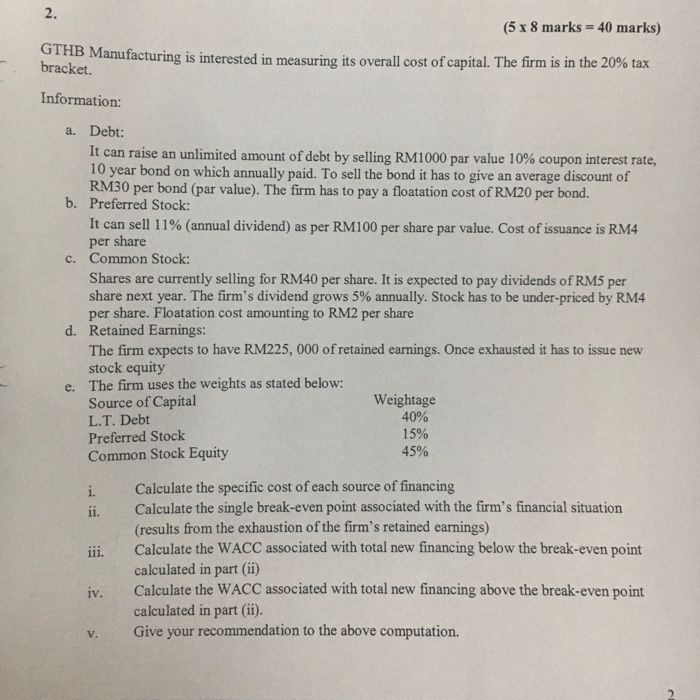

2. (5 x 8 marks = 40 marks) GTHB Manufacturing is interested in measuring its overall cost of capital. The firm is in the 20% tax bracket. Information: a. Debt: It can raise an unlimited amount of debt by selling RM1000 par value 10% coupon interest rate, 10 year bond on which annually paid. To sell the bond it has to give an average discount of RM30 per bond (par value). The firm has to pay a floatation cost of RM20 per bond. b. Preferred Stock: It can sell 11% (annual dividend) as per RM100 per share par value. Cost of issuance is RM4 per share c. Common Stock: Shares are currently selling for RM40 per share. It is expected to pay dividends of RM5 per share next year. The firm's dividend grows 5% annually. Stock has to be under-priced by RM4 per share. Floatation cost amounting to RM2 per share d. Retained Earnings: The firm expects to have RM225, 000 of retained earnings. Once exhausted it has to issue new stock equity e. The firm uses the weights as stated below: Source of Capital Weightage L.T. Debt 40% Preferred Stock 15% Common Stock Equity 45% i. ii. iii. Calculate the specific cost of each source of financing Calculate the single break-even point associated with the firm's financial situation (results from the exhaustion of the firm's retained earnings) Calculate the WACC associated with total new financing below the break-even point calculated in part (ii) Calculate the WACC associated with total new financing above the break-even point calculated in part (ii). Give your recommendation to the above computation. iv. v. 2. (5 x 8 marks = 40 marks) GTHB Manufacturing is interested in measuring its overall cost of capital. The firm is in the 20% tax bracket. Information: a. Debt: It can raise an unlimited amount of debt by selling RM1000 par value 10% coupon interest rate, 10 year bond on which annually paid. To sell the bond it has to give an average discount of RM30 per bond (par value). The firm has to pay a floatation cost of RM20 per bond. b. Preferred Stock: It can sell 11% (annual dividend) as per RM100 per share par value. Cost of issuance is RM4 per share c. Common Stock: Shares are currently selling for RM40 per share. It is expected to pay dividends of RM5 per share next year. The firm's dividend grows 5% annually. Stock has to be under-priced by RM4 per share. Floatation cost amounting to RM2 per share d. Retained Earnings: The firm expects to have RM225, 000 of retained earnings. Once exhausted it has to issue new stock equity e. The firm uses the weights as stated below: Source of Capital Weightage L.T. Debt 40% Preferred Stock 15% Common Stock Equity 45% i. ii. iii. Calculate the specific cost of each source of financing Calculate the single break-even point associated with the firm's financial situation (results from the exhaustion of the firm's retained earnings) Calculate the WACC associated with total new financing below the break-even point calculated in part (ii) Calculate the WACC associated with total new financing above the break-even point calculated in part (ii). Give your recommendation to the above computation. iv. v