Answered step by step

Verified Expert Solution

Question

1 Approved Answer

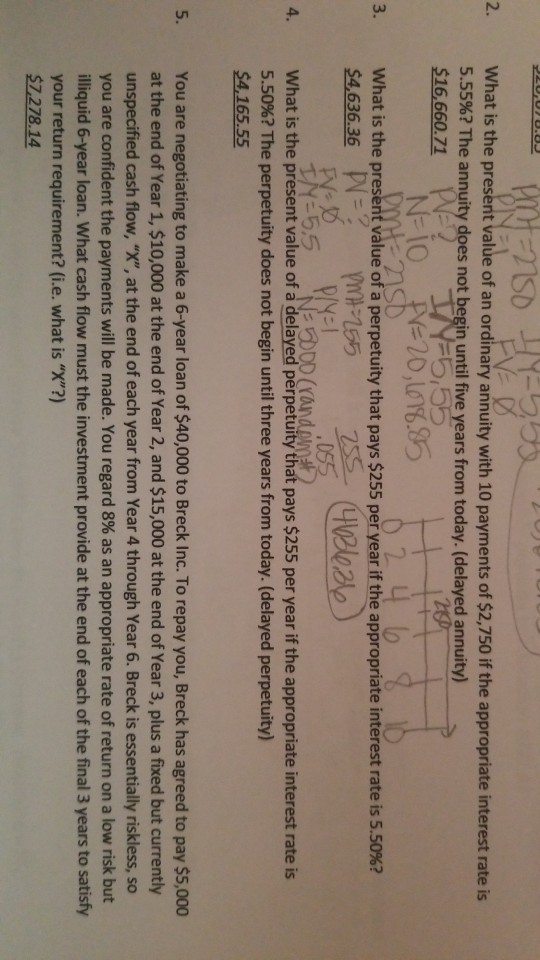

#2 & #4 20UU.UJ 2. F=20,618.85 mt=250 -55 EVE What is the present value of an ordinary annuity with 10 payments of $2,750 if the

#2 & #4

20UU.UJ 2. F=20,618.85 mt=250 -55 EVE What is the present value of an ordinary annuity with 10 payments of $2,750 if the appropriate interest rate is 5.55%? The annuity does not begin until five years from today. (delayed annuity) $16,660.71 PVE? Y-5,50 N-10 Dmt 2750 02. 46 What is the present value of a perpetuity that pays $255 per year if the appropriate interest rate is 5.50%? $4,636.36 PV = ? Pmt=255 FV=0 TM=5.5 'N 5000 (random What is the present value of a delayed perpetuity that pays $255 per year if the appropriate interest rate is 5.50%? The perpetuity does not begin until three years from today. (delayed perpetuity) $4,165.55 62 3. 255 4 bleibe PLY! .055 4. 5. You are negotiating to make a 6-year loan of $40,000 to Breck Inc. To repay you, Breck has agreed to pay $5,000 at the end of Year 1, $10,000 at the end of Year 2, and $15,000 at the end of Year 3, plus a fixed but currently unspecified cash flow, "X", at the end of each year from Year 4 through Year 6. Breck is essentially riskless, so you are confident the payments will be made. You regard 8% as an appropriate rate of return on a low risk but illiquid 6-year loan. What cash flow must the investment provide at the end of each of the final 3 years to satisfy your return requirement? (i.e. what is "X"?) $7,278.14Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started