Answered step by step

Verified Expert Solution

Question

1 Approved Answer

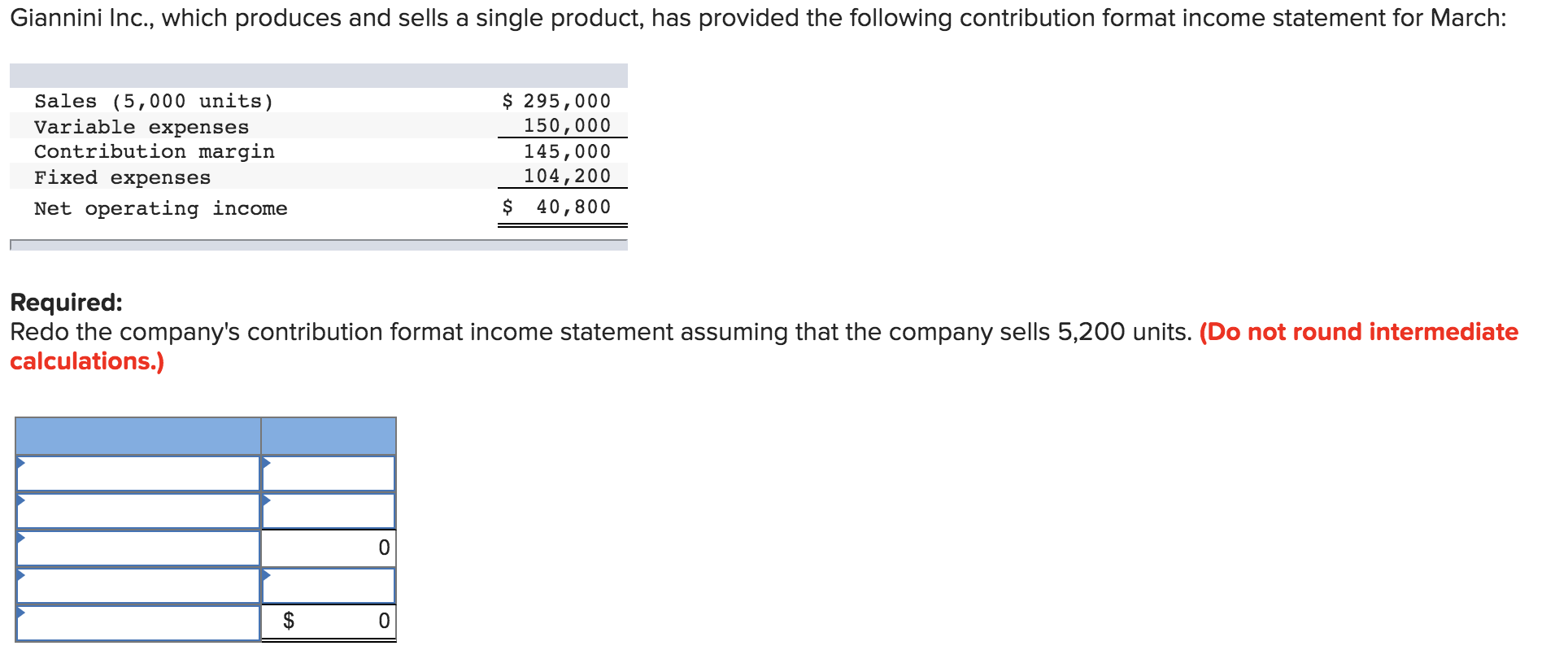

Giannini Inc., which produces and sells a single product, has provided the following contribution format income statement for March: Sales (5,000 units) Variable expenses

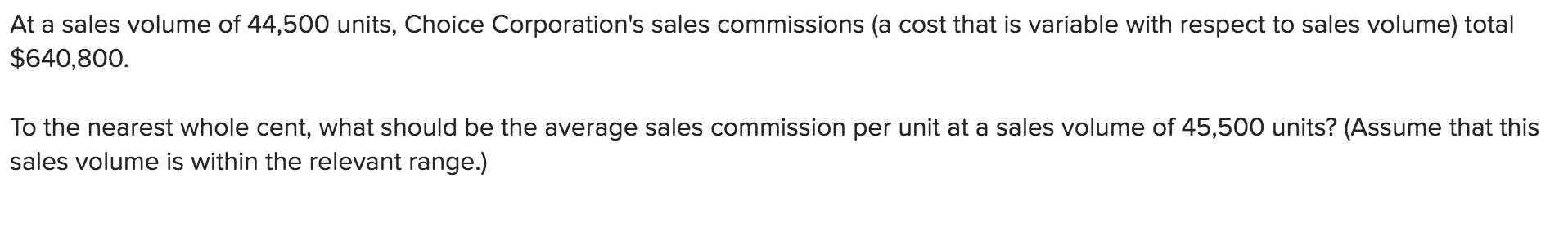

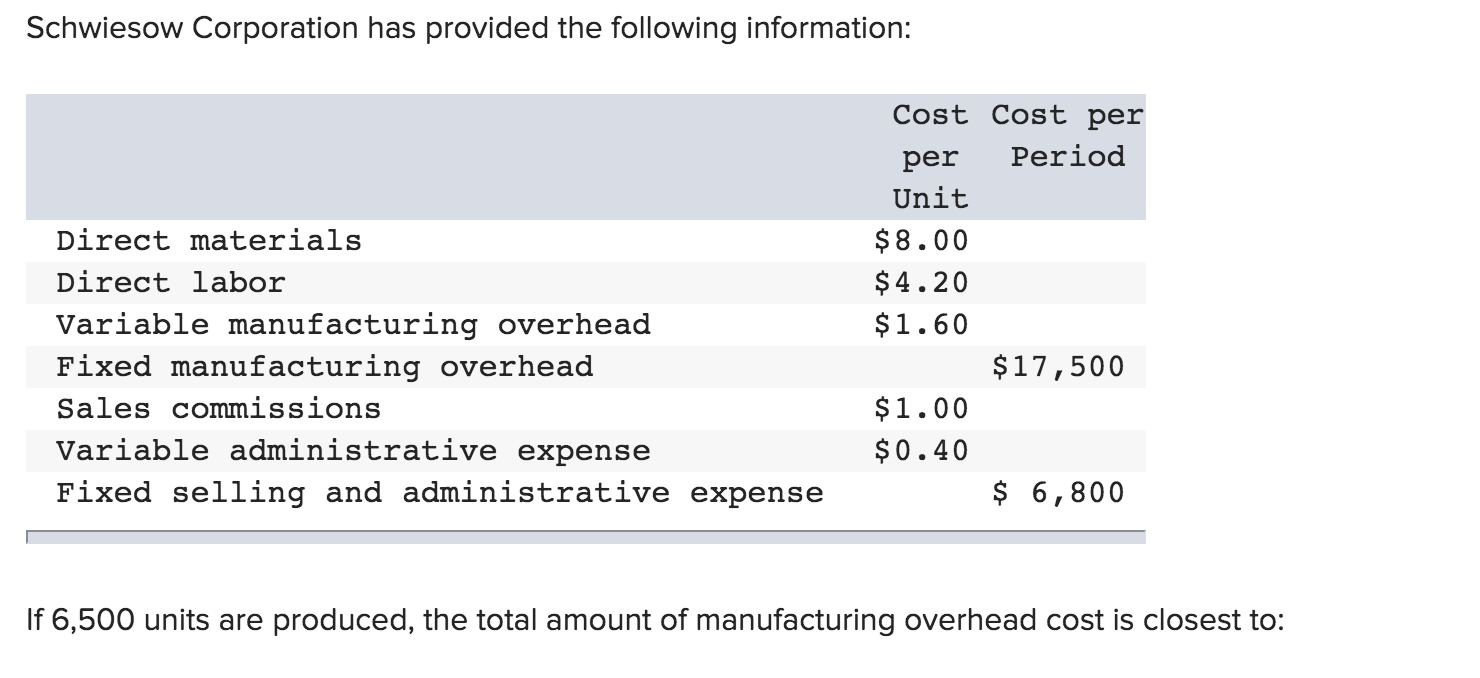

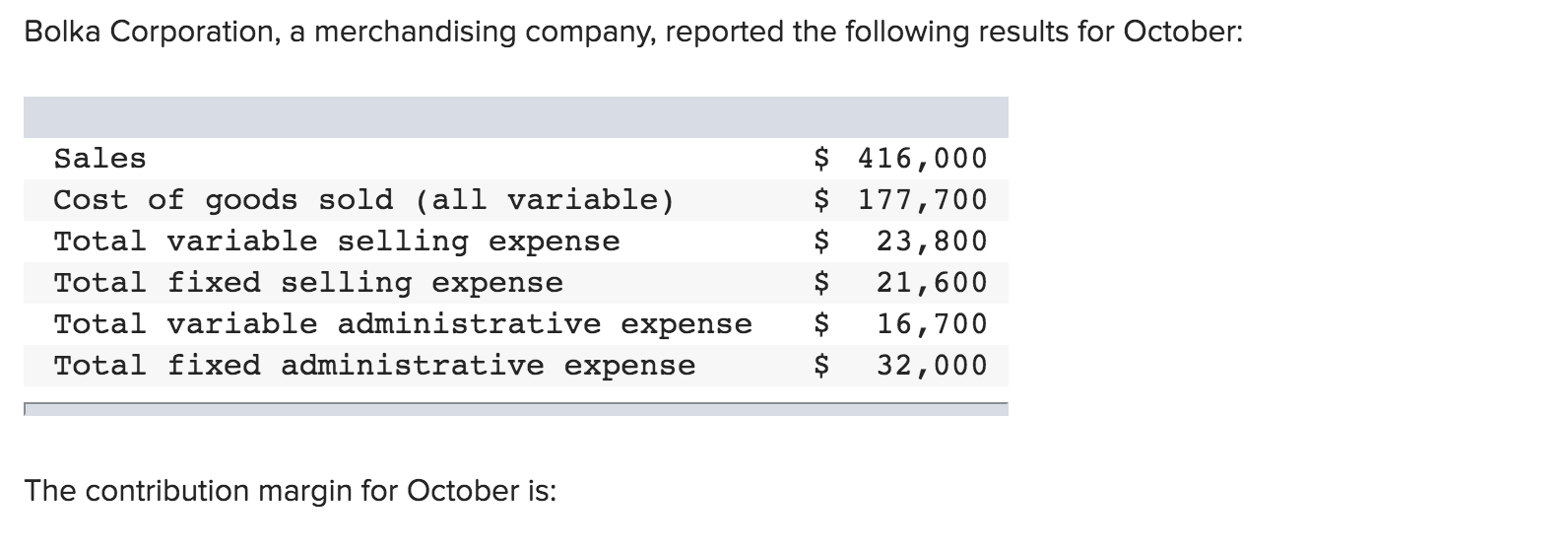

Giannini Inc., which produces and sells a single product, has provided the following contribution format income statement for March: Sales (5,000 units) Variable expenses Contribution margin $ 295,000 150,000 145,000 Fixed expenses 104,200 Net operating income $ 40,800 Required: Redo the company's contribution format income statement assuming that the company sells 5,200 units. (Do not round intermediate calculations.) $ At a sales volume of 44,500 units, Choice Corporation's sales commissions (a cost that is variable with respect to sales volume) total $640,800. To the nearest whole cent, what should be the average sales commission per unit at a sales volume of 45,500 units? (Assume that this sales volume is within the relevant range.) Schwiesow Corporation has provided the following information: Cost Cost per per Period Unit Direct materials $8.00 Direct labor $ 4.20 Variable manufacturing overhead Fixed manufacturing overhead $1.60 $17,500 Sales commissions $1.00 Variable administrative expense $0.40 Fixed selling and administrative expense $ 6,800 If 6,500 units are produced, the total amount of manufacturing overhead cost is closest to: Bolka Corporation, a merchandising company, reported the following results for October: $ 416,000 $ 177,700 Sales Cost of goods sold (all variable) Total variable selling expense Total fixed selling expense $ 23,800 $ 21,600 Total variable administrative expense Total fixed administrative expense $ 16,700 $ 32,000 The contribution margin for October is:

Step by Step Solution

★★★★★

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Contribution format income statement Sales520059 306800 Less Variable costs520030 15...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started