Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( 2 5 points ) In a study of the influence of financial institutions on bond interest rates in Germany, quarterly data over a period

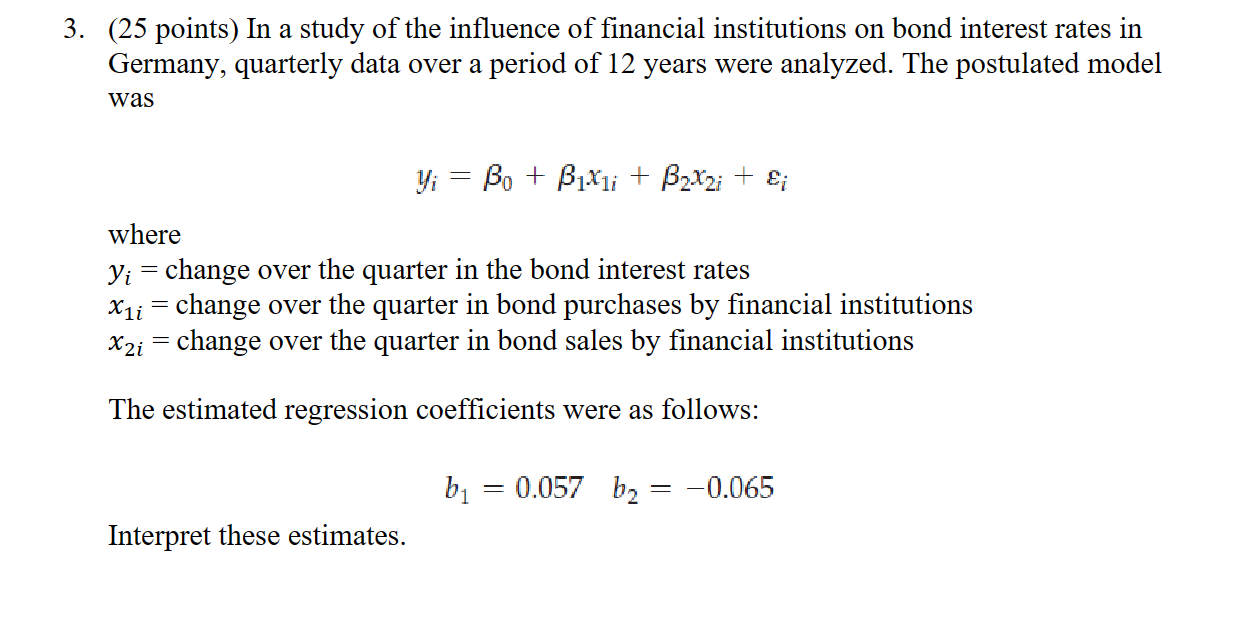

points In a study of the influence of financial institutions on bond interest rates in

Germany, quarterly data over a period of years were analyzed. The postulated model

was

where

change over the quarter in the bond interest rates

change over the quarter in bond purchases by financial institutions

change over the quarter in bond sales by financial institutions

The estimated regression coefficients were as follows:

Interpret these estimates.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started