Answered step by step

Verified Expert Solution

Question

1 Approved Answer

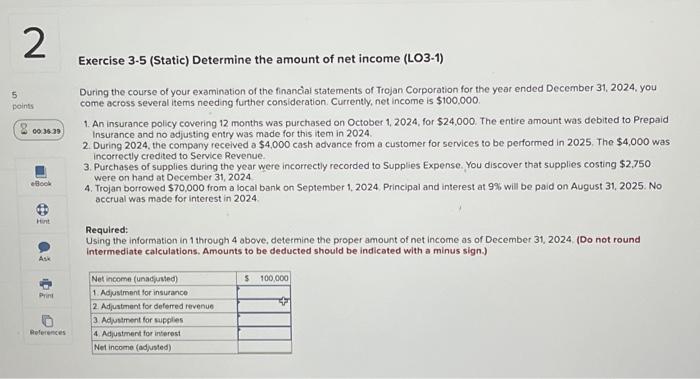

2 5 points 00:36:39 eBook Hint Ask Print References Exercise 3-5 (Static) Determine the amount of net income (LO3-1) During the course of your examination

2 5 points 00:36:39 eBook Hint Ask Print References Exercise 3-5 (Static) Determine the amount of net income (LO3-1) During the course of your examination of the financial statements of Trojan Corporation for the year ended December 31, 2024, you come across several items needing further consideration. Currently, net income is $100,000. 1. An insurance policy covering 12 months was purchased on October 1, 2024, for $24,000. The entire amount was debited to Prepaid Insurance and no adjusting entry was made for this item in 2024. 2. During 2024, the company received a $4,000 cash advance from a customer for services to be performed in 2025. The $4,000 was incorrectly credited to Service Revenue. 3. Purchases of supplies during the year were incorrectly recorded to Supplies Expense. You discover that supplies costing $2,750 were on hand at December 31, 2024. 4. Trojan borrowed $70,000 from a local bank on September 1, 2024. Principal and interest at 9% will be paid on August 31, 2025. No accrual was made for interest in 2024. Required: Using the information in 1 through 4 above, determine the proper amount of net income as of December 31, 2024. (Do not round intermediate calculations. Amounts to be deducted should be indicated with a minus sign.) Net income (unadjusted) 1. Adjustment for insurance 2. Adjustment for deferred revenue 3. Adjustment for supplies. 4. Adjustment for interest Net income (adjusted) $ 100,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started