Answered step by step

Verified Expert Solution

Question

1 Approved Answer

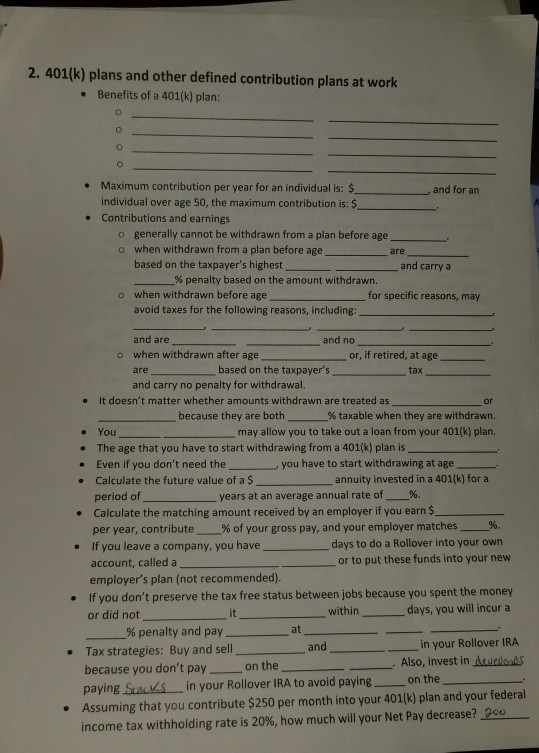

2. 401(k) plans and other defined contribution plans at work Benefits of a 401(k) plan: . . Maximum contribution per year for an individual is:

2. 401(k) plans and other defined contribution plans at work Benefits of a 401(k) plan: . . Maximum contribution per year for an individual is: $ and for an individual over age 50, the maximum contribution is: $ Contributions and earnings . generally cannot be withdrawn from a plan before age when withdrawn from a plan before age based on the taxpayer's highest o o are and carry a % penalty based on the amount withdrawn. for specific reasons, may when withdrawn before age avoid taxes for the following reasons, including: o and are when withdrawn after age are and carry no penalty for withdrawal. o or, if retired, at age based on the taxpayer's tax It doesn't matter whether amounts withdrawn are treated as or % taxable when they are withdrawn. may allow you to take out a loan from your 401(k) plan. because they are both - You The age that you have to start withdrawing from a 401(k) plan is Even if you don't need the you have to start withdrawing at age annuity invested in a 401(k) for a %. . Calculate the future value of a$ . Calculate the matching amount received by an employer if you earn $ . If you leave a company, you have _days to do a Rollover into your own period of years at an average annual rate of per year, contribute % of your gross pay, and your employer matches 96. or to put these funds into your new account, called a employer's plan (not recommended). If you don't preserve the tax free status between jobs because you spent the money or did not .. within _days, you will incur a it in your Rollover IRA Also, invest in Aurdeals Tax strategies: Buy and sell because you don't pay on the paying Stzuks in your Rollover IRA to avoid payingon the Assuming that you contribute $250 per month into your 401(k) plan and your federal income tax withholding rate is 20%, how much will your Net Pay decrease? an

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started