Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. 3. 4. 5. Discuss the agency concerns surrounding the dividend payment and the share repurchase. Explain in detail how useful accounting figures are

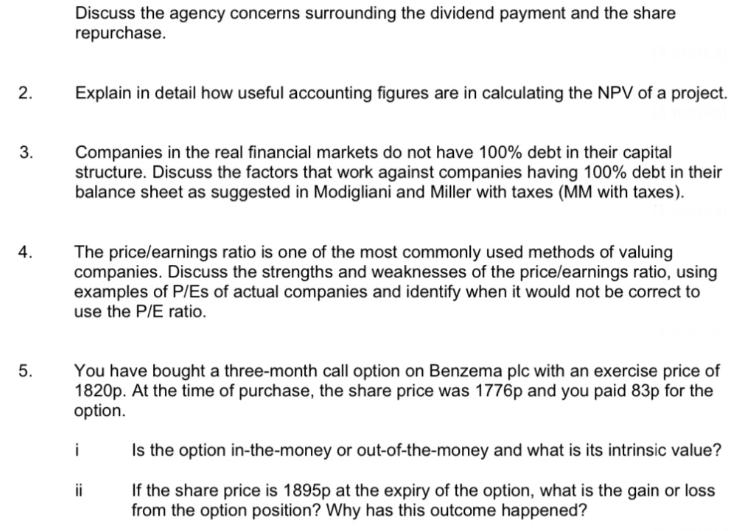

2. 3. 4. 5. Discuss the agency concerns surrounding the dividend payment and the share repurchase. Explain in detail how useful accounting figures are in calculating the NPV of a project. Companies in the real financial markets do not have 100% debt in their capital structure. Discuss the factors that work against companies having 100% debt in their balance sheet as suggested in Modigliani and Miller with taxes (MM with taxes). The price/earnings ratio is one of the most commonly used methods of valuing companies. Discuss the strengths and weaknesses of the price/earnings ratio, using examples of P/Es of actual companies and identify when it would not be correct to use the P/E ratio. You have bought a three-month call option on Benzema plc with an exercise price of 1820p. At the time of purchase, the share price was 1776p and you paid 83p for the option. i Is the option in-the-money or out-of-the-money and what is its intrinsic value? If the share price is 1895p at the expiry of the option, what is the gain or loss from the option position? Why has this outcome happened?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started