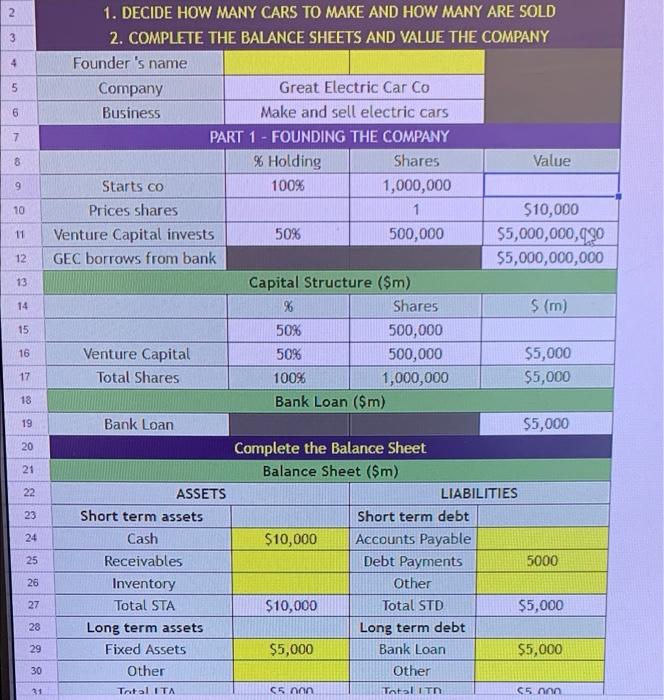

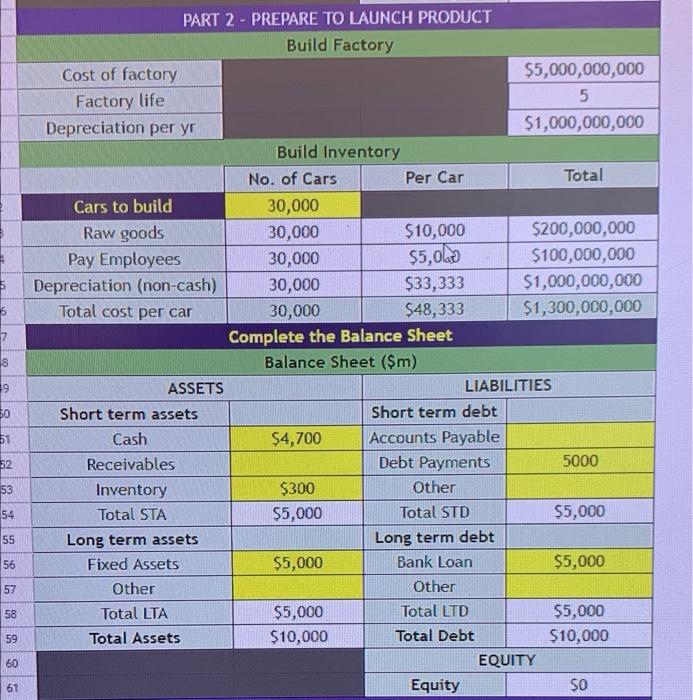

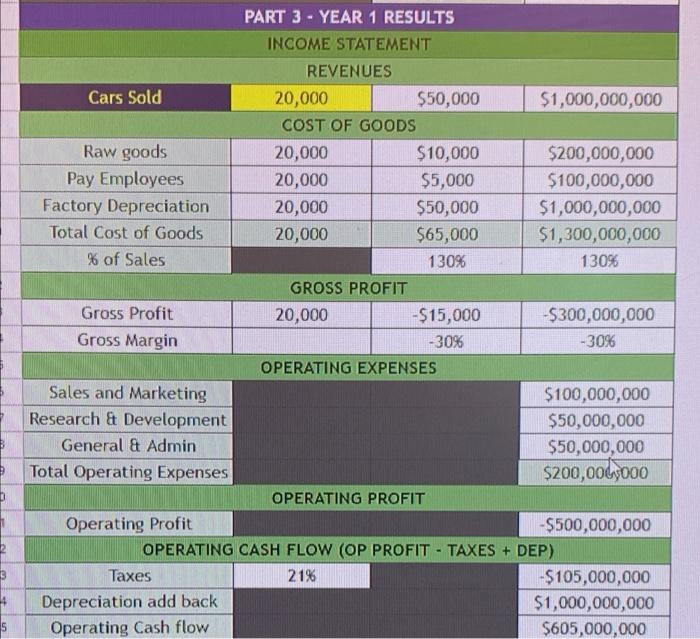

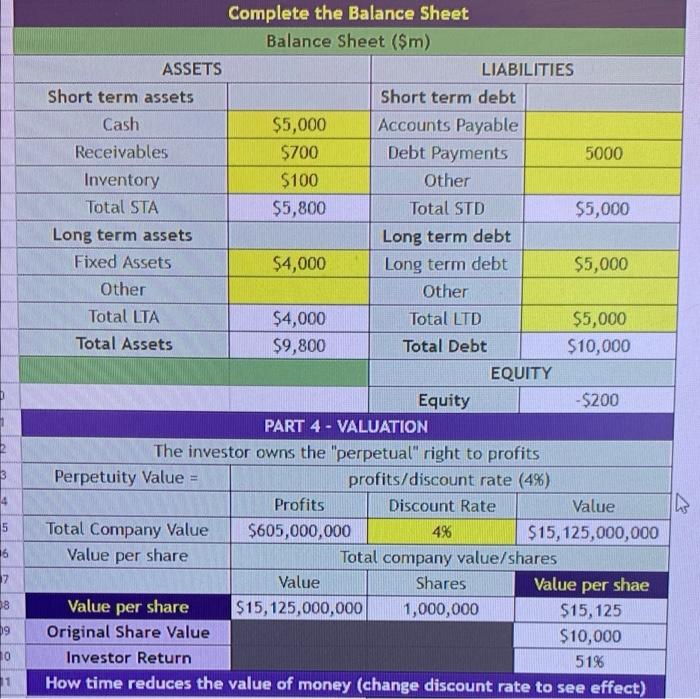

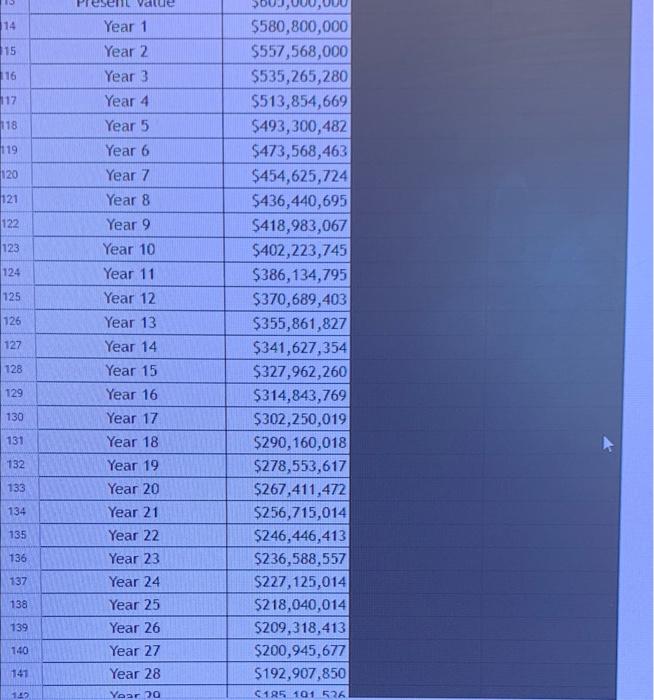

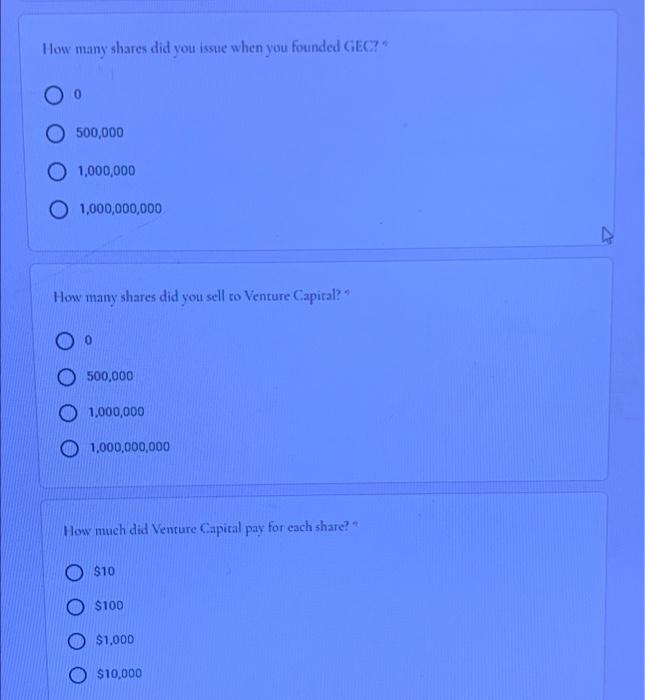

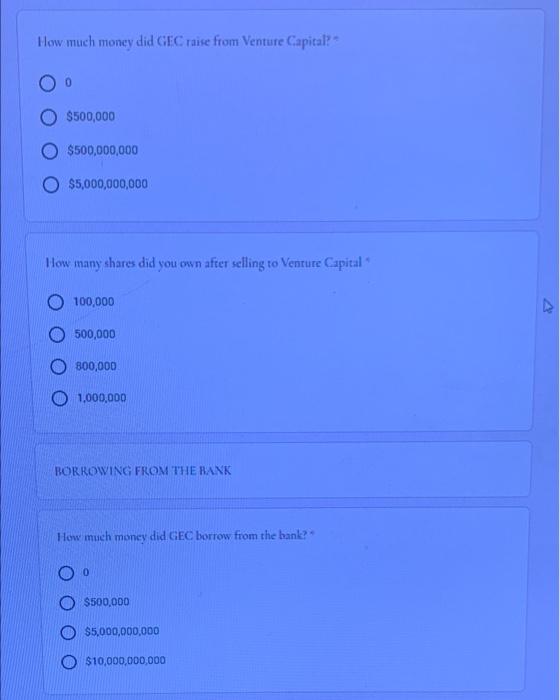

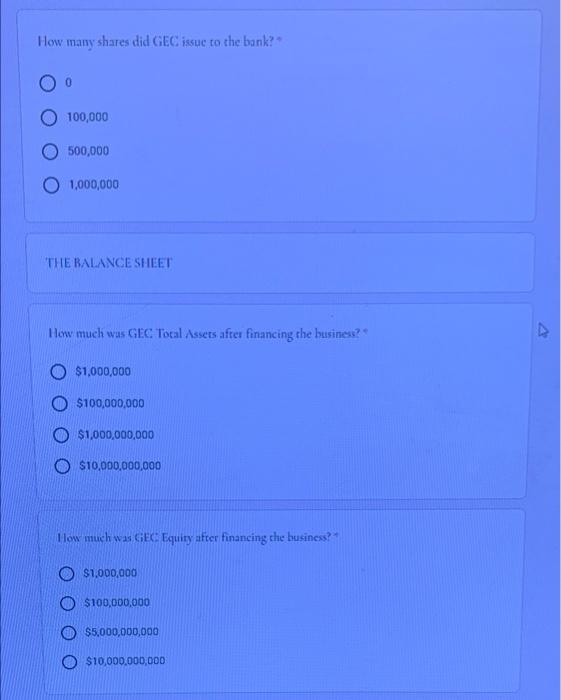

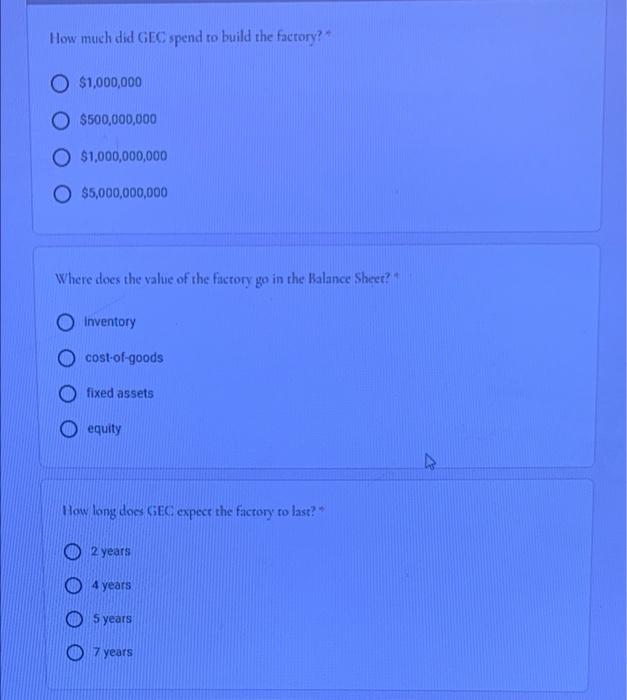

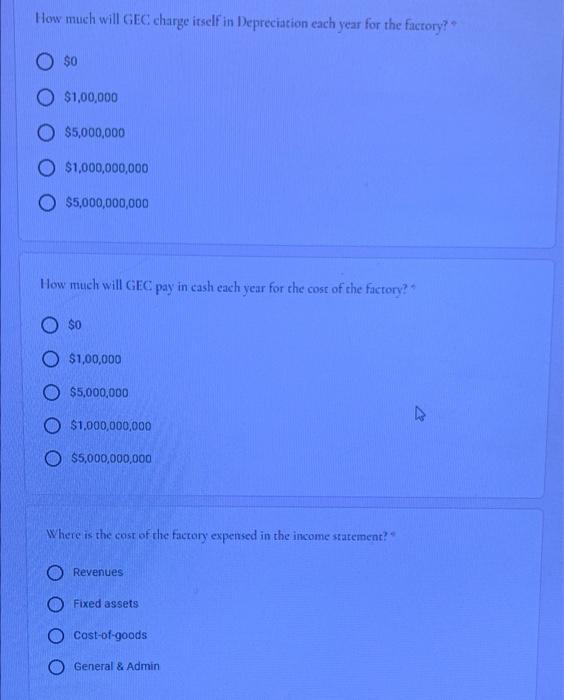

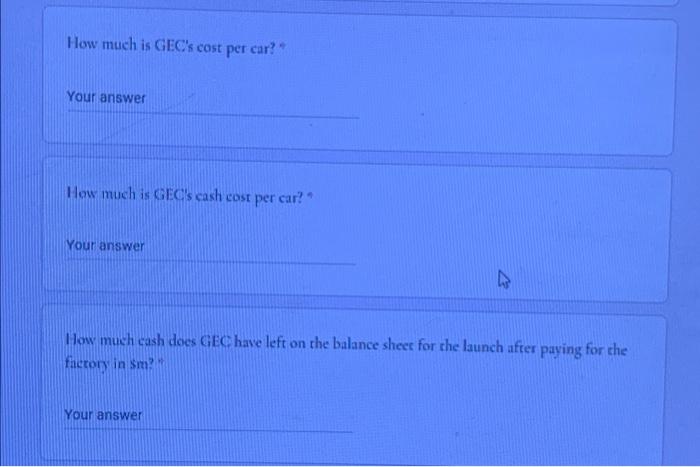

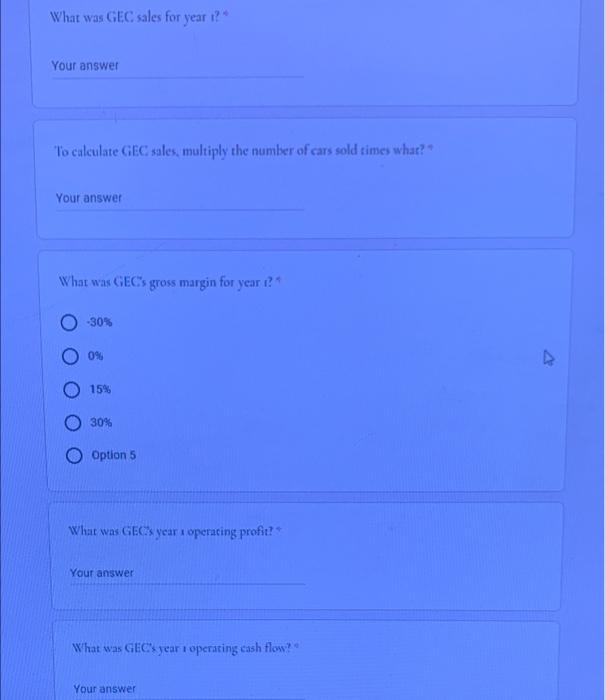

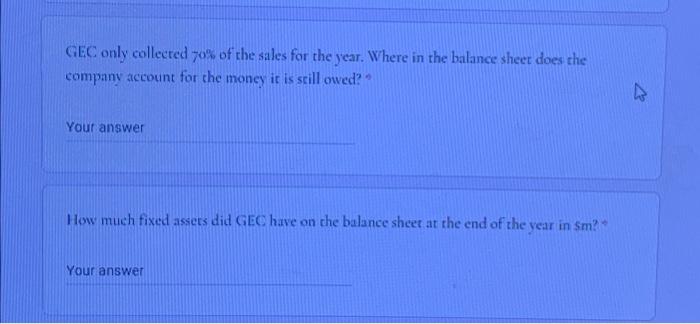

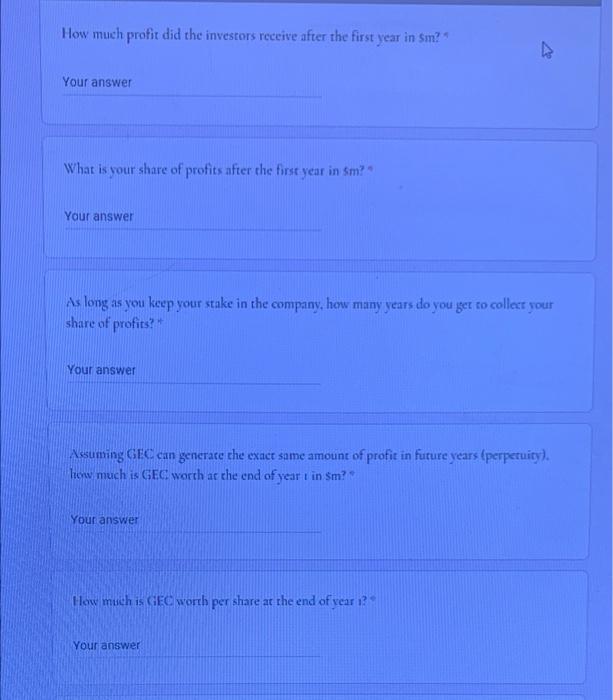

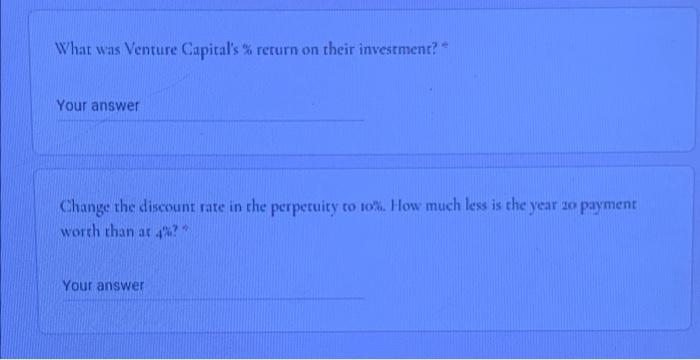

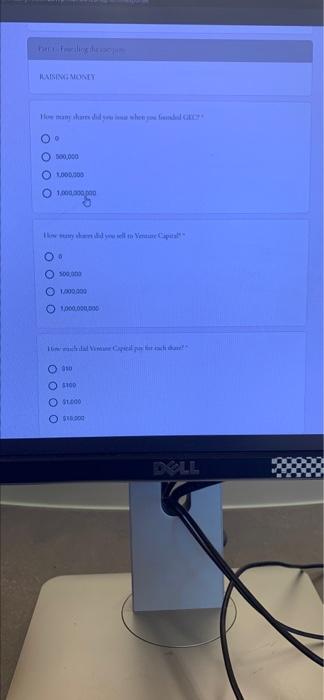

2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 1. DECIDE HOW MANY CARS TO MAKE AND HOW MANY ARE SOLD 2. COMPLETE THE BALANCE SHEETS AND VALUE THE COMPANY Founder's name Company Great Electric Car Co Business Make and sell electric cars PART 1 - FOUNDING THE COMPANY % Holding Shares Value Starts co 100% 1,000,000 Prices shares 1 $10,000 Venture Capital invests 50% 500,000 $5,000,000,990 GEC borrows from bank $5,000,000,000 Capital Structure ($m) % Shares $ (m) 50% 500,000 Venture Capital 50% 500,000 $5,000 Total Shares 100% 1,000,000 $5,000 Bank Loan (m) Bank Loan $5,000 Complete the Balance Sheet Balance Sheet (m) ASSETS LIABILITIES Short term assets Short term debt Cash $10,000 Accounts Payable Receivables Debt Payments 5000 Inventory Other Total STA $10,000 Total STD $5,000 Long term assets Long term debt Fixed Assets $5,000 Bank Loan $5,000 Other Other Trital ITA (5.00 Tatalin 55 000 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 5 7 18 PART 2 - PREPARE TO LAUNCH PRODUCT Build Factory Cost of factory $5,000,000,000 Factory life 5 Depreciation per yr $1,000,000,000 Build Inventory No. of Cars Per Car Total Cars to build 30,000 Raw goods 30,000 $10,000 $200,000,000 Pay Employees 30,000 $5,000 $100,000,000 Depreciation (non-cash) 30,000 $33,333 $1,000,000,000 Total cost per car 30,000 $48,333 $1,300,000,000 Complete the Balance Sheet Balance Sheet ($m) ASSETS LIABILITIES Short term assets Short term debt Cash $4,700 Accounts Payable Receivables Debt Payments 5000 Inventory $300 Other Total STA $5,000 Total STD $5,000 Long term assets Long term debt Fixed Assets $5,000 Bank Loan $5,000 Other Other Total LTA $5,000 Total LTD $5,000 Total Assets $10,000 Total Debt $10,000 EQUITY Equity $0 19 50 51 52 53 54 55 56 57 58 59 60 61 PART 3 - YEAR 1 RESULTS INCOME STATEMENT REVENUES Cars Sold 20,000 $50,000 $1,000,000,000 COST OF GOODS Raw goods 20,000 $10,000 $200,000,000 Pay Employees 20,000 $5,000 $100,000,000 Factory Depreciation 20,000 $50,000 $1,000,000,000 Total Cost of Goods 20,000 $65,000 $1,300,000,000 % of Sales 130% 130% GROSS PROFIT Gross Profit 20,000 -$15,000 -$300,000,000 Gross Margin -30% -30% OPERATING EXPENSES Sales and Marketing $100,000,000 Research & Development $50,000,000 General & Admin $50,000,000 Total Operating Expenses $200,0045000 OPERATING PROFIT Operating Profit -$500,000,000 OPERATING CASH FLOW (OP PROFIT - TAXES + DEP) Taxes 21% -$105,000,000 Depreciation add back $1,000,000,000 Operating Cash flow $605,000,000 3 b 3 5 Complete the Balance Sheet Balance Sheet ($m) ASSETS LIABILITIES Short term assets Short term debt Cash $5,000 Accounts Payable Receivables $700 Debt Payments 5000 Inventory $100 Other Total STA $5,800 Total STD $5,000 Long term assets Long term debt Fixed Assets $4,000 Long term debt $5,000 Other Other Total LTA $4,000 Total LTD $5,000 Total Assets $9,800 Total Debt $10,000 EQUITY Equity -$200 PART 4 - VALUATION The investor owns the "perpetual" right to profits Perpetuity Value = profits/discount rate (4%) Profits Discount Rate Value Total Company Value $605,000,000 4% $15, 125,000,000 Value per share Total company value/shares Value Shares Value per shae Value per share $15,125,000,000 1,000,000 $15,125 Original Share Value $10,000 Investor Return 51% How time reduces the value of money (change discount rate to see effect) 3 4 TA 5 6 7 08 09 10 14 15 116 117 118 119 120 121 122 123 124 125 126 127 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 Year 16 Year 17 Year 18 Year 19 Year 20 Year 21 Year 22 Year 23 Year 24 Year 25 Year 26 Year 27 Year 28 Year 20 $580,800,000 $557,568,000 $535,265,280 $513,854,669 $493,300,482 $473,568,463 $454,625,724 $436,440,695 $418,983,067 $402,223,745 $386,134,795 $370,689,403 $355,861,827 $341,627,354 $327,962,260 $314,843,769 $302,250,019 $290, 160,018 $278,553,617 $267,411,472 $256,715,014 $246,446,413 $236,588,557 $227,125,014 $218,040,014 $209,318,413 $200,945,677 $192,907,850 C185. 101 526 128 129 130 131 132 133 134 135 136 137 138 139 140 141 14 Great Electric Car Co. Assume GEC builds 30,000 cars before launch, sells 20,000 cars in year and still has 30,000 cars in inventory at the end of year 1 How many shares did you issue when you founded GEC? 0 0 O 500,000 O 1,000,000 O 1,000,000,000 v How many shares did you sell ro Venture Capital? 500,000 1,000,000 1,000,000,000 How much did Venture Capital pay for each share? $10 $100 $1,000 $10,000 How much money did GEC raise from Venture Capital? $500,000 $500,000,000 $5,000,000,000 How many shares did you own after selling to Venture Capital 100,000 V 500,000 800,000 1,000,000 BORROWING FROM THE BANK How much money did GEC borrow from the bank? 0 $500,000 $5,000,000,000 $10,000,000,000 How many shares did GEC issue to the bank? Oo 100,000 500,000 1,000,000 THE BALANCE SHEET How much was GEC Total Assets after financing the business? O $1,000,000 $100,000,000 $1,000,000,000 O $10,000,000,000 How much was GEC Equity after financing the business? $1,000,000 $100,000,000 $5,000,000,000 $10,000,000,000 How much did GEC spend to build the factory? O $1,000,000 $500,000,000 O $1,000,000,000 O $5,000,000,000 Where does the value of the factory go in the Balance Sheet? Inventory cost-of-goods fixed assets equity How long does GEC expect the factory to last? 2 years 4 years 5 years 7 years How much will GEC charge itself in Depreciation each year for the factory? O $0 $1,00,000 $5,000,000 $1,000,000,000 $5,000,000,000 How much will GEC pay in cash each year for the cost of the factory? O $0 $1,00,000 $5,000,000 O $1,000,000,000 O $5,000,000,000 Where is the cost of the factory expensed in the income statement? O Revenues O Fixed assets O cost-of-goods General & Admin How much is GEC's cost per car? Your answer How much is GEC's cash cost per car? Your answer How much cash does GEC have left on the balance sheet for the launch after paying for the factory in sm Your answer What was GEC sales for year i?" Your answer To calculate GEC sales, multiply the number of cars sold times what? Your answer What was GEC's gross margin for year? -30% 09 15% 30% Option 5 What was GECs year operating profit! Your answer What was GEC's year I operating cash flow? Your answer GEC only collected 70% of the sales for the year. Where in the balance sheer does the company account for the money it is still owed? Your answer How much fixed assets did GEC have on the balance sheet at the end of the year in Sm? Your answer How much profit did the investors receive after the first year in Sm? Your answer What is your share of profits after the first year in Sm? Your answer As long as you keep your stake in the company, how many years do you get to collect your share of profits? Your answer Assuming GEC can generate the exact same amount of profit in future years (perpetuity). low much is GEC worth at the end of year in $m? Your answer How much is GEC worth per share at the end of year i? Your answer What was Venture Capital's return on their investment? Your answer Change the discount rate in the perpetuity to 10%. How much less is the year 20 payment worth than at %? Your answer PUISINE MONEY Homewhere O LOS 1.000.00 0 0 300,000 1/800.000 O 1000.000.000 no 1100 00719 0 bo e e. DOLL