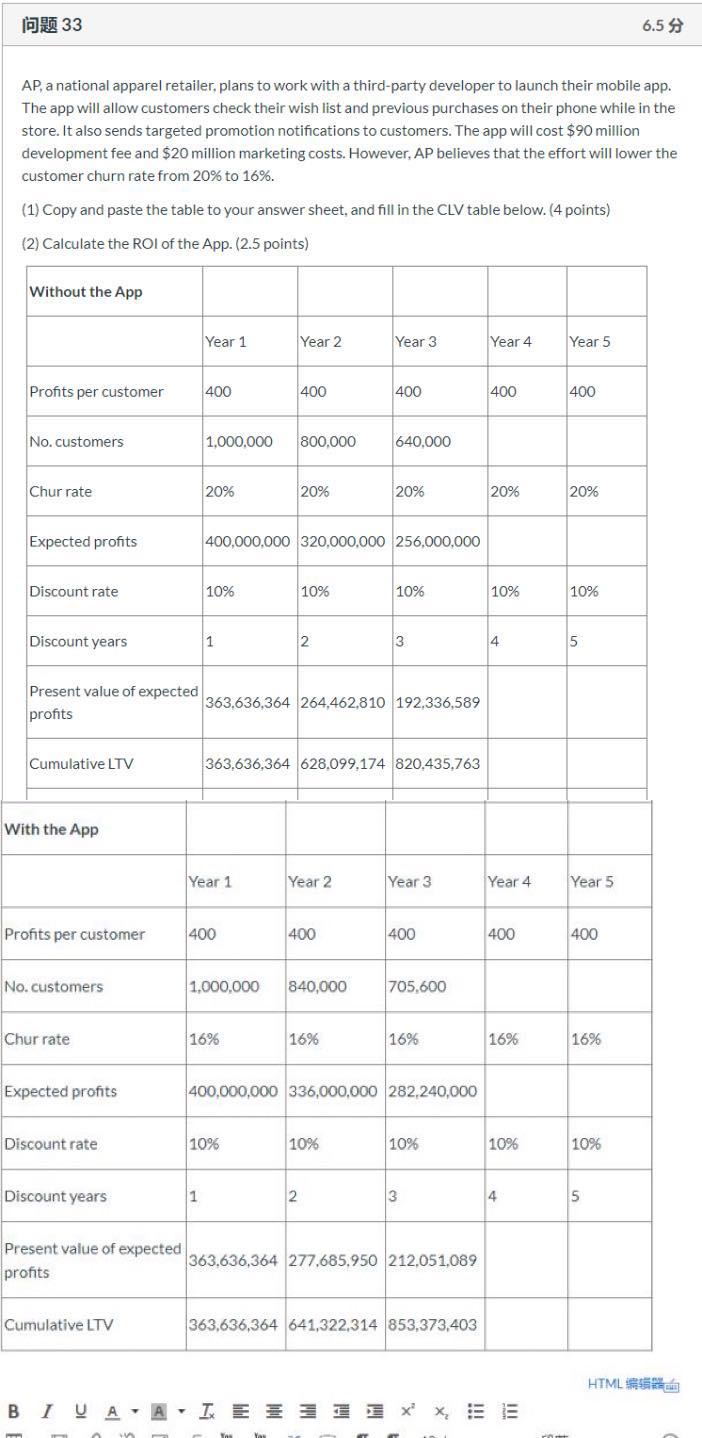

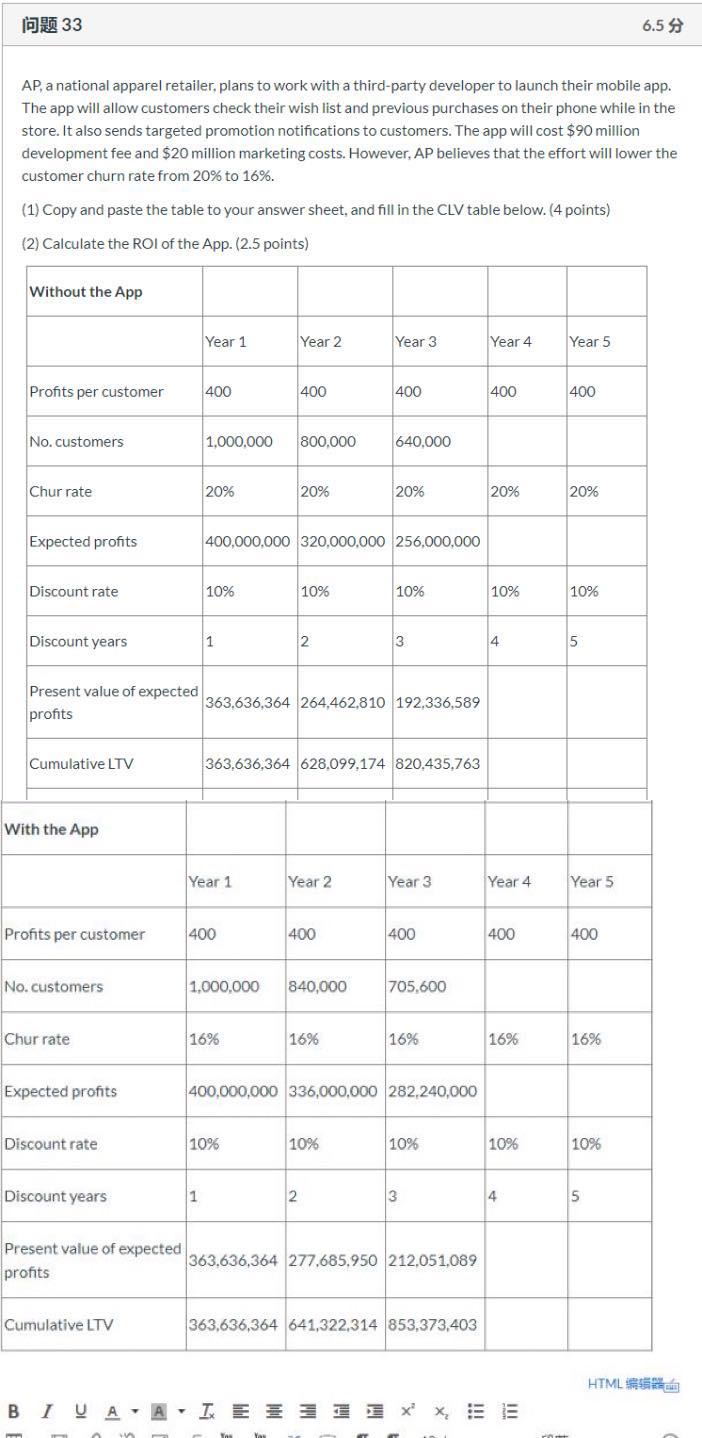

2 33 6.5$ AP, a national apparel retailer, plans to work with a third-party developer to launch their mobile app. The app will allow customers check their wish list and previous purchases on their phone while in the store. It also sends targeted promotion notifications to customers. The app will cost $90 million development fee and $20 million marketing costs. However, AP believes that the effort will lower the customer churn rate from 20% to 16%. (1) Copy and paste the table to your answer sheet, and fill in the CLV table below. (4 points) (2) Calculate the ROI of the App. (2.5 points) Without the App Year 1 Year 2 Year 3 Year 4 Year 5 Profits per customer 400 400 400 400 400 No. customers 1,000,000 800,000 640,000 Chur rate 20% 20% 20% 20% 20% Expected profits 400,000,000 320,000,000 256,000,000 Discount rate 10% 10% 10% 10% 10% Discount years 5 Present value of expected 263.636.364 264.462,810 192,336,589 profits Cumulative LTV 363.636,364 628,099.174 820.435.763 With the App Year 1 Year 2 Year 3 Year 4 Year 5 Profits per customer 400 400 400 400 400 No. customers 1,000,000 840,000 705,600 Chur rate 16% 16% 16% 16% 16% Expected profits 400,000,000 336,000,000 282,240,000 Discount rate 10% 10% 10% 10% 10% Discount years Present value of expected 363.636,364 277,685,950 212,051,089 profits Cumulative LTV 363,636,364 641,322,314 853,373,403 HTML SSR 2 33 6.5$ AP, a national apparel retailer, plans to work with a third-party developer to launch their mobile app. The app will allow customers check their wish list and previous purchases on their phone while in the store. It also sends targeted promotion notifications to customers. The app will cost $90 million development fee and $20 million marketing costs. However, AP believes that the effort will lower the customer churn rate from 20% to 16%. (1) Copy and paste the table to your answer sheet, and fill in the CLV table below. (4 points) (2) Calculate the ROI of the App. (2.5 points) Without the App Year 1 Year 2 Year 3 Year 4 Year 5 Profits per customer 400 400 400 400 400 No. customers 1,000,000 800,000 640,000 Chur rate 20% 20% 20% 20% 20% Expected profits 400,000,000 320,000,000 256,000,000 Discount rate 10% 10% 10% 10% 10% Discount years 5 Present value of expected 263.636.364 264.462,810 192,336,589 profits Cumulative LTV 363.636,364 628,099.174 820.435.763 With the App Year 1 Year 2 Year 3 Year 4 Year 5 Profits per customer 400 400 400 400 400 No. customers 1,000,000 840,000 705,600 Chur rate 16% 16% 16% 16% 16% Expected profits 400,000,000 336,000,000 282,240,000 Discount rate 10% 10% 10% 10% 10% Discount years Present value of expected 363.636,364 277,685,950 212,051,089 profits Cumulative LTV 363,636,364 641,322,314 853,373,403 HTML SSR