Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. (30 points) For this question we will be constructing an optimal complete portfolio from equity and bond mutual funds. Assume that you have a

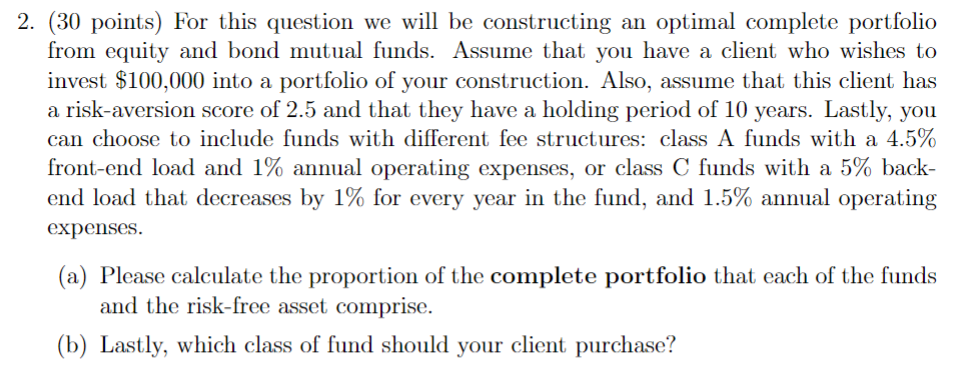

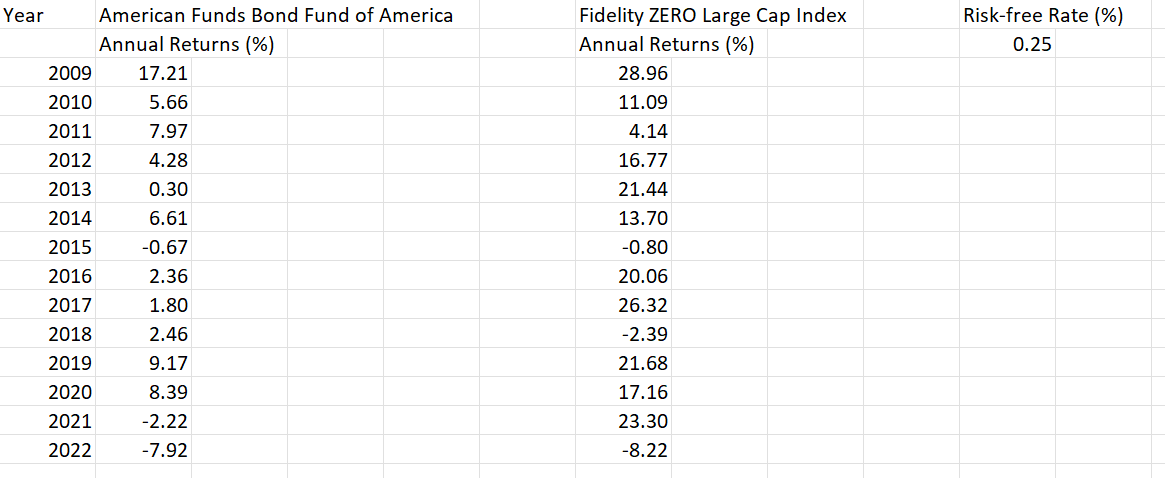

2. (30 points) For this question we will be constructing an optimal complete portfolio from equity and bond mutual funds. Assume that you have a client who wishes to invest $100,000 into a portfolio of your construction. Also, assume that this client has a risk-aversion score of 2.5 and that they have a holding period of 10 years. Lastly, you can choose to include funds with different fee structures: class A funds with a 4.5% front-end load and 1% annual operating expenses, or class C funds with a 5% backend load that decreases by 1% for every year in the fund, and 1.5% annual operating expenses. (a) Please calculate the proportion of the complete portfolio that each of the funds and the risk-free asset comprise. (b) Lastly, which class of fund should your client purchase? \begin{tabular}{|c|c|c|c|c|} \hline & American Funds Bon & Fidelity ZERO Large & Index & Risk-free Rate (\%) \\ \hline & Annual Returns (\%) & Annual Returns (\%) & & 0.25 \\ \hline 2009 & 17.21 & 28.96 & & \\ \hline 2010 & 5.66 & 11.09 & & \\ \hline 2011 & 7.97 & 4.14 & & \\ \hline 2012 & 4.28 & 16.77 & & \\ \hline 2013 & 0.30 & 21.44 & & \\ \hline 2014 & 6.61 & 13.70 & & \\ \hline 2015 & -0.67 & -0.80 & & \\ \hline 2016 & 2.36 & 20.06 & & \\ \hline 2017 & 1.80 & 26.32 & & \\ \hline 2018 & 2.46 & -2.39 & & \\ \hline 2019 & 9.17 & 21.68 & & \\ \hline 2020 & 8.39 & 17.16 & & \\ \hline 2021 & -2.22 & 23.30 & & \\ \hline 2022 & -7.92 & -8.22 & & \\ \hline \end{tabular}

2. (30 points) For this question we will be constructing an optimal complete portfolio from equity and bond mutual funds. Assume that you have a client who wishes to invest $100,000 into a portfolio of your construction. Also, assume that this client has a risk-aversion score of 2.5 and that they have a holding period of 10 years. Lastly, you can choose to include funds with different fee structures: class A funds with a 4.5% front-end load and 1% annual operating expenses, or class C funds with a 5% backend load that decreases by 1% for every year in the fund, and 1.5% annual operating expenses. (a) Please calculate the proportion of the complete portfolio that each of the funds and the risk-free asset comprise. (b) Lastly, which class of fund should your client purchase? \begin{tabular}{|c|c|c|c|c|} \hline & American Funds Bon & Fidelity ZERO Large & Index & Risk-free Rate (\%) \\ \hline & Annual Returns (\%) & Annual Returns (\%) & & 0.25 \\ \hline 2009 & 17.21 & 28.96 & & \\ \hline 2010 & 5.66 & 11.09 & & \\ \hline 2011 & 7.97 & 4.14 & & \\ \hline 2012 & 4.28 & 16.77 & & \\ \hline 2013 & 0.30 & 21.44 & & \\ \hline 2014 & 6.61 & 13.70 & & \\ \hline 2015 & -0.67 & -0.80 & & \\ \hline 2016 & 2.36 & 20.06 & & \\ \hline 2017 & 1.80 & 26.32 & & \\ \hline 2018 & 2.46 & -2.39 & & \\ \hline 2019 & 9.17 & 21.68 & & \\ \hline 2020 & 8.39 & 17.16 & & \\ \hline 2021 & -2.22 & 23.30 & & \\ \hline 2022 & -7.92 & -8.22 & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started