Answered step by step

Verified Expert Solution

Question

1 Approved Answer

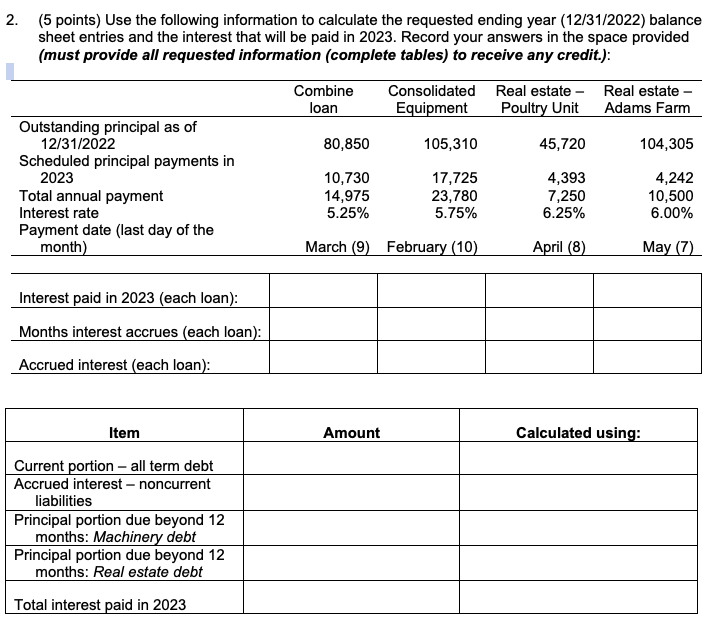

2. (5 points) Use the following information to calculate the requested ending year (12/31/2022) balance sheet entries and the interest that will be paid

2. (5 points) Use the following information to calculate the requested ending year (12/31/2022) balance sheet entries and the interest that will be paid in 2023. Record your answers in the space provided (must provide all requested information (complete tables) to receive any credit.): Outstanding principal as of 12/31/2022 Scheduled principal payments in 2023 Total annual payment Interest rate Payment date (last day of the month) Interest paid in 2023 (each loan): Months interest accrues (each loan): Accrued interest (each loan): Item Current portion - all term debt Accrued interest - noncurrent liabilities Principal portion due beyond 12 months: Machinery debt Principal portion due beyond 12 months: Real estate debt Total interest paid in 2023 Combine loan Consolidated Equipment 80,850 10,730 14,975 5.25% March (9) February (10) Amount 105,310 17,725 23,780 5.75% Real estate - Poultry Unit 45,720 4,393 7,250 6.25% April (8) Real estate- Adams Farm 104,305 4,242 10,500 6.00% Calculated using: May (7)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the ending year 12312022 balance sheet entries and the interest that will be paid in 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started