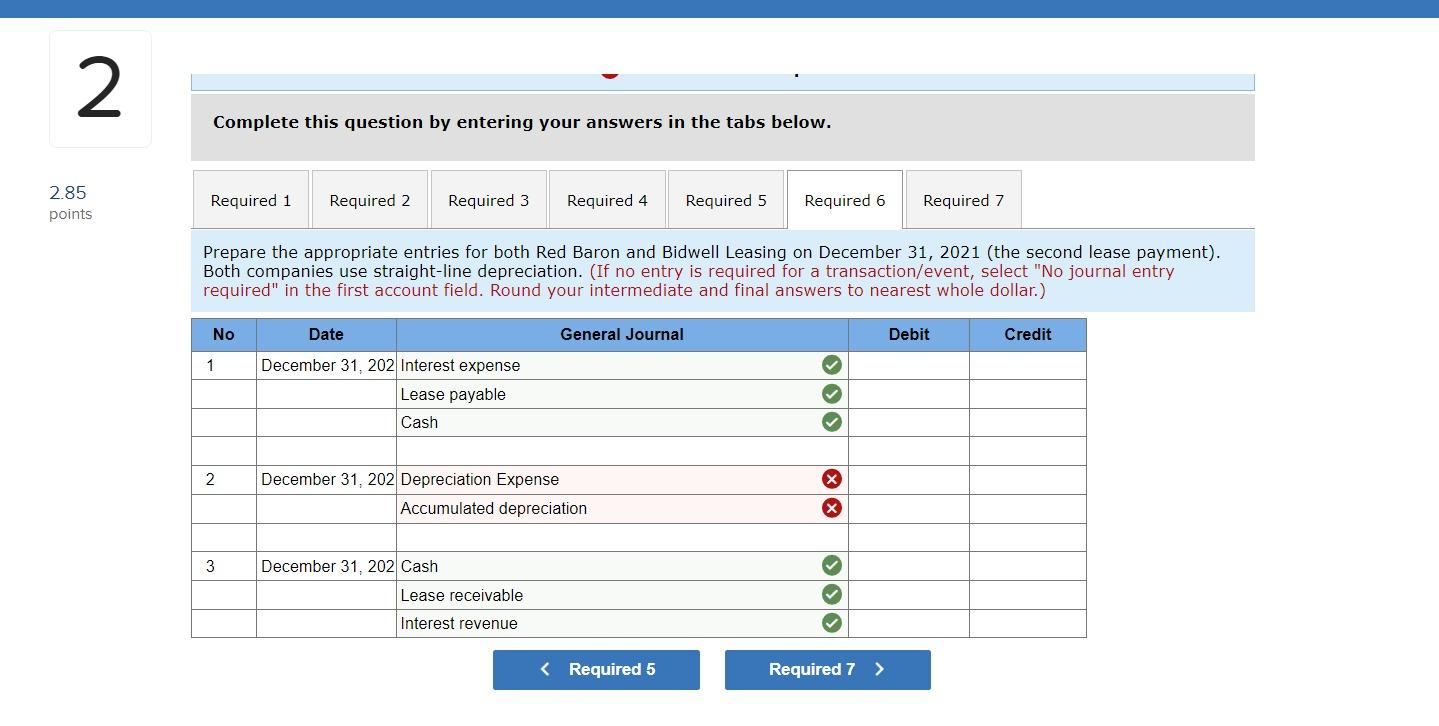

2 2.85 points Problem 15-19 (Algo) Initial direct costs; sales-type lease [LO15-2, 15-7] Bidwell Leasing purchased a single-engine plane for its fair value of $571,220 and leased it to Red Baron Flying Club on January 1, 2021. (FV of $1, PV of $1, FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Terms of the lease agreement and related facts were: a. Eight annual payments of $100,000 beginning January 1, 2021, the beginning of the lease, and at each December 31 through 2027. Red Baron knows that Bidwell Leasing's implicit interest rate was 11%. The estimated useful life of the plane is eight years. Payments were calculated as follows: Amount to be recovered (fair value) Lease payments at the beginning of each of the next eight years: ($571,220 5.7122*) $571,220 $100,000 *Present value of an annuity due of $1: n = 8,i=11%. b. Red Baron's incremental borrowing rate is 12%. c. Incremental Costs of negotiating and consummating the completed lease transaction incurred by Bidwell Leasing were $15,622. Required: 1. How should this lease be classified (a) by Bidwell Leasing (the lessor) and (b) by Red Baron (the lessee)? 2. Prepare the appropriate entries for both Red Baron Flying Club and Bidwell Leasing on January 1, 2021. 3. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club. 2 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club. (Round your intermediate and final answers to nearest whole dollar. Enter all amounts as positive values.) 2.85 points Date Payments Lease Amortization Schedule Effective Interest Decrease Outstanding in Balance Balance $ 571,220 1/1/21 12/31/21 $ 100,000 S 0 $ 0 471,220 100,000 0 100,000 371,220 12/31/22 100,000 51,834 x 48,166 323,054 12/31/23 100,000 46,536 x 53,464 269,590 12/31/24 100,000 40,655 x 59,345 210,245 12/31/25 100,000 34,127 x 65,873 144,372 12/31/26 100,000 26,881 x 73,119 71,253 12/31/27 100,000 28,747 71,253 $ 800,000 $ 228,780 $ 471,220 2 2.85 points 2. Prepare the appropriate entries for both Red Baron Flying Club and Bidwell Leasing on January 1, 2021. 3. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club. 4. Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term. 5. Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing. 6. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment). Both companies use straight-line depreciation. 7. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2027 (the final lease payment). Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term. (Round your intermediate and final answers to nearest whole dollar.) Effective rate of interest 11 % 2 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing. (Round your intermediate and final answers to nearest whole dollar. Enter all amounts as positive values.) Lease Amortization Schedule 2.85 points Date Payments Effective Interest Decrease in Balance Outstanding Balance 1/1/21 12/31/21 $ 100,000 571,220 x 100,000 100,000 471,220 12/31/22 100,000 51,834 48,166 423,054 12/31/23 100,000 46,536 x 53,464 369,590 12/31/24 100,000 40,655 x 59,345 310,245 12/31/25 100,000 34,127 x 65,873 244,372 12/31/26 100,000 26,881 x 73,119 171,253 12/31/27 100,000 18,837 81,163 90,090 $ 800,000 $ 218,870 $ 481,130 2 Complete this question by entering your answers in the tabs below. 2.85 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 points Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment). Both companies use straight-line depreciation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to nearest whole dollar.) No 1 2 Date December 31, 202 Interest expense Lease payable Cash December 31, 202 Depreciation Expense General Journal Accumulated depreciation 3 December 31, 202 Cash Lease receivable Interest revenue Debit Credit

2 2.85 points Problem 15-19 (Algo) Initial direct costs; sales-type lease [LO15-2, 15-7] Bidwell Leasing purchased a single-engine plane for its fair value of $571,220 and leased it to Red Baron Flying Club on January 1, 2021. (FV of $1, PV of $1, FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Terms of the lease agreement and related facts were: a. Eight annual payments of $100,000 beginning January 1, 2021, the beginning of the lease, and at each December 31 through 2027. Red Baron knows that Bidwell Leasing's implicit interest rate was 11%. The estimated useful life of the plane is eight years. Payments were calculated as follows: Amount to be recovered (fair value) Lease payments at the beginning of each of the next eight years: ($571,220 5.7122*) $571,220 $100,000 *Present value of an annuity due of $1: n = 8,i=11%. b. Red Baron's incremental borrowing rate is 12%. c. Incremental Costs of negotiating and consummating the completed lease transaction incurred by Bidwell Leasing were $15,622. Required: 1. How should this lease be classified (a) by Bidwell Leasing (the lessor) and (b) by Red Baron (the lessee)? 2. Prepare the appropriate entries for both Red Baron Flying Club and Bidwell Leasing on January 1, 2021. 3. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club. 2 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club. (Round your intermediate and final answers to nearest whole dollar. Enter all amounts as positive values.) 2.85 points Date Payments Lease Amortization Schedule Effective Interest Decrease Outstanding in Balance Balance $ 571,220 1/1/21 12/31/21 $ 100,000 S 0 $ 0 471,220 100,000 0 100,000 371,220 12/31/22 100,000 51,834 x 48,166 323,054 12/31/23 100,000 46,536 x 53,464 269,590 12/31/24 100,000 40,655 x 59,345 210,245 12/31/25 100,000 34,127 x 65,873 144,372 12/31/26 100,000 26,881 x 73,119 71,253 12/31/27 100,000 28,747 71,253 $ 800,000 $ 228,780 $ 471,220 2 2.85 points 2. Prepare the appropriate entries for both Red Baron Flying Club and Bidwell Leasing on January 1, 2021. 3. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club. 4. Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term. 5. Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing. 6. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment). Both companies use straight-line depreciation. 7. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2027 (the final lease payment). Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term. (Round your intermediate and final answers to nearest whole dollar.) Effective rate of interest 11 % 2 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing. (Round your intermediate and final answers to nearest whole dollar. Enter all amounts as positive values.) Lease Amortization Schedule 2.85 points Date Payments Effective Interest Decrease in Balance Outstanding Balance 1/1/21 12/31/21 $ 100,000 571,220 x 100,000 100,000 471,220 12/31/22 100,000 51,834 48,166 423,054 12/31/23 100,000 46,536 x 53,464 369,590 12/31/24 100,000 40,655 x 59,345 310,245 12/31/25 100,000 34,127 x 65,873 244,372 12/31/26 100,000 26,881 x 73,119 171,253 12/31/27 100,000 18,837 81,163 90,090 $ 800,000 $ 218,870 $ 481,130 2 Complete this question by entering your answers in the tabs below. 2.85 Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 points Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment). Both companies use straight-line depreciation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to nearest whole dollar.) No 1 2 Date December 31, 202 Interest expense Lease payable Cash December 31, 202 Depreciation Expense General Journal Accumulated depreciation 3 December 31, 202 Cash Lease receivable Interest revenue Debit Credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started