Answered step by step

Verified Expert Solution

Question

1 Approved Answer

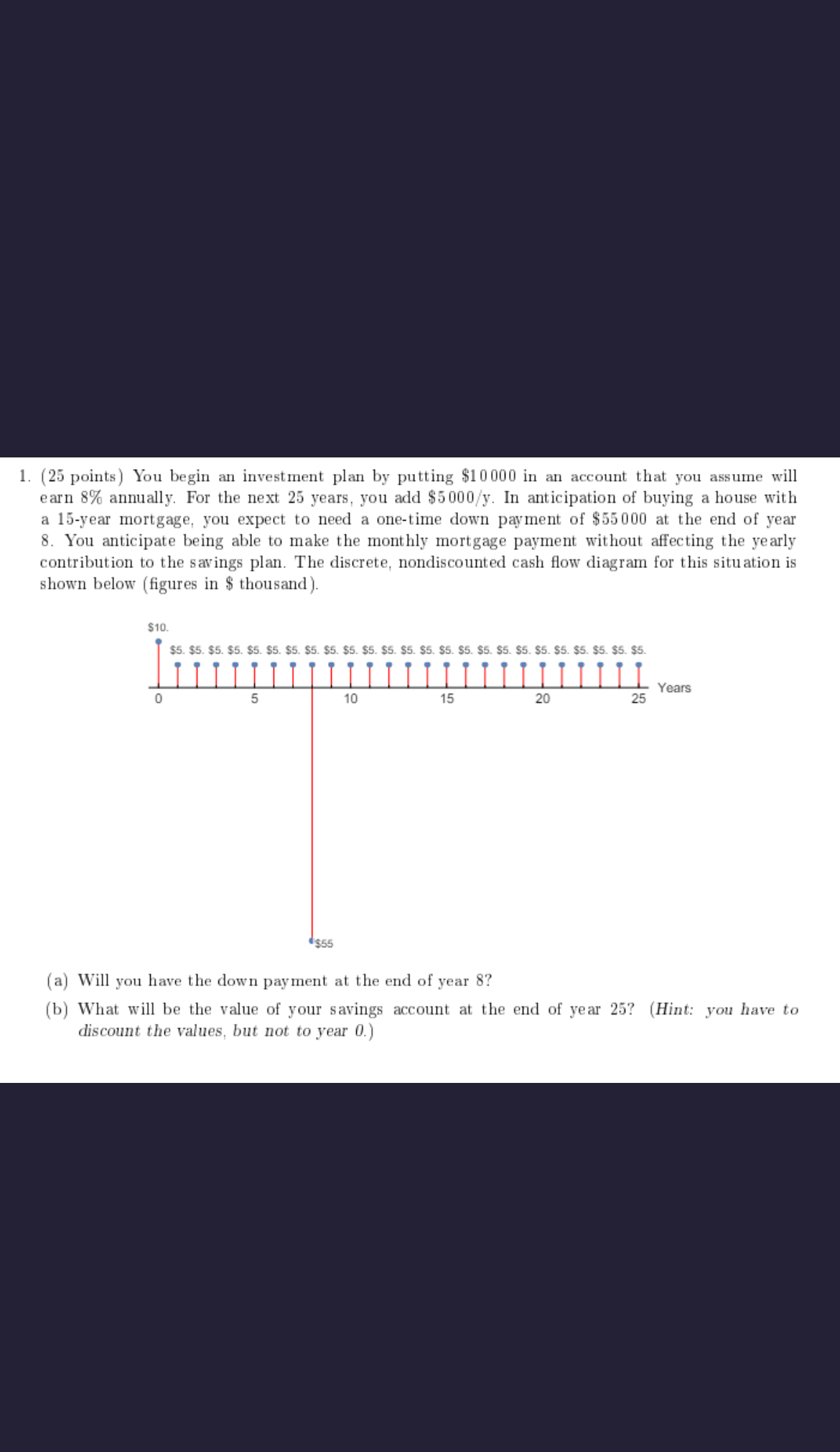

( 2 5 points ) You begin an investment plan by putting $ 1 0 0 0 0 in an account that you assume will

points You begin an investment plan by putting $ in an account that you assume will earn annually. For the next years, you add $ In anticipation of buying a house with a year mortgage, you expect to need a onetime down payment of $ at the end of year You anticipate being able to make the monthly mortgage payment without affecting the yearly contribution to the savings plan. The discrete, nondiscounted cash flow diagram for this situation is shown below figures in $ thousand

a Will you have the down payment at the end of year

b What will be the value of your savings account at the end of year Hint: you have to discount the values, but not to year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started