Answered step by step

Verified Expert Solution

Question

1 Approved Answer

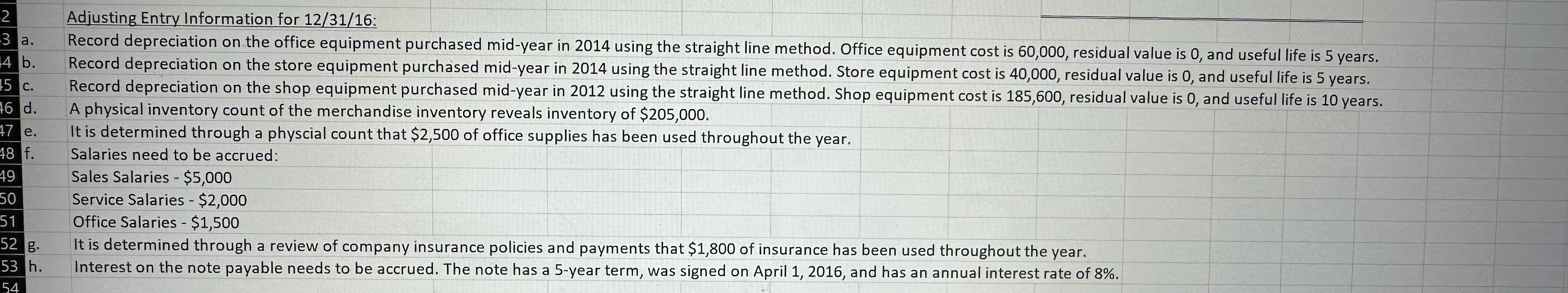

-2 -3 a. 14 b. 45 c. 16 d. 47 e. 48 f. 49 50 51 52 g. 53 h. 54 Adjusting Entry Information

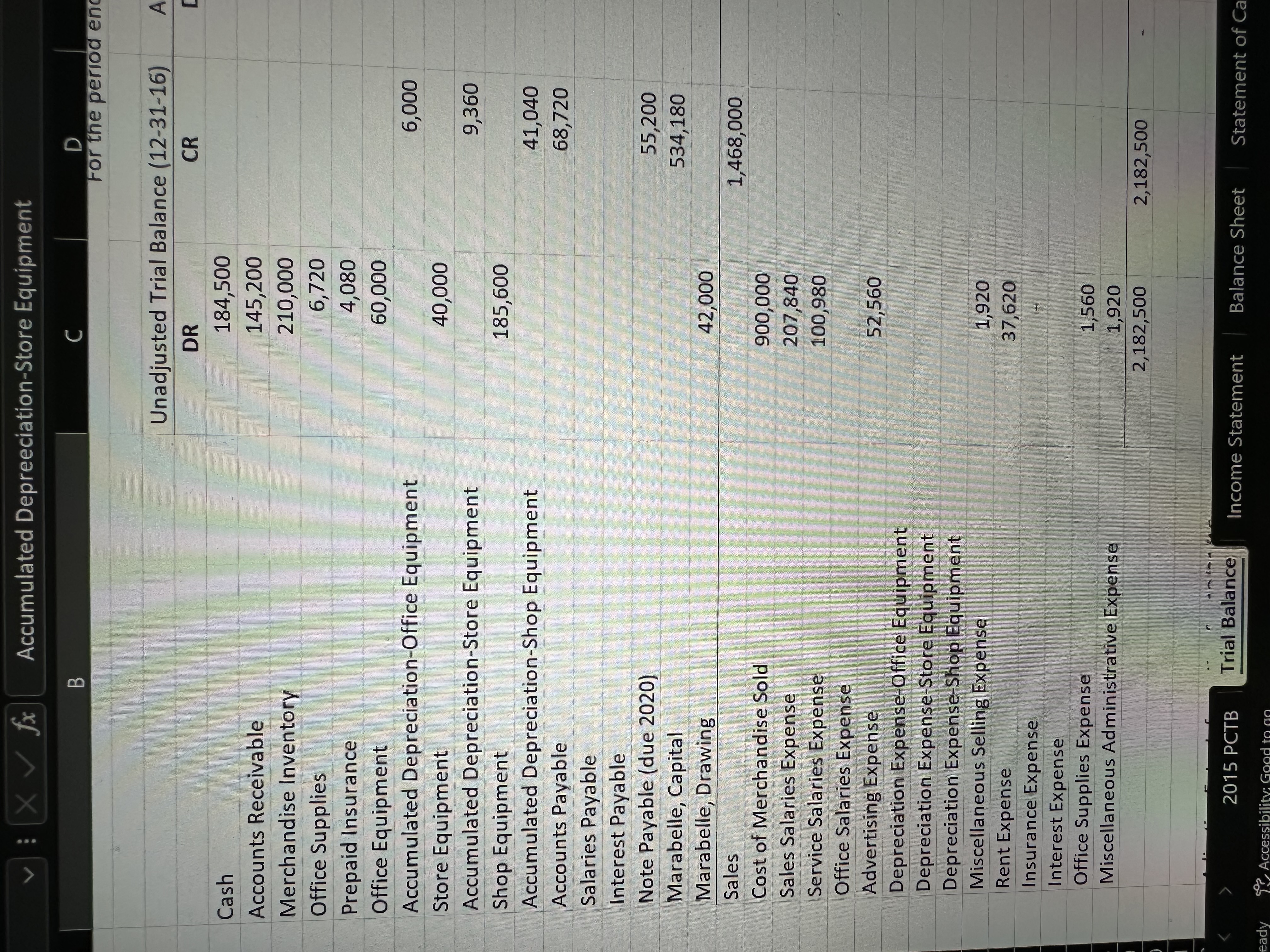

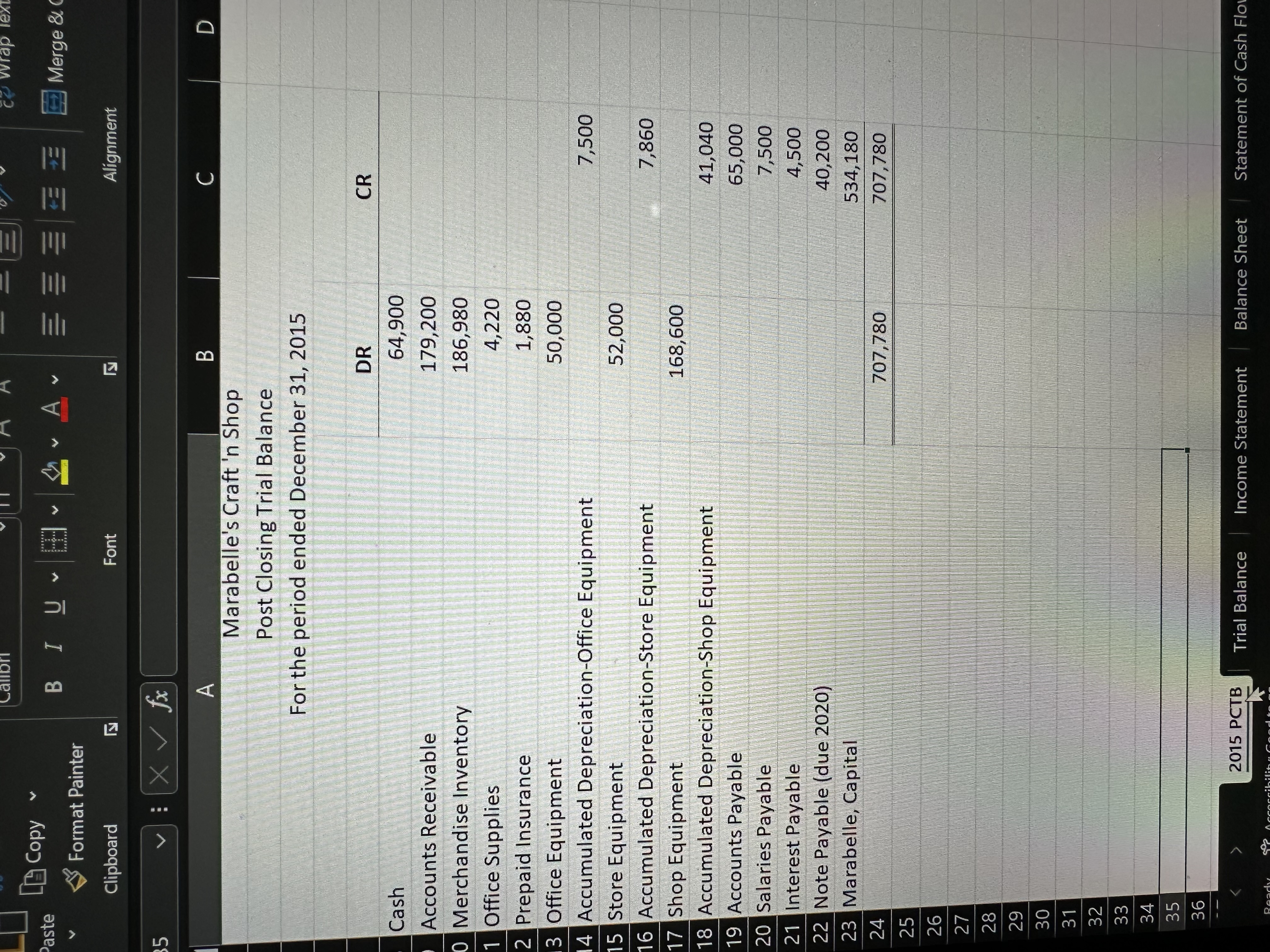

-2 -3 a. 14 b. 45 c. 16 d. 47 e. 48 f. 49 50 51 52 g. 53 h. 54 Adjusting Entry Information for 12/31/16: Record depreciation on the office equipment purchased mid-year in 2014 using the straight line method. Office equipment cost is 60,000, residual value is 0, and useful life is 5 years. Record depreciation on the store equipment purchased mid-year in 2014 using the straight line method. Store equipment cost is 40,000, residual value is 0, and useful life is 5 years. Record depreciation on the shop equipment purchased mid-year in 2012 using the straight line method. Shop equipment cost is 185,600, residual value is 0, and useful life is 10 years. A physical inventory count of the merchandise inventory reveals inventory of $205,000. It is determined through a physcial count that $2,500 of office supplies has been used throughout the year. Salaries need to be accrued: Sales Salaries - $5,000 Service Salaries - $2,000 Office Salaries - $1,500 It is determined through a review of company insurance policies and payments that $1,800 of insurance has been used throughout the year. Interest on the note payable needs to be accrued. The note has a 5-year term, was signed on April 1, 2016, and has an annual interest rate of 8%. X fx Cash Accounts Receivable Merchandise Inventory eady B Office Supplies Prepaid Insurance Office Equipment Accumulated Depreciation-Office Equipment Store Equipment Accumulated Depreciation-Store Equipment Shop Equipment Accumulated Depreciation-Shop Equipment Accounts Payable Salaries Payable Interest Payable Note Payable (due 2020) Marabelle, Capital Marabelle, Drawing Sales Cost of Merchandise Sold Sales Salaries Expense Service Salaries Expense Office Salaries Expense Accumulated Depreeciation-Store Equipment 2015 PCTB Accessibility: Good to an Advertising Expense Depreciation Expense-Office Equipment Depreciation Expense-Store Equipment Depreciation Expense-Shop Equipment Miscellaneous Selling Expense Rent Expense Insurance Expense Interest Expense Office Supplies Expense Miscellaneous Administrative Expense Unadjusted Trial Balance (12-31-16) DR CR 184,500 145,200 210,000 6,720 4,080 60,000 40,000 185,600 42,000 900,000 207,840 100,980 52,560 1,920 37,620 1,560 1,920 2,182,500 D For the period enc -! Trial Balance Income Statement Balance Sheet 6,000 9,360 41,040 68,720 55,200 534,180 1,468,000 2,182,500 A C Statement of Ca Paste 35 25 26 27 28 29 30 31 32 [Copy 33 34 35 36 Format Painter Clipboard Ready 12 Calibri Cash Accounts Receivable 0 Merchandise Inventory 1 Office Supplies 2 Prepaid Insurance 3 Office Equipment 14 Accumulated Depreciation-Office Equipment 15 Store Equipment 16 Accumulated Depreciation-Store Equipment 17 Shop Equipment 18 Accumulated Depreciation-Shop Equipment 19 Accounts Payable 20 Salaries Payable 21 Interest Payable 22 Note Payable (due 2020) 23 Marabelle, Capital 24 BIU H X fx A Accessibilit Font B Marabelle's Craft 'n Shop Post Closing Trial Balance For the period ended December 31, 2015 DR 64,900 179,200 186,980 4,220 1,880 50,000 52,000 168,600 707,780 Alignment C CR 7,500 7,860 ? 41,040 65,000 7,500 4,500 40,200 534,180 707,780 wrap lext Merge & C D 2015 PCTB Trial Balance Income Statement Balance Sheet Statement of Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Depreciation Office Equipment Cost 60000 Residual Value 0 Useful Life 5 years Depreciation Expense Cost Residual Value Useful Life Depreciation Expense 60000 0 5 12000 Adjusting Entry Debit Deprecia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started