Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

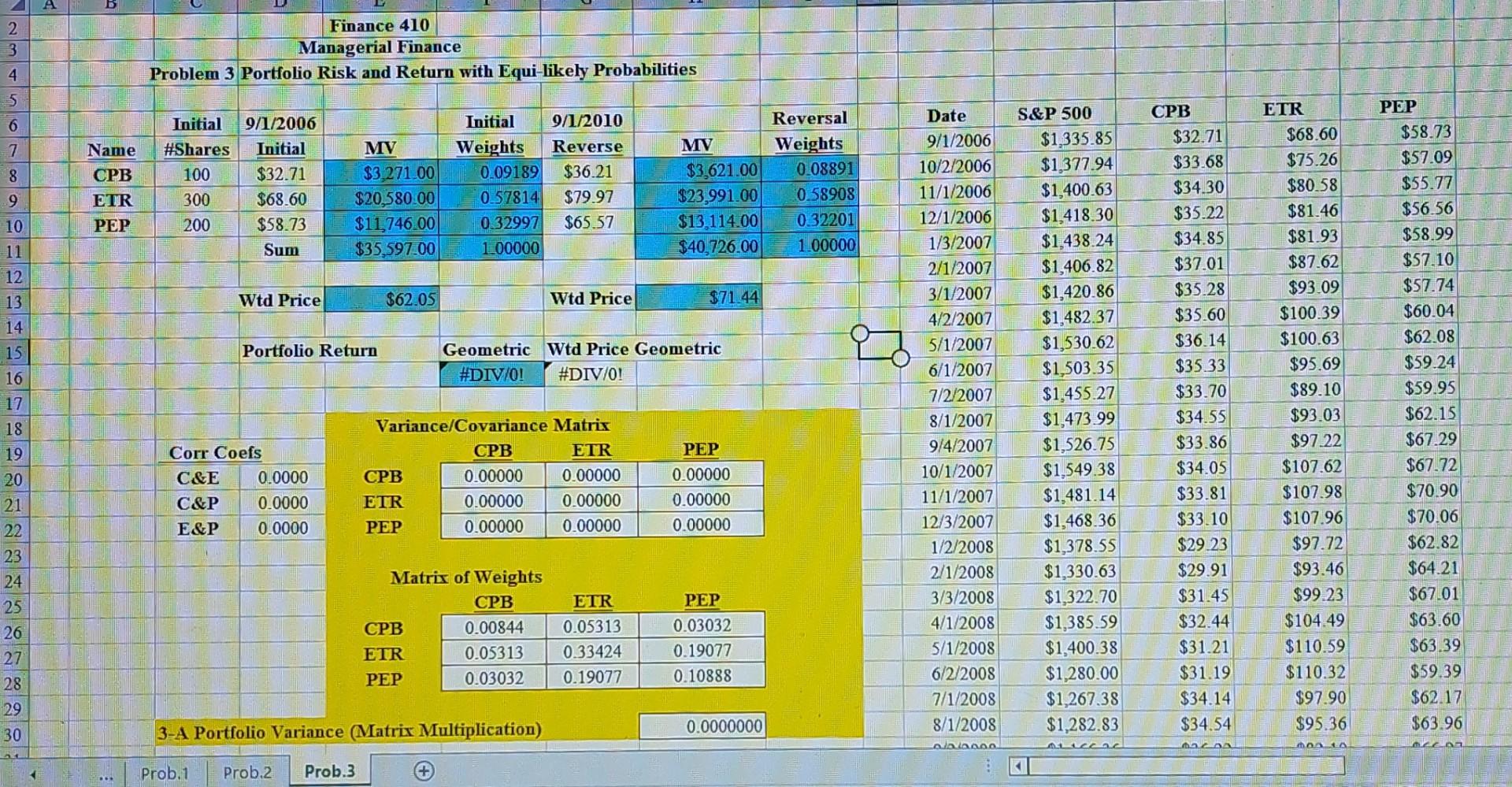

2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Finance 410 Managerial Finance Problem 3 Portfolio Risk and Return with Equi-likely Probabilities 9/1/2006 Initial Name #Shares Initial CPB ETR 100 300 200 $32.71 $68.60 $58.73 Sum PEP Wtd Price Portfolio Return Corr Coefs C&E C&P E&P MV $3.271.00 $20,580.00 $11.746.00 $35.597.00 0.0000 0.0000 0.0000 $62.05 CPB ETR PEP Initial 9/1/2010 Weights Reverse $36.21 0.09189 0.57814 $79.97 0.32997 $65.57 100000 Geometric #DIV/0! Variance/Covariance CPB ETR PEP CPB 0.00000 0.00000 0.00000 Matrix of Weights CPB 0.00844 0.05313 0.03032 3-A Portfolio Variance (Matrix Multiplication) Prob.1 Prob.2 Prob.3 Wtd Price Matrix ETR 0.00000 0.00000 0.00000 Reversal Weights 0.08891 0.58908 $3,621.00 $23,991.00 $13,114.00 0.32201 $40,726.00 1.00000 Wtd Price Geometric #DIV/0! ETR 0.05313 0.33424 0.19077 MV $71.44 PEP 0.00000 0.00000 0.00000 PEP 0.03032 0.19077 0.10888 0.0000000 Date 9/1/2006 10/2/2006 11/1/2006 12/1/2006 1/3/2007 2/1/2007 3/1/2007 4/2/2007 5/1/2007 6/1/2007 7/2/2007 8/1/2007 9/4/2007 10/1/2007 11/1/2007 12/3/2007 1/2/2008 2/1/2008 3/3/2008 4/1/2008 5/1/2008 6/2/2008 7/1/2008 8/1/2008 S&P 500 4 $1,335.85 $1,377.94 $1,400.63 $1,418.30 $1,438.24 $1,406.82 $1,420.86 $1,482.37 $1,530.62 $1,503.35 $1,455.27 $1,473.99 $1,526.75 $1,549.38 $1,481.14 $1,468.36 $1,378.55 $1,330.63 $1,322.70 $1,385.59 $1,400.38 $1,280.00 $1,267.38 $1,282.83 ALICO CPB $32.71 $33.68 $34.30 $35.22 $34.85 $37.01 $35.28 $35.60 $36.14 $35.33 $33.70 $34.55 $33.86 $34.05 $33.81 $33.10 $29.23 $29.91 $31.45 $32.44 $31.21 $31.19 $34.14 $34.54 Bacaa ETR $68.60 $75.26 $80.58 $81.46 $81.93 $87.62 $93.09 $100.39 $100.63 $95.69 $89.10 $93.03 $97.22 $107.62 $107.98 $107.96 $97.72 $93.46 $99.23 $104.49 $110.59 $110.32 $97.90 $95.36 000 10 PEP $58.73 $57.09 $55.77 $56.56 $58.99 $57.10 $57.74 $60.04 $62.08 $59.24 $59.95 $62.15 $67.29 $67.72 $70.90 $70.06 $62.82 $64.21 $67.01 $63.60 $63.39 $59.39 $62.17 $63.96 Accor 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Finance 410 Managerial Finance Problem 3 Portfolio Risk and Return with Equi-likely Probabilities 9/1/2006 Initial Name #Shares Initial CPB ETR 100 300 200 $32.71 $68.60 $58.73 Sum PEP Wtd Price Portfolio Return Corr Coefs C&E C&P E&P MV $3.271.00 $20,580.00 $11.746.00 $35.597.00 0.0000 0.0000 0.0000 $62.05 CPB ETR PEP Initial 9/1/2010 Weights Reverse $36.21 0.09189 0.57814 $79.97 0.32997 $65.57 100000 Geometric #DIV/0! Variance/Covariance CPB ETR PEP CPB 0.00000 0.00000 0.00000 Matrix of Weights CPB 0.00844 0.05313 0.03032 3-A Portfolio Variance (Matrix Multiplication) Prob.1 Prob.2 Prob.3 Wtd Price Matrix ETR 0.00000 0.00000 0.00000 Reversal Weights 0.08891 0.58908 $3,621.00 $23,991.00 $13,114.00 0.32201 $40,726.00 1.00000 Wtd Price Geometric #DIV/0! ETR 0.05313 0.33424 0.19077 MV $71.44 PEP 0.00000 0.00000 0.00000 PEP 0.03032 0.19077 0.10888 0.0000000 Date 9/1/2006 10/2/2006 11/1/2006 12/1/2006 1/3/2007 2/1/2007 3/1/2007 4/2/2007 5/1/2007 6/1/2007 7/2/2007 8/1/2007 9/4/2007 10/1/2007 11/1/2007 12/3/2007 1/2/2008 2/1/2008 3/3/2008 4/1/2008 5/1/2008 6/2/2008 7/1/2008 8/1/2008 S&P 500 4 $1,335.85 $1,377.94 $1,400.63 $1,418.30 $1,438.24 $1,406.82 $1,420.86 $1,482.37 $1,530.62 $1,503.35 $1,455.27 $1,473.99 $1,526.75 $1,549.38 $1,481.14 $1,468.36 $1,378.55 $1,330.63 $1,322.70 $1,385.59 $1,400.38 $1,280.00 $1,267.38 $1,282.83 ALICO CPB $32.71 $33.68 $34.30 $35.22 $34.85 $37.01 $35.28 $35.60 $36.14 $35.33 $33.70 $34.55 $33.86 $34.05 $33.81 $33.10 $29.23 $29.91 $31.45 $32.44 $31.21 $31.19 $34.14 $34.54 Bacaa ETR $68.60 $75.26 $80.58 $81.46 $81.93 $87.62 $93.09 $100.39 $100.63 $95.69 $89.10 $93.03 $97.22 $107.62 $107.98 $107.96 $97.72 $93.46 $99.23 $104.49 $110.59 $110.32 $97.90 $95.36 000 10 PEP $58.73 $57.09 $55.77 $56.56 $58.99 $57.10 $57.74 $60.04 $62.08 $59.24 $59.95 $62.15 $67.29 $67.72 $70.90 $70.06 $62.82 $64.21 $67.01 $63.60 $63.39 $59.39 $62.17 $63.96 Accor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started