Answered step by step

Verified Expert Solution

Question

1 Approved Answer

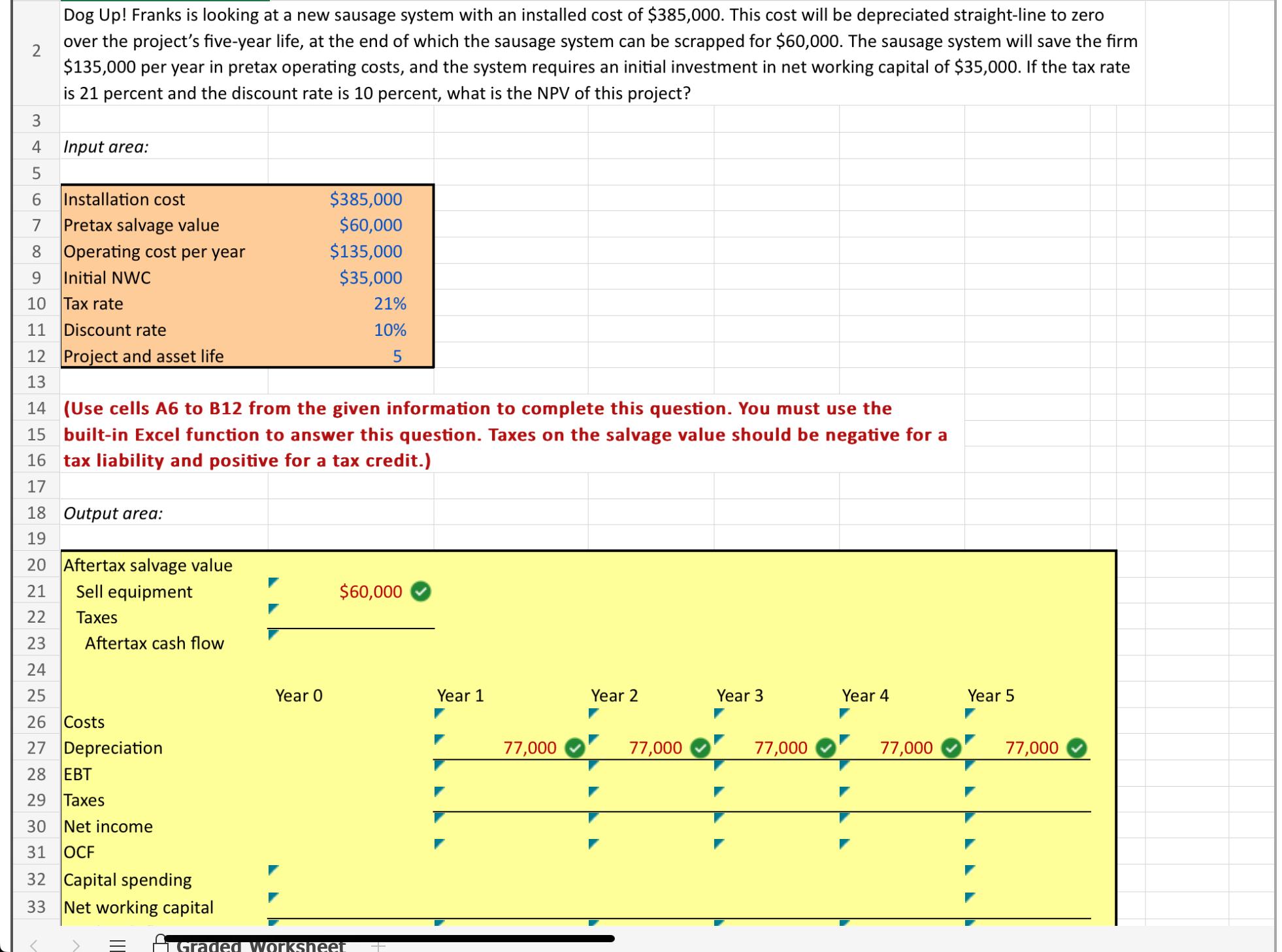

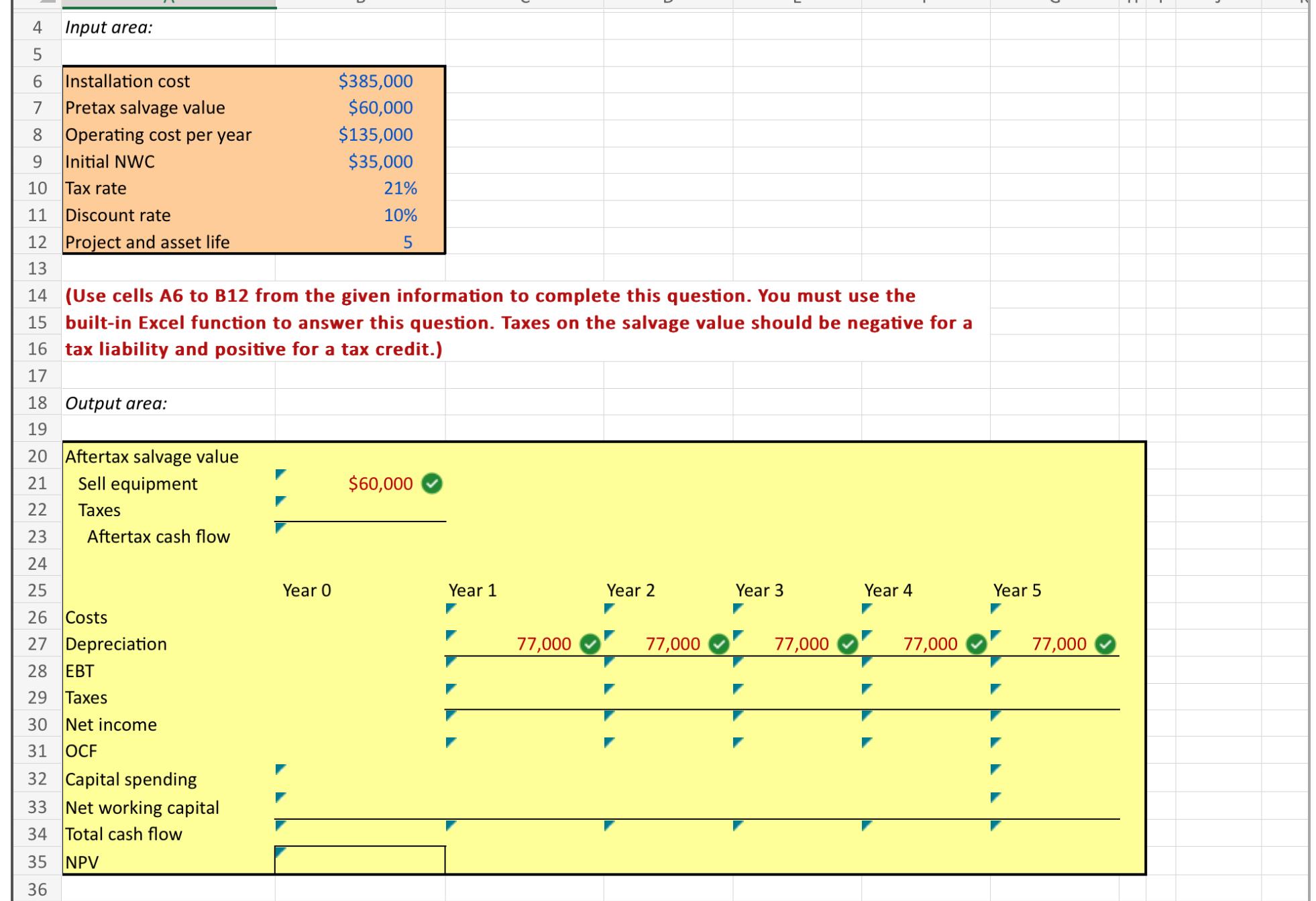

2 34 5 Dog Up! Franks is looking at a new sausage system with an installed cost of $385,000. This cost will be depreciated

2 34 5 Dog Up! Franks is looking at a new sausage system with an installed cost of $385,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $60,000. The sausage system will save the firm $135,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $35,000. If the tax rate is 21 percent and the discount rate is 10 percent, what is the NPV of this project? Input area: 6 Installation cost $385,000 7 Pretax salvage value $60,000 8 Operating cost per year $135,000 9 Initial NWC $35,000 10 Tax rate 21% 11 Discount rate 10% 12 Project and asset life 5 13 14 (Use cells A6 to B12 from the given information to complete this question. You must use the 15 built-in Excel function to answer this question. Taxes on the salvage value should be negative for a 16 tax liability and positive for a tax credit.) 17 18 Output area: 19 20 Aftertax salvage value 21 Sell equipment 22 Taxes 23 Aftertax cash flow 24 25 26 Costs 27 Depreciation 28 EBT 29 Taxes 30 Net income 31 OCF $60,000 Year O Year 1 32 Capital spending 33 Net working capital 1 Graded Worksheet 77,000 Year 2 Year 3 Year 4 Year 5 77,000 77,000 77,000 77,000 4 Input area: 5 6 Installation cost $385,000 7 Pretax salvage value $60,000 8 Operating cost per year $135,000 9 Initial NWC $35,000 10 Tax rate 21% 11 Discount rate 10% 12 Project and asset life 5 13 14 (Use cells A6 to B12 from the given information to complete this question. You must use the 15 built-in Excel function to answer this question. Taxes on the salvage value should be negative for a 16 tax liability and positive for a tax credit.) 17 18 Output area: 19 20 Aftertax salvage value 21 Sell equipment 22 Taxes 23 Aftertax cash flow 24 25 26 Costs 27 Depreciation 28 EBT 29 Taxes 30 Net income 31 OCF 32 Capital spending 33 Net working capital 34 Total cash flow 35 NPV mm 36 $60,000 Year O Year 1 77,000 Year 2 Year 3 Year 4 Year 5 77,000 77,000 77,000 77,000

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations to determine the NPV of the sausage system project Installation cost 38500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started