Question

2. (30 pts) Celgene Bioscienceshjjh has a contract manufacturing project currently underway. They project is scheduled to last 5 more years. They are considering replacing

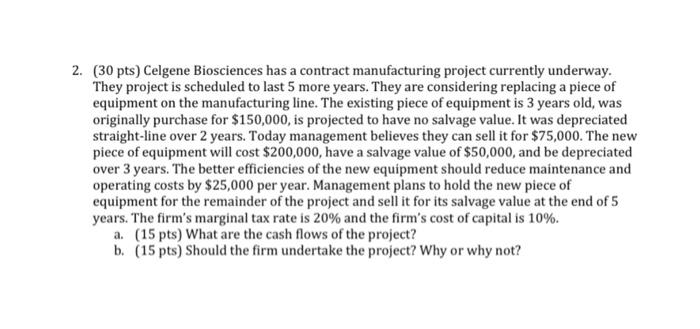

2. (30 pts) Celgene Bioscienceshjjh has a contract manufacturing project currently underway.They project is scheduled to last 5 more years. They are considering replacing a piece ofequipment on the manufacturing line. The existing piece of equipment is 3 years old, wasoriginally purchase for $150,000, is projected to have no salvage value. It was depreciatedstraight-line over 2 years. Today management believes they can sell it for $75,000. The newpiece of equipment will cost $200,000, have a salvage value of $50,000, and be depreciatedover 3 years. The better efficiencies of the new equipment should reduce maintenance andoperating costs by $25,000 per year. Management plans to hold the new piece ofequipment for the remainder of the project and sell it for its salvage value at the end of 5years. The firms marginal tax rate is 20% and the firms cost of capital is 10%.a. (15 pts) What are the cash flows of the project?b. (15 pts) Should the firm undertake the project? Why or why notnnj

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started